Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Flo and the gecko better keep an eye on market share.

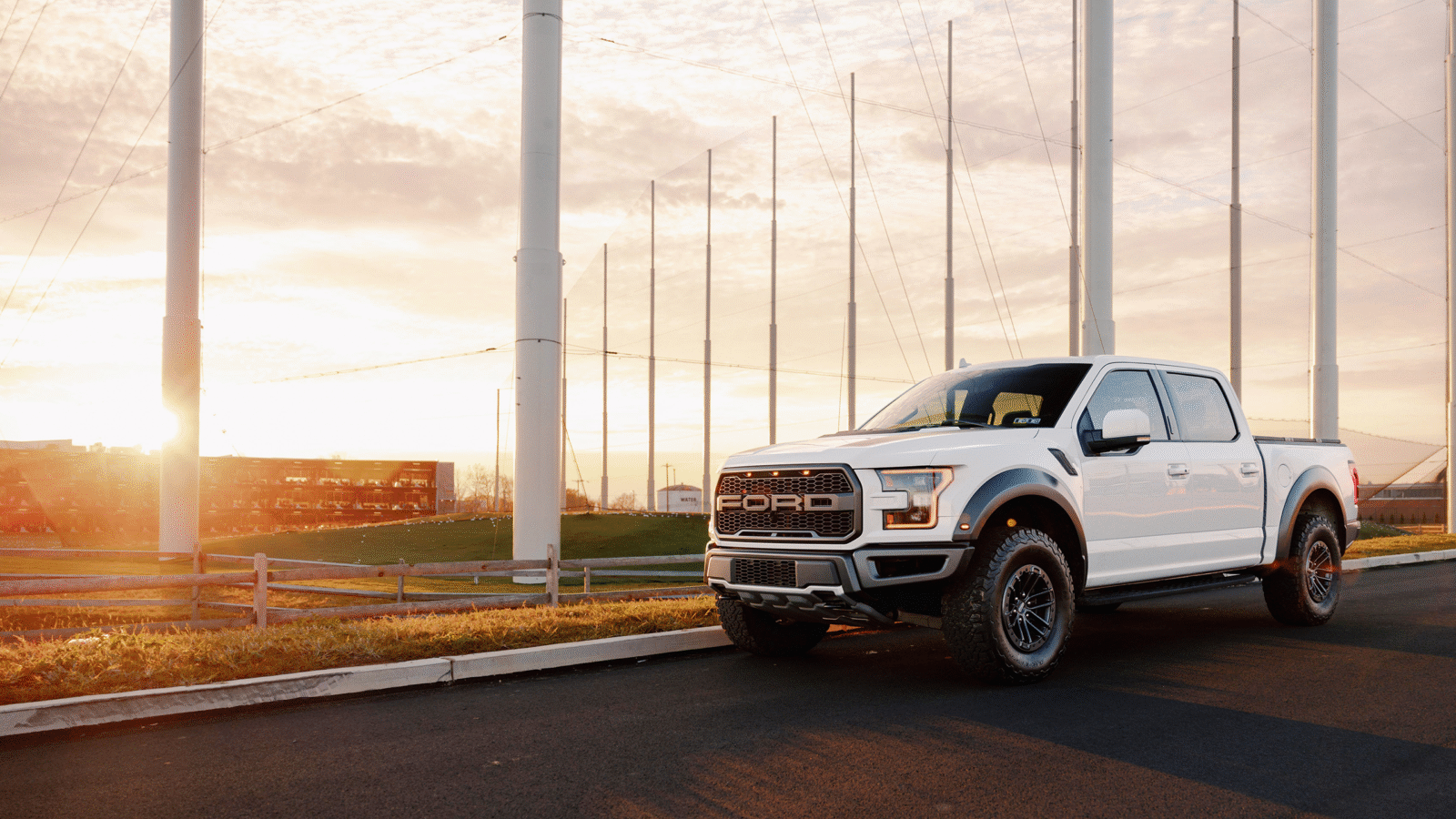

General Motors is launching a new car insurance product that will adjust rates based on a policyholder’s safe-driving habits (or lack thereof).

Safety Saves

GM’s insurance plans will be branded under its connected-car subsidiary OnStar, which comes installed on all GM vehicles in North America. Along with its security and emergency features, OnStar collects meticulous data which can be used to price policies:

- Apologies to Jay Leno and other auto enthusiasts, but driving a different car every day will not earn you a discount. However, safe driving like obeying speed limits and avoiding sudden stops will be rewarded come billing time.

- Down the road GM wants to incorporate even more sophisticated data into its insurance rates, such as how often blind spot detection or automated braking are engaged.

GM kicks off an employee pilot program for OnStar Insurance this week and plans to offer it nationwide next year. The company is teaming up with a subsidiary of American Family Insurance to underwrite policies.

Data Drivers

Insurance companies have offered safe-driving discounts for years, but they’ve relied on smartphone apps or portable devices to supply data.

For General Motors the launch is actually a re-launch. GM offered car insurance before the Financial Crisis and is now betting that car sensors and on-board computers will help it succeed once again.

Brian Rhodes of IHS Markit said, “The automaker has more data at its fingertips that can tie into a unique score and provide more value for insurance purposes.”

The Final Drive

Research firm Berg Insight expects that 50 million auto insurance policies in North America will use digitally-logged car data by 2023, up from just 10.6 million at the end of 2018.