Grayscale Wants in on Quantum Computing ETFs

The company, which briefly owned the biggest spot bitcoin ETF, wants to invest in another potentially disruptive technology that could even pose a threat to crypto.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

Who says a crypto asset manager has to focus on crypto asset management?

There’s a world of possibilities out there, and one of the big crypto ETF issuers appears to be branching out. Grayscale filed on Thursday with the Securities and Exchange Commission for the Quantum Computing ETF. The Stamford, Connecticut-based firm started in the US ETF business in 2022 — and, thanks to the move of assets from its Bitcoin Trust to the spot bitcoin ETF it launched in 2024, temporarily had the biggest bitcoin ETF by assets. By August 2024, the significantly cheaper iShares Bitcoin Trust ETF surpassed it.

Since then, Grayscale has been building out a line of ETFs with four focused solely on digital assets, two focused on income, two with equities exposure, one dedicated to bitcoin mining companies, and one to adopters of the digital asset.

Quantum Leap

The proposed ETF, which is pending SEC approval but could launch by mid August, would be passively managed, tracking an index of companies “producing proof-of-concept or commercialized quantum computing technologies” and makers of components enabling the technology, according to the prospectus.

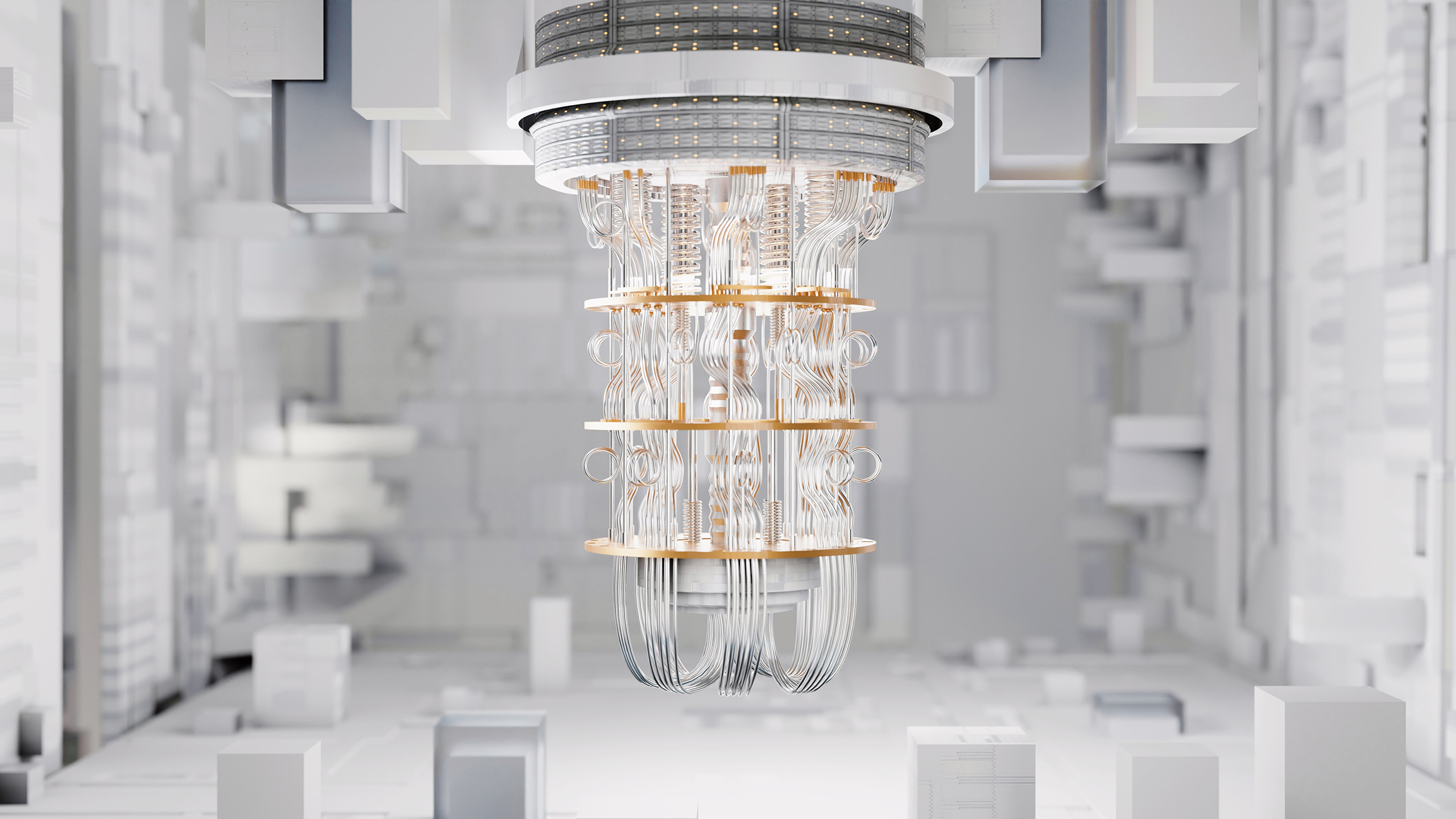

There is a lot of hype around quantum computing, which benefits from using both the wave and particle natures of matter, though the technology has not been developed in a mainstream capacity yet. It could improve upon the power of classical computers exponentially and make extraordinarily complex calculations in very short times. The technology could even pose a threat to crypto, as it could be used to break the security and gain access to wallets — something BlackRock recently warned investors about.

Stop Being Disruptive: There are a handful of tech and artificial-intelligence-focused ETFs with exposure to quantum computing technology. But at least one ETF is already dedicated to the area: the $1.3 billion Defiance Quantum ETF, which launched in 2018. That fund has seen average annualized returns of 21% since inception, per Morningstar. “It’s performed very well,” said Bryan Armour, director of ETF and passive strategies research for North America. Even so, “investors are pushing to get in early by virtue of the shift in first-mover advantage of new technologies … It’s never as smooth as investors would think.”

Armour cited examples of other high-flying technology investments that later sputtered, including:

- The internet (back when it was spelled with a capital “I”) and the dotcom bubble that led to the famous bust.

- One of the most disruptive technologies over the past century, commercial aviation, has long struggled with profitability, despite its popularity.

Spot On: Grayscale is still primarily focused on digital assets. It, along with other firms, is waiting for decisions from the SEC on spot-price Solana and XRP ETFs that it has requested, for example. Whether the company intends to branch out in other ways is a question, but the firm didn’t respond to a request for comment. “Obviously crypto is its core competency, and it made most of its money by offering a private trust,” Armour said. Quantum computing, on the other hand, “is not a core competency.”