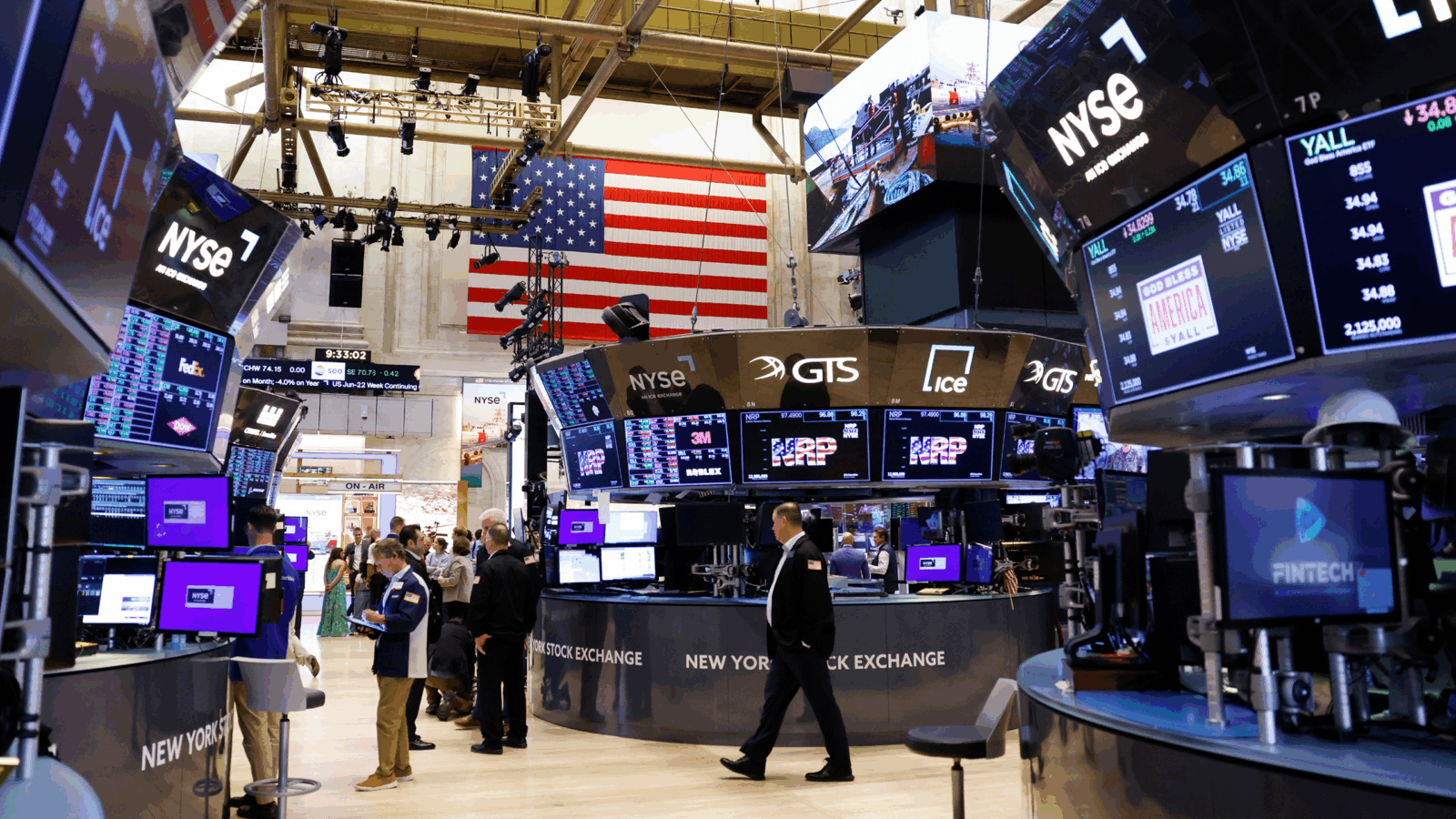

Wall Street is Pricing in Interest Rate Cuts

Increasingly, Wall Street thinks we see rate cuts soon, according to a Wall Street Journal analysis published Monday.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Wall Street knows that interest rates can’t stay high forever. And, like little kids in the backseat during a long road trip, investors can’t help but keep asking “Are we there yet? Are we there yet? Are we there yet?”

Increasingly, Wall Street thinks we’ll be there soon, according to a Wall Street Journal analysis published Monday.

Fed Up

Interest-rate futures last week show that investors have pegged the odds at 60% that the Fed will cut rates by May of 2024, according to CME Group data seen by the WSJ. That’s way more bullish than the 29% chance indicated by futures bets near the end of October. The CME data also suggests that investors are now expecting up to four rate cuts by the end of next year.

That jives with recent behavior on the S&P 500, which has risen roughly 9% so far this month after an October dip. That places November on track for the best month the index has seen since June 2022, and reflects expectations that inflation will continue to fall and the Fed will subsequently lower rates to maintain economic growth, or to hedge against a slowdown. Movement on the bond market reflects the same, with yields on longer-term bonds still below those of shorter-term bonds. The so-called inverted yield curve tends to reflect an expectation of a possible economic slowdown, which, again, is likely to prompt rate cuts at the Fed.

Economists are largely on the same page as Wall Street investors:

- In Bloomberg’s latest survey of economists, published Monday, respondents said they still expect the Fed to begin loosening monetary policy by sometime around the second quarter of next year — echoing Wall Street’s futures bets of a May rate slash.

- Still, economists have grown slightly more pessimistic about inflation’s cool-down. Projections for 2024’s core personal consumption expenditures index — a measure of inflation preferred by the Fed that excludes volatile food and energy prices — hit 2.5% in the latest Bloomberg poll, up from a 2.4% prediction in October.

Soft Spoken: Tamping down inflation without triggering a recession remains the name of the game for Jerome Powell and the Fed. While the inverted yield curve and expectations of rate cuts may look like Wall Street is anticipating a recession, that isn’t necessarily so. In the past, the Fed has cut rates by as much as 4% during a recession, Sonu Varghese, global macro strategist at financial advisory firm Carson Group, told the WSJ. So expectations of just a single-point reduction, or less, by the end of next year is more of a prediction of Powell slightly tipping the scales to secure a soft landing. Call it a rate-cutting insurance policy.