Why IBIT’s Spooked By Quantum Computing

The world’s leading asset manager says the cryptography underlying Bitcoin could be compromised by quantum hackers.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

One of the fastest-growing ETFs of all time may have an Achilles heel … or maybe it’s a Trojan horse.

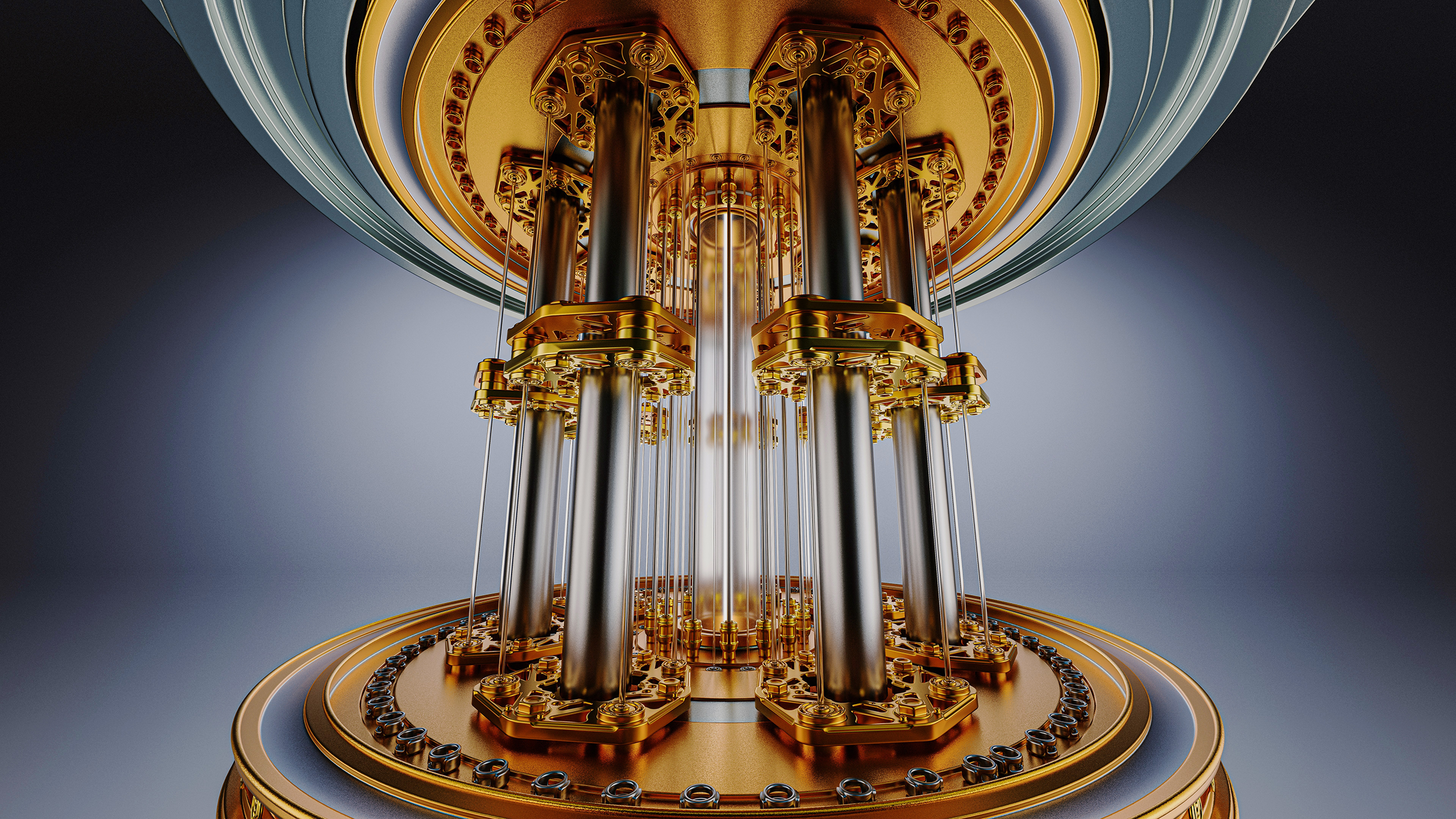

BlackRock has officially acknowledged that quantum computing could become a cybersecurity risk to its iShares Bitcoin Trust (IBIT) in a filing this month, marking the first time the new technology has been formally recognized as a potential threat. As quantum computing power advances, the world’s leading asset manager said the cryptography underlying bitcoin could become compromised by quantum hackers leading to stolen coins. With a net asset value of $64 billion in IBIT alone, or just under 3% of the total coins that will ever be produced, that sounds like a very expensive problem. But how big a threat does quantum computing really pose?

“A large-scale quantum computer would be able to break the digital signature scheme that currently secures Bitcoin wallets,” said Jonathan Katz, professor of computer science at the University of Maryland.

High Probability Events

The worry is that advanced computers might break private keys by reverse-solving the mathematical puzzles based on Bitcoin’s elliptic-curve signatures, essentially gaining the password, according to a report. Flaws in digital assets have been exploited before, including flaws that disabled some functionality, exposed personal information and led to thefts, according to the filing. “In any of these circumstances, a malicious actor may be able to compromise the security of the Bitcoin network or take the Trust’s bitcoin, which would adversely affect the value of the shares,” the company said.

Still, that wouldn’t make Bitcoin obsolete. In fact, the underlying technology securing the blockchain, including the mining of new coins, would still be viable if Bitcoin upgraded to quantum-secure methods, Katz said. “The main danger to Bitcoin would be if large-scale quantum computers become available before this transition happens,” he told ETF Upside. “But people in the cryptocurrency community are well aware of the threat of quantum computers, so I don’t consider this a very high-probability event.”

Wake Up, Wallet. A bigger issue could be inside inactive Bitcoin wallets. Quantum hackers could make quick work of wallets that have been lost, or are otherwise dormant, said Tether CEO Paolo Ardoino. There may be anywhere from 2.3 million to 3.7 million bitcoins that are permanently lost, or about 11–18% of the fixed supply, according to Ledger Academy. “Any bitcoin in lost wallets, including Satoshi (if not alive), will be hacked and put back in circulation,” Ardoino said in a post on X in February. “Quantum-resistant addresses will eventually be added to Bitcoin before there is any serious threat.”