GM Pitches Tariff Contingency Plan to Skeptical Investors

The stakes could hardly be larger for General Motors, which pitched a simple message to investors: We have a plan and the future is bright.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

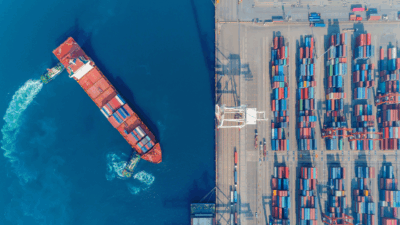

Investors of all stripes are asking themselves one question: “Will he or won’t he?” He being President Donald Trump and tariffs on imports being what he’s promised he will impose.

And the stakes could hardly be larger for General Motors, which tried to assuage the uncertainty Tuesday with a simple message: We have a plan and the future is bright. Investors weren’t immediately buying it: Shares in America’s largest US automaker, one of the first major corporations to sketch out a potential post-tariff path, fell 8.9% in the company’s worst day since 2020.

Ready to Shift Gears

But the fact is, Detroit-based GM has been on a roll of late, thanks to strong SUV and pickup truck sales. Executives announced Tuesday that profit in 2024, excluding one-time charges, climbed 21% to $14.9 billion, a record. The company sold 2.7 million vehicles in the US last year, the most since 2019. GM also predicted $11.2 billion to $12.5 billion in net income for 2025, ahead of analyst expectations.

That’s a nice position to be in, if not for certain world events. President Trump, as you’ve heard a million times now, is mulling placing 25% tariffs on imports from Canada and Mexico. And GM happens to produce roughly a third of the US vehicles it sells in those two countries, leaving its business exposed and investors wary of its shares, at least on Tuesday:

- Chief Executive Mary Barra tried to pacify concerns Tuesday by noting the company has “several levers that we can pull,” including factory space in the US where it can shift the production of some pickup trucks. Barra also said GM might accelerate shipments of vehicles from Canada and Mexico to get ahead of tariffs, creating some breathing room as it realigns production at home.

- One thing GM will not do is anything that involves deploying a major amount of capital without clarity, Barra said, noting no tariff policy has been announced. The Financial Times reported Monday that newly confirmed Treasury Secretary Scott Bessent would prefer to introduce tariffs gradually, starting with a much lower 2.5% levy.

The selloff in GM may well have been triggered by a perfect storm of political fears and a one-time $4 billion restructuring charge related to its struggling China business, which helped put the company $2.9 billion in the red in the fourth quarter. The bottom line: Businesses with exposure to tariffs should expect a degree of skepticism from investors, even if they have an “extensive playbook” they’re ready to run, as GM’s CFO Paul Jacobson said Monday.

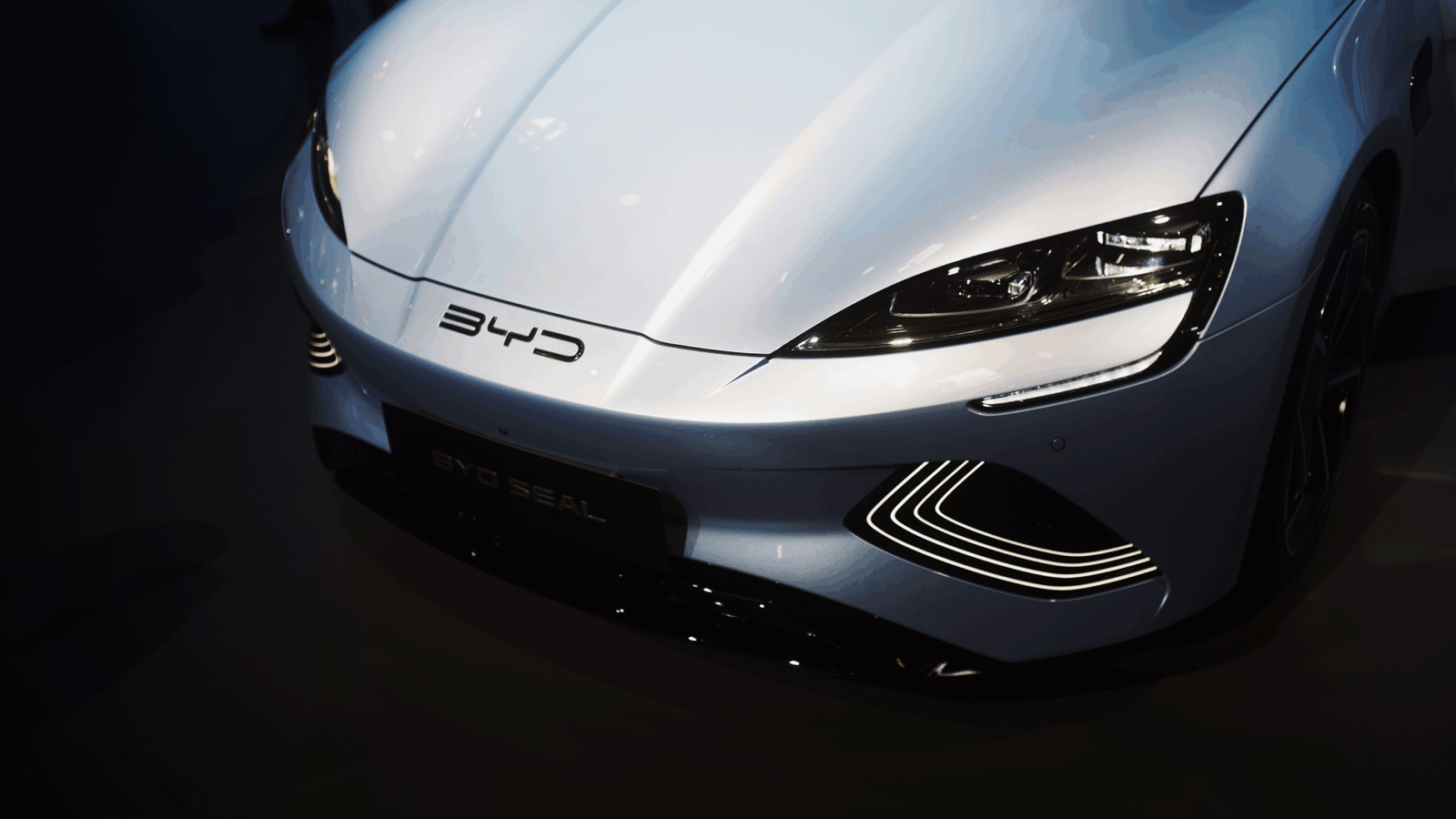

Electric Gravyland: While electric vehicle sales have slowed, GM has nearly doubled its EV market share in the US to 12.5% since the first quarter of 2024. More importantly, after losing billions on EVs to scale up operations and build out a fleet, GM’s EV sales covered the cost of materials and labor for the first time in the fourth quarter, a key milestone toward profitability. Of course, that was all before a certain other policy change from the White House…