PE Invasion Weighs on Wealth Management

The massive private-equity investments are causing concerns about its impact on the wealth management industry.

Sign up for market insights, wealth management practice essentials and industry updates.

Private equity firms just couldn’t keep their hands off wealth managers in 2024.

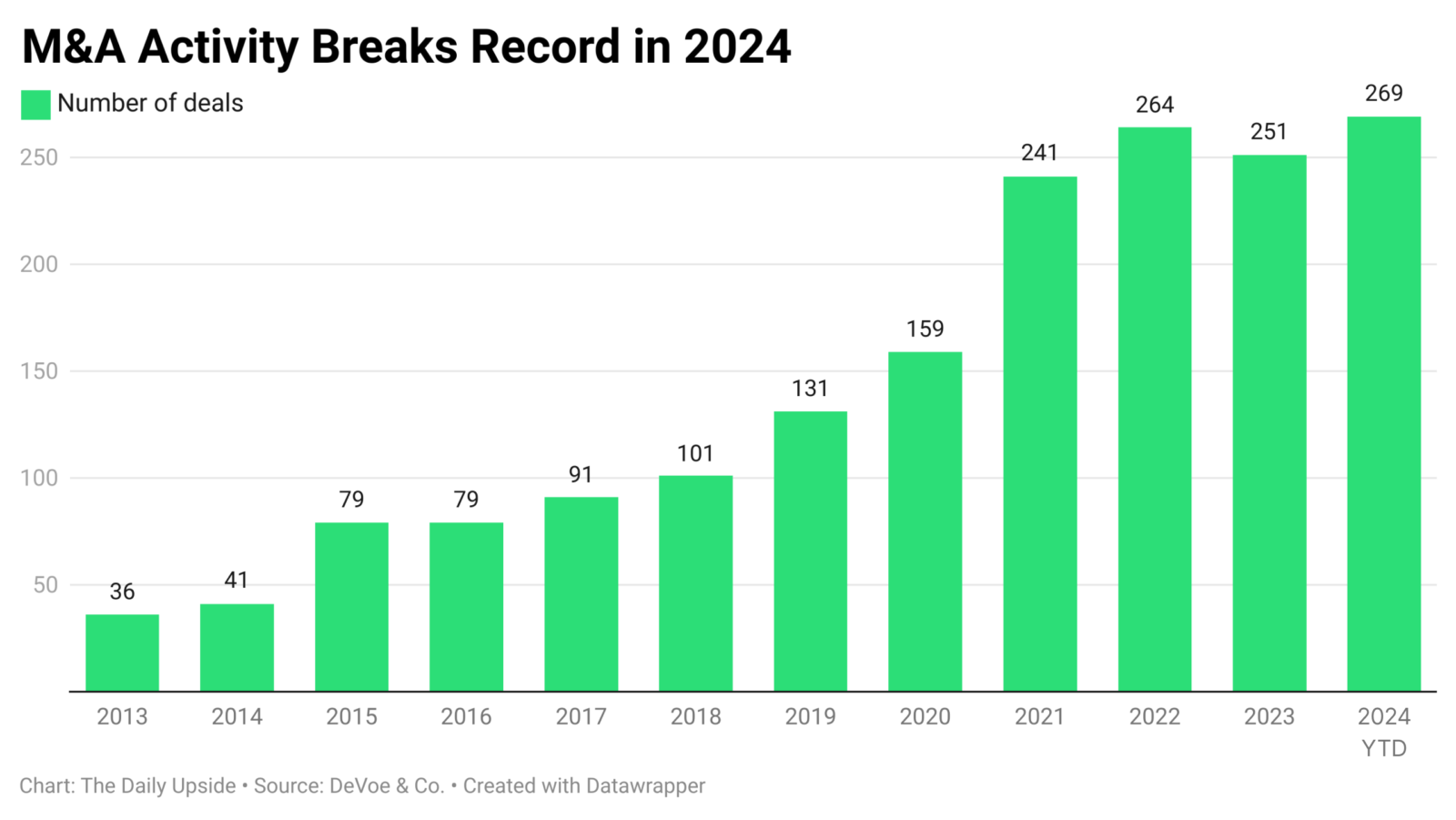

With markets roaring and assets hitting all-time highs, there were at least a half a dozen multi-billion-dollar deals that shook the industry this year. Fisher Investments cemented a $3 billion deal in June, followed by Envestnet’s $4.5 billion sale in July, and there were dozens of others. In fact, M&A activity set new records in the registered investment advisor space, with 269 total transactions completed so far in 2024, according to DeVoe & Co. As these massive advisory firms get larger, so do their value propositions. PE investors are expected to become more aggressive in 2025 as interest rates decline, leading to even bigger and more frequent deals, according to the study.

There are certainly questions about how the new powers that be will behave. Some experts question whether PE firms will run into conflicts of interest trying to uphold fiduciary standards, while squeezing out profits for investors. It’s an open ended question that may take years — or, shall we say, fund life cycles — to figure out.

Tip The Scales

PE has been smitten with wealth management for the better part of a decade, and for good reason. By the end of 2029, the value of wealth management firms globally will approach $3 trillion, up from just under $2 trillion last year, according to a report. A Cerulli estimate pegged the opportunity for RIA acquisitions at $3.7 trillion last year. Other major deals this year include:

- TPG’s minority stake in the largest RIA Creative Planning, valuing it at a reported $15 billion.

- CI Financial’s all-cash deal with Mubadala Capital that took it private at a valuation of $8.6 billion.

- PE firm KKR’s purchase of the $150 billion wealth manager Janney Montgomery Scott in July.

- There’s more, but you get the picture.

Not So Fast. What does an influx of PE money mean for the industry as a whole — and for the end clients advisers are trying to serve? Well, all that private equity attention may be starting to take its toll. While private equity brings in more funding, it’s also expecting lucrative profits on tight time tables.

A report from Forrester cited the massive tech provider InvestCloud, which has been majority-owned by Motive Partners and Clearlake Capital since 2021. Earlier this year, the firm raised its service fees 5% despite complaints about slow platform enhancements. If private equity continues to prioritize revenue over platform improvements and customer support, wealth managers may seek alternatives, according to the researchers.