CI Financial to be Taken Private in Deal with Mubadala Capital

The deal expands Mubadala Capital’s reach in the US while giving CI Financial additional backing after years of snapping up RIAs.

Sign up for market insights, wealth management practice essentials and industry updates.

One of the quickest ways into the US is through Canada.

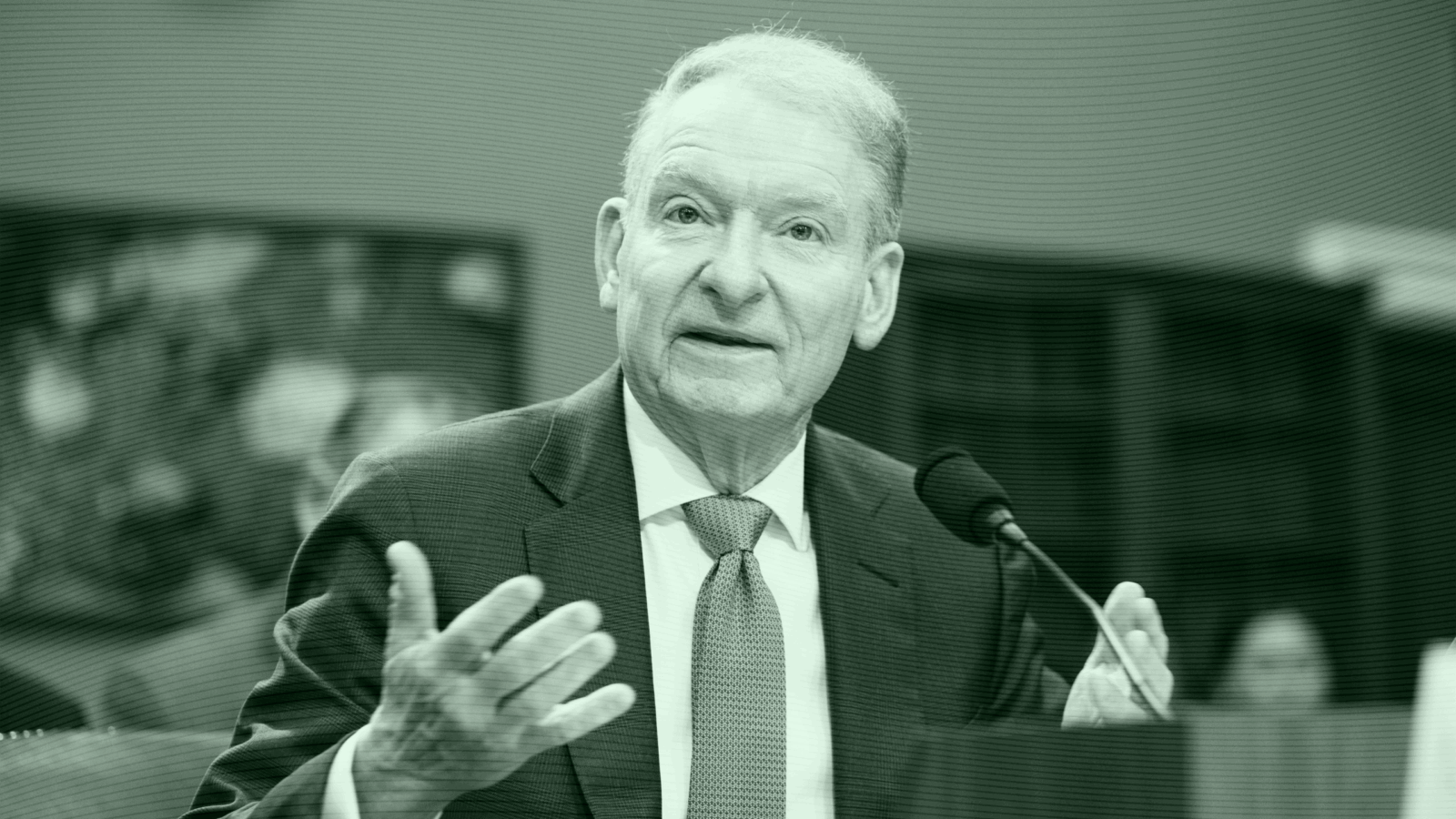

CI Financial has agreed to be taken private in an all-cash deal with Mubadala Capital, a subsidiary of the Abu Dhabi Investment Authority, that values the Canadian asset manager’s enterprise at about $8.6 billion. The purchase represents a 33% premium to CI’s closing price last week, according to a statement. The massive Toronto-based wealth manager, which runs Corient Private Wealth in the US, will continue to operate under its current structure and management team, and will be independent of Mubadala’s other portfolio businesses.

Mubadala’s full takeover might just be the remedy CI Financial was looking for after years of buying major RIAs across the US.

Big Deal, Eh?

CI Financial has been on an M&A tear in recent years, which has left it with plenty of debt and a share price that hasn’t moved much in the past three years. The strategy caused S&P Global Ratings to cut the firm’s debt to junk in 2023, according to Bloomberg.

That same year, CI sold a 20% stake in its US advisor division to a consortium of investors that included the ADIA. The company has acquired dozens of firms with billions of dollars in assets under management:

- Just this month, Corient closed on a deal to buy Ensemble Capital Management, an RIA headquartered in San Francisco with about $1.77 billion in AUM.

- CI Financial added 15 RIAs to its US private wealth business in 2021 alone, including Bluestein, Gofen, and RegentAtlantic.

- The company now oversees roughly $180 billion in its US wealth management arm, according to company reports.

“Mubadala Capital invests with a long-term outlook and represents long-term capital — providing stability and certainty for CIʼs clients and employees,” CI’s Chief Executive Officer Kurt MacAlpine said in a statement.

Coming to America. The deal marks not only Mubadala’s largest acquisition to date, but one of the biggest direct investments into North America by a Middle Eastern group. Earlier this year, Mubadala closed a similar deal, acquiring just over 90% of the equity of credit manager Fortress Investment Group that was held by Japanese conglomerate SoftBank.