Gold ETFs Shine as Price Hits $4,000

Investors have been piling into gold ETFs amid uncertainty exacerbated by the government shutdown and the dollar’s declining status.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

It’s not just a flash in the pan. Gold is having a moment, and ETF sales have gone technically… well, bonkers, as its price crushed records, reaching $4,000 per ounce on Tuesday.

Despite this year’s strong stock market performance, uncertainty is a major concern for investors, with the latest contributor being the US government shutdown. That has people leaning into decentralized stores of assets like gold and cryptocurrencies, said David Schassler, VanEck’s head of multiasset solutions. The current government shutdown feels more severe than prior ones, given that the Trump administration has proposed making permanent workforce cuts. Further, jobs data for September is being delayed by the shutdown, compounding concerns over the Federal Reserve’s independence, inflation and other issues, Schassler said in a statement.

“Shutdowns used to be sideshows,” he said. “Each week brings another hit to institutional trust: political violence, weaponized agencies, fraying alliances and now the shutdown. Investors are beginning to connect the dots.”

Gold ETF Prospectors

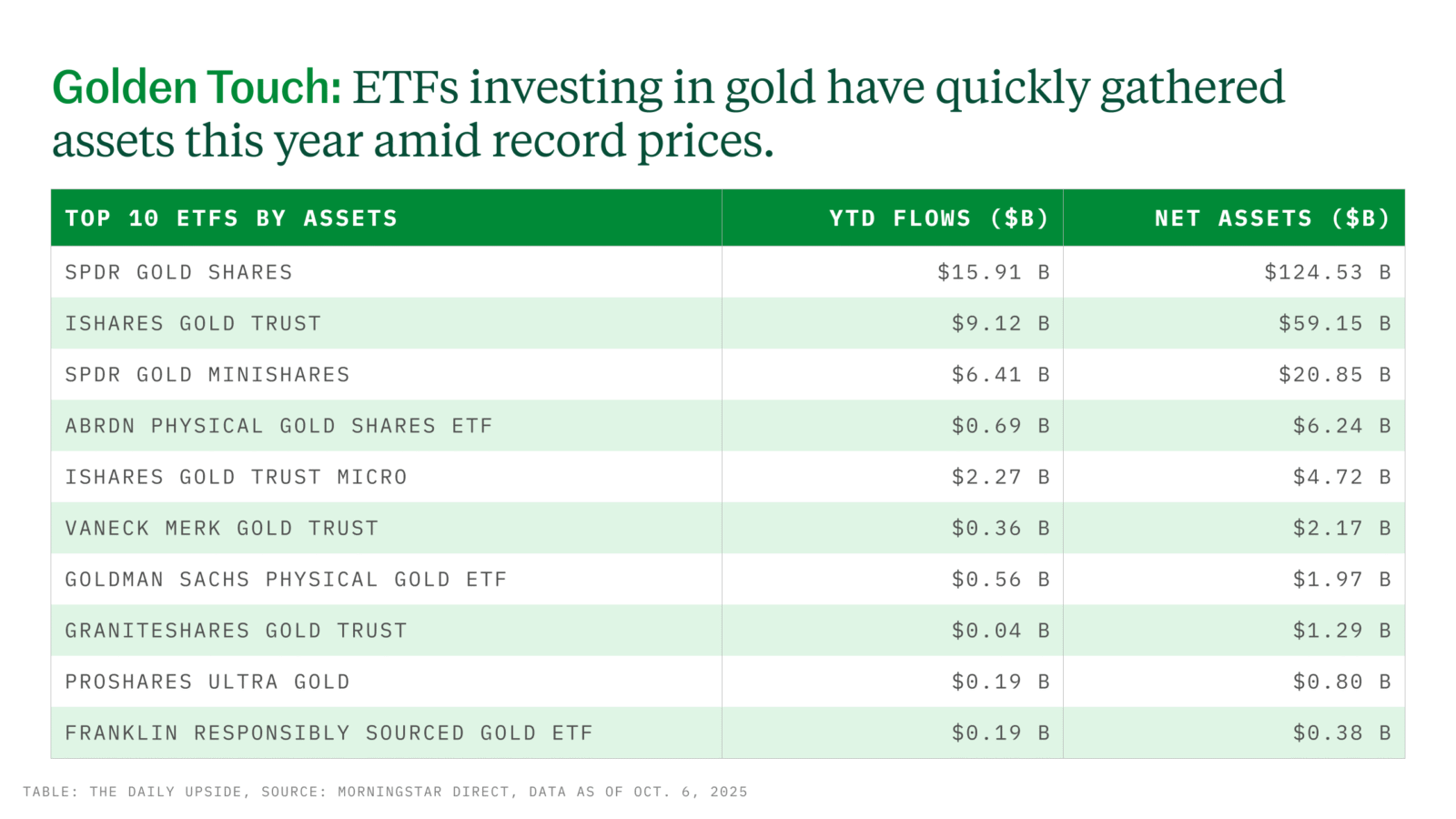

More than $9 billion flowed into US gold ETFs in September, the highest-ever figure for a single month. The big winner from that was State Street’s $124 billion SPDR Gold Shares (GLD), which raked in $3.5 billion, according to data from Morningstar Direct. Despite that fund being the biggest seller among gold ETFs last month, it took in even more in August, at $4.1 billion in net sales.

What advisors are saying:

- “I started recommending my clients take an allocation in gold in early 2023 and have not stopped recommending it,” said John Bell, owner of Free State Financial Planning. “While gold has been called an inflation hedge, I think that is a little overdone. In my opinion, gold does best in times of crisis.”

- “We have increased exposure, not as a performance driver, but to protect against market surprises,” said Assunta McLane, senior wealth advisor at Summit Place Financial Advisors.

Golden Eye: Historically, gold has performed well, with annualized returns over 20 years being 11%, compared with 9% for equities and 2% for global bonds, according to a recent report by Pictet Asset Management. Meanwhile, Goldman Sachs analysts are predicting a near $5,000-per-ounce spot price by the end of 2026, The Wall Street Journal reported. However, Citadel CEO Ken Griffin told Bloomberg that he is concerned about the moves investors have made to gold and away from the US dollar.

At least people aren’t just burying gold in their backyards anymore (hopefully).