The EU’s EV Tariffs Favor Tesla, But Maybe Not Enough

The European Commission on Tuesday solidified new tariffs for electric vehicles imported from China. The actual numbers aren’t harsh.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

A win is a win, even when it’s little.

The European Commission on Tuesday solidified new tariffs for electric vehicles imported from China. The EU has been making noise about imposing tariffs for a while, arguing that they’re necessary to stop cheap Chinese EVs from flooding the market. The actual numbers the EU has settled on aren’t too harsh, and Tesla, which is not a Chinese company but exports from China, got a better deal than most.

Tariff Off

The EU launched an antitrust investigation into China-made EVs in September last year. Chinese state subsidies mean that large domestic firms like BYD can offer vehicles at a much lower price point than foreign rivals like Tesla.

While Tesla has managed to come out of this tariff situation somewhat victorious, the raw numbers still skew in favor of domestic Chinese companies:

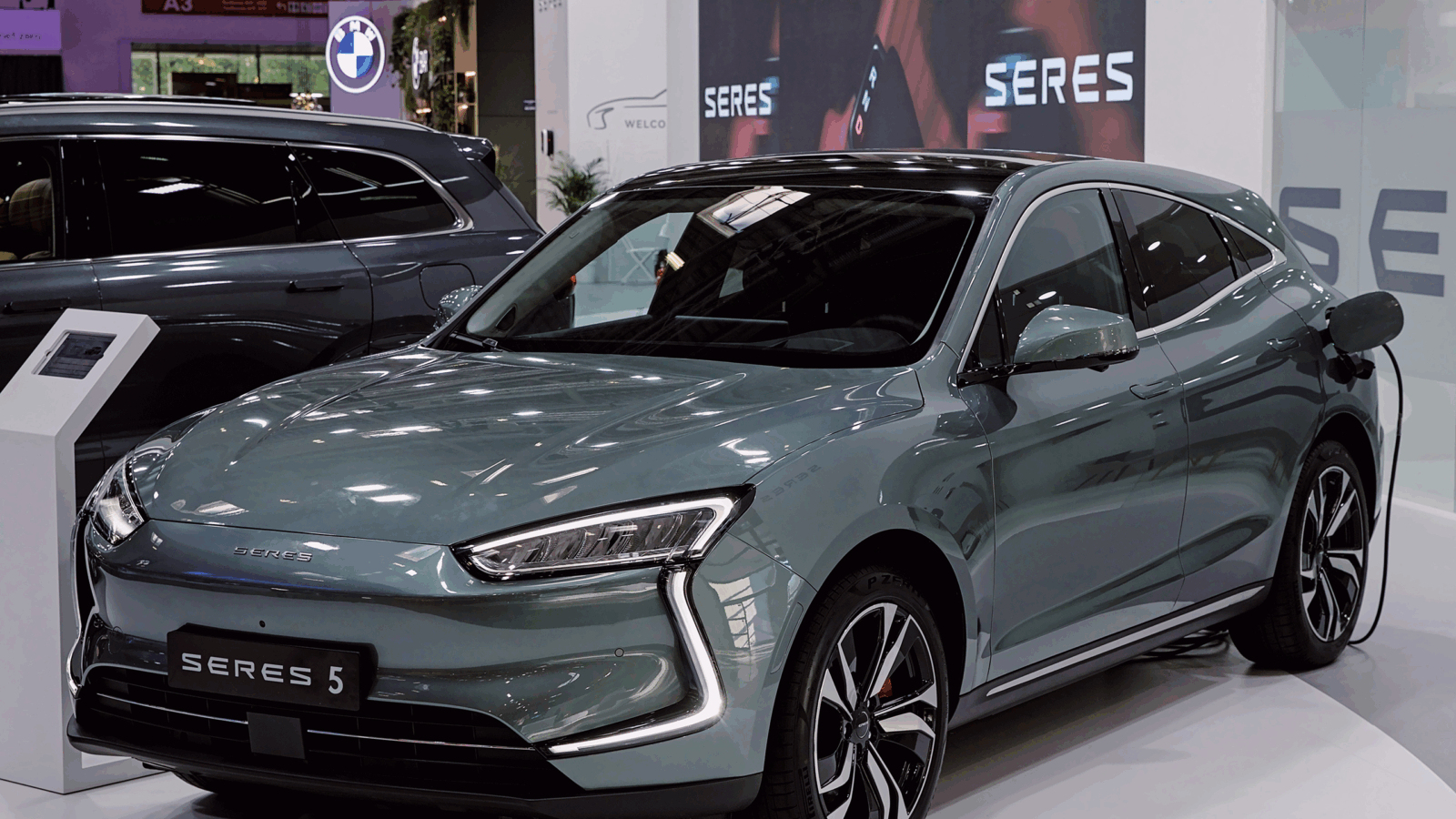

- Tesla will have to pay a tariff of 9% under the new directive, while BYD will have to pay 17%, Geely 19.3%, and SAIC 36.3%. Tesla already hiked the price of its Model 3 cars in multiple European countries last month by €1,500 ($1,622) when it was reported that the EU was going to slap it with a 20% tariff (which it looks like Tesla successfully appealed).

- Emma Orr, director of bids for the EV sector at startup consultancy Winning Business, told The Daily Upside that even when weighed down with tariffs, Chinese firms are hard to beat on price. “People are still likely to buy BYD cars […] because even with the tariff, it is still a very economical economy/budget car,” said Orr.

Cory Hewett, director at FIXD automotive, told The Daily Upside that the EU’s new tariffs are “likely too muted to fully achieve the desired result,” adding: “Even with the tariffs, BYDs may still be cheaper than the competition in the European [market] while generating higher profits per vehicle than in their home markets in China.”

Home Turf: Tesla might have won a battle in Europe, but there’s a war raging back in China. Elon Musk managed to convince the Chinese government back in April to let Tesla sell its driver-assistance software in the country — but that still hasn’t happened yet. Musk said he expects the company’s famous Full Self-Driving software to be cleared by regulators by the end of the year, but according to a Wall Street Journal report, local companies are bulking out the driver-assistance market before Tesla’s even had a chance to get its foot in the car door.