Inflation Ticks up Slightly in November, CPI Report Says

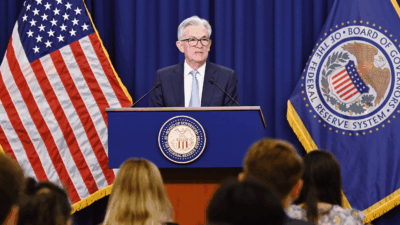

Another month, another frustratingly sticky inflation report. Still, a rate cut seems certain when the Federal Reserve meets next week.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Another month, another frustratingly sticky inflation report.

On Wednesday, the US Bureau of Labor Statistics released the latest Consumer Price Index figures, which showed prices increased 2.7% year-over-year in November and 0.3% from the month prior. Still, the devil’s in the details, and a rate cut still looks all but certain when the Federal Reserve meets next week.

Home is Where the Inflation No Longer Is

In one of the final CPI reports before Trump 2.0 gets underway, there was some good news and some bad news. The bad: Consumer goods, a broad category that’s inherently most likely to be impacted by tariffs should they come, experienced the worst month-to-month increase in prices in over a year. The good news: Housing costs, long one of the stickiest of inflationary forces, finally saw inflation ease month-over-month across both owned and rental categories for the first time since 2021. Meanwhile, a separate report released Wednesday showed that real hourly earnings grew 1.3% compared with a year ago — low enough for experts to conclude that the hot labor market is no longer driving inflation.

In sum: a pretty clear picture ahead for the Fed’s next meeting. CME’s FedWatch has pegged the chance of another quarter-point rate cut at the meeting at over 98%, up from around a 65% chance just a month ago. Odds of a second cut in January are around just 23%. Translation: Who knows what tariffs will bring?

For now though, at least some economists and experts are softly putting the blame for that everlasting last mile of inflation-taming on the consumer:

- “Overall, we’re looking at an environment where the low-hanging fruit has been picked… we’re getting to a point where you really need the demand side of the economy to weaken,” Wells Fargo senior economist Sarah House told The Wall Street Journal. In other words: Consumers need to slow down, a troubling call when consumer sentiment has actually increased since last month’s election.

- On the flip-side, KPMG Economics chief economist Diane Swonk tells the WSJ that some recent consumption, especially on big ticket items, is due to consumers trying to beat the likely-inflationary tariffs: “Something like that never would have happened prepandemic, and the fact that we saw it is just a red flag for the Fed to watch out for.”

Spin the Globe: Countries in the rest of the world face their own unique issues in inflation fights. The Bank of Canada on Wednesday instituted a half-point rate cut, likely with an eye on stoking growth in the face of looming tariffs. Meanwhile, the Bank of Japan meets next week and might increase rates from a target of 0.25% to 0.5%, which would be another show of antideflationary strength for the Land of the Rising Sun — though a hike remains far from certain.