In Casinos, the House Always Wins. What About Prediction Markets?

Can Kalshi and Polymarket become the massive, all-purpose financial vehicles envisioned by backers or will they be disrupted by regulators?

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

First, to borrow a line from Clint Eastwood’s Dirty Harry, you have to ask yourself one question: Do I feel lucky?

If the answer is yes, prediction markets like Kalshi and Polymarket are fighting each other to help you take advantage of Fortuna’s favor (and presumably your unique expertise or inside knowledge) to cash in on the outcome of virtually any known unknown, from election outcomes to the future prices of financial market assets and the winners of sporting events of all stripes.

Two of the market’s biggest players, and both based in the US, the platforms will let you wager on everything from who President Trump will nominate as Fed Chair (a $10 bet on Kevin Hassett in mid-December would win you a payout of $13, equating to a 72% chance, on Kalshi) to who will win the Oscar for Best Actor ($10 on favorite Timothee Chalamet would get you $21, equal to a 44% chance, on Kalshi) to who will be the FIFA World Cup 2026 champion ($10 on Spain would garner a payout of $62.50, equating to a 16% chance, on Polymarket, vs. a 13% chance for both England and France).

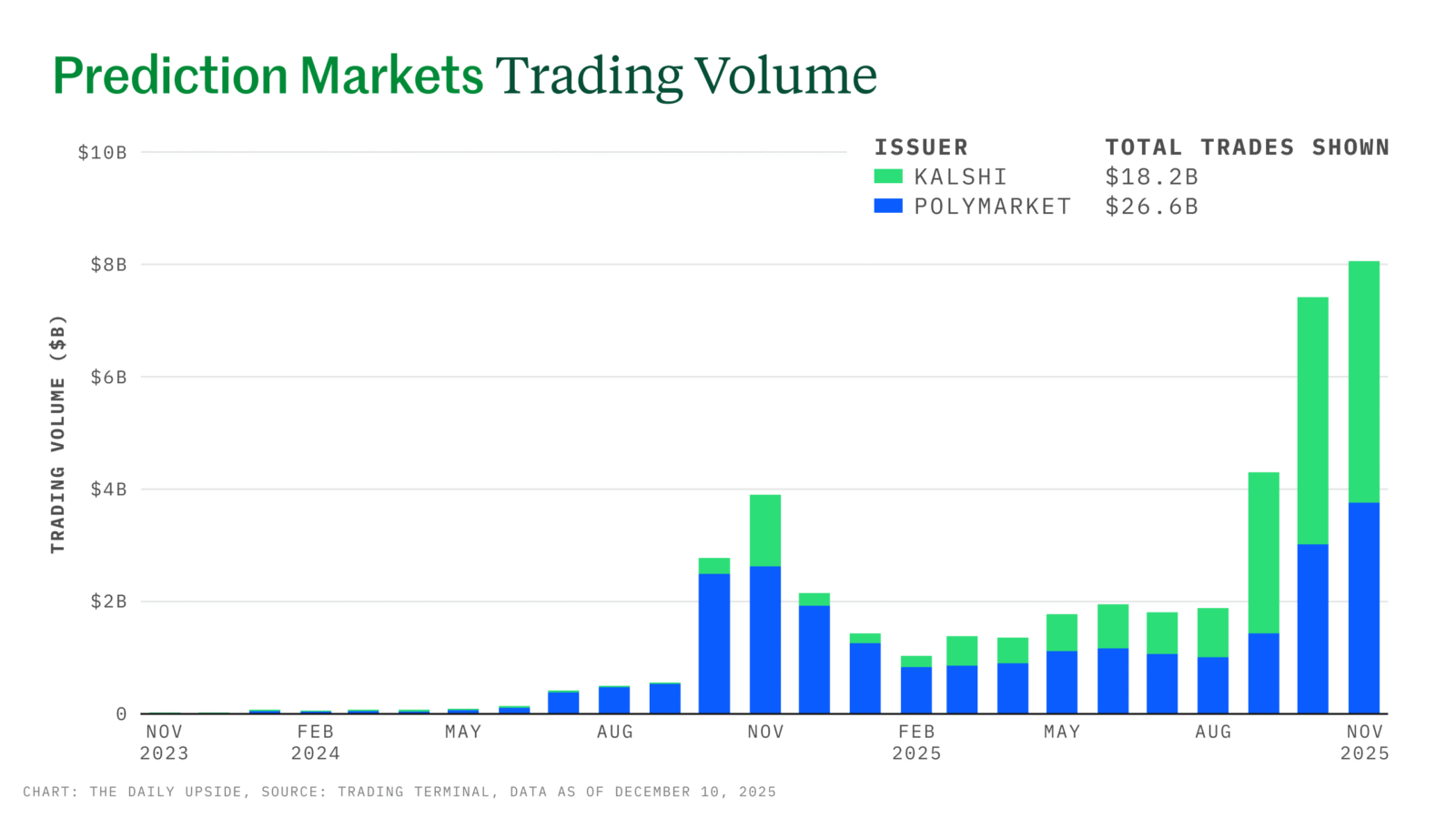

Altogether, in November, Kalshi garnered $4.3 billion in bets while Polymarket amassed $3.8 billion, up from $1.3 billion and $2.6 billion, respectively, in November 2024, according to data provider Token Terminal.

The totals reflect their dueling bids to become the market’s dominant player, a battle that has prompted both to raise massive amounts of funding, with Kalshi most recently valued at $11 billion and Polymarket at $9 billion. Polymarket, which has the added luster of being built on crypto rails, recently re-entered the US market after being barred in 2022 for failing to register with the Commodity Futures Trading Commission (Polymarket users in the US currently have to join a waiting list to use the service). The two by no means have the field to themselves, however: Many other deep-pocketed firms have recently entered the prediction market or are about to, including Coinbase, Robinhood, Crypto.com and Fanatics, as well as two of the largest online sports betting sites, FanDuel and DraftKings.

‘Mankind’s Most Accurate’

Proponents of prediction markets like to point out that their reliance on large groups of actors with strong financial incentives to make correct calls makes them more accurate than polls and media prognostications (on a recent episode of 60 Minutes, Polymarket’s brash 27-year-old founder and CEO Shayne Coplan called the prediction market “the most accurate thing we have as mankind right now”). And indeed, Polymarket gained considerable credibility and publicity when its markets showed Trump winning the 2024 US presidential election weeks before polls did the same. Polymarket betters worldwide wagered some $3.6 billion on the election’s outcome.

Moreover, if these markets grow large enough, from the millions of dollars being bet on popular individual events today to billions, they could become a valuable way for companies to hedge against all types of risks and adverse outcomes.

Can they pull it off, becoming all-purpose financial vehicles, or will they be disrupted by critics and state regulators who argue that the platforms violate their laws? Connecticut, for instance, claims Kalshi, Robinhood and Crypto.com don’t have the proper licenses to handle sports wagers in the state and aren’t following state rules, like restricting betting to people over the age of 21. “These platforms are deceptively advertising that their services are legal, but our laws are clear,” Department of Consumer Protection Gaming Director Kris Gilman said in a statement. “A prediction market wager is not an investment.”

Ironically, the outcome of that struggle is one you can’t currently bet on via either Kalshi or Polymarket. Experts say, however, that a couple of factors will help determine the result.

Event Horizon

The first is the regulatory environment, which has been favorable at the federal level since a judge appointed by former President Joe Biden gave Kalshi the green light to offer bets on US elections to users in September 2024. That receptiveness has continued under the Trump administration, with its emphasis on innovation in financial markets. Indeed, Trump’s own media company, Truth Social, has announced plans to enter the prediction market and Donald Trump Jr. himself is an investor in Polymarket and serves as an advisor to both Polymarket and Kalshi.

There’s no guarantee the cozy relationship will continue beyond Trump’s current term, however, says Koleman Strumpf, an economics professor at Wake Forest who studies prediction markets. “What we’ll have in 2028, I have no clue,” Strumpf notes.

How courts will rule on cases involving prediction markets is another open question. Kalshi, for example, is facing multiple lawsuits in the US, including, most recently, a federal class action suit filed by betters on its site who contend that the company illegally profited from its market-making practices. For its part, Kalshi called the charges a “meritless fiction” that represents a fundamental misunderstanding of how its contracts operate, but judges and juries may disagree. Plaintiffs in other cases challenging the status of prediction markets include several Native American tribes and, separately, eight states that have sent Kalshi cease-and-desist letters.

Advice from the Smart Money

The final challenge may be the biggest: What would happen if there were a scandal involving significant market manipulation by betters to secure a profitable outcome? The incentive for such schemes that the platforms provide, simply by existing, is a major concern for the industry’s critics. The betting world got a taste of how that might play out in October, when the FBI arrested two NBA players, one of whom had already been banned, on charges that included altering play to influence specific online bets.

For its part, Polymarket has said that its goal is to “create accurate, unbiased forecasts for the most important events to society” and that it often discusses controversial events that it posts, such as a current one on whether Israel will strike Lebanon on various days in December, with actual participants to weigh whether to offer them or not.

In the end, Strumpf says that how average folks might best utilize these markets is to quickly and efficiently learn about topics and questions they’re most concerned about.

“Regular people who do not trade in these markets at all can pop open Polymarket or Kalshi and draft on all this knowledge of all these smart people,” Strumpf says. “And sure, you could try to read a bunch of articles to distill that same bit of information, but A, instead of five seconds, you’ll spend five hours, and B, none of those sources will actually probably answer the question that you really want to know at the end of the day.”