Uber Paying $300M Fare in Robotaxi Deal

A pact announced Thursday calls for Uber to invest $300 million in Lucid and buy at least 20,000 robotaxis from the company over six years.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Uber is hopping into a carpool with electric vehicle startup Lucid and self-driving software firm Nuro to develop robotaxis that will ferry passengers on the rideshare giant’s network.

A pact announced Thursday calls for Uber to invest $300 million in Lucid and buy at least 20,000 robotaxis from the company over six years. It’s a great endorsement for Lucid, which has yet to fully recover from a February selloff prompted by its CEO resigning amid concerns it was burning through cash at a bonfire pace. Lucid’s shares popped 36% Thursday. But the deal left some scratching their heads.

Dealing from a ‘Weak Hand’

Uber’s very real drivers make for uniquely human experiences: Two old friends lovingly reunited after 20 years, in one viral example. But the company has wisely struck over a dozen autonomous driving partnerships as emotionless robots make their way into the taxi market. Among them are deals with Google’s Waymo in Atlanta and Austin, as well as with Chinese autonomous vehicle-tech company Pony AI in the Middle East, British AV-tech company Wayve in London, and Volkswagen and Intel spinoff Mobileye in Los Angeles. The battle for the market is expected to be fierce and involve some of the world’s most powerful firms: Tesla kickstarted its own robotaxi service in Austin last month, while Amazon subsidiary Zoox is testing robotaxis in multiple US cities.

Uber’s partnership with Lucid is set to be launched in a “major US city” in late 2026 before expanding to other markets. Lucid, which reported a net loss of $366 million in the first quarter after losing $3 billion the previous year and has seen its stock decline nearly 95% since 2021, receives funding to outfit its assembly line with hardware suitable for making autonomous vehicles with technology like Nuro’s. Nuro, meanwhile, is getting a “multi-hundred-million-dollar” investment of its own. Uber, of course, theoretically has 20,000 future electric autonomous robotaxis to look forward to, but some observers say it may also be buying a headache:

- Analysts at Wedbush said in a note that the deal highlights Uber’s weak hand in the robotaxi race and, by bringing on potential competitors, may damage its ongoing relationship with Waymo. They did not hold back, with one especially withering comparison: “This feels like the search equivalent of doing a deal with AskJeeves, Overture or Infoseek back in the day to protect against Google on the horizon. Meanwhile, Tesla and Waymo just keep building AI infrastructure and data collection.”

- Meanwhile, Wedbush noted that pouring hundreds of millions into Lucid and Nuro and buying 20,000 cars could “impair the capital efficiency story” that has revived Uber’s stock, propelling it to a record high as recently as last week. Then, there’s the simple math: Lucid delivered just 10,000 vehicles last year, and Wedbush said it would likely take more capital to make 20,000 self-driving AVs for a single client in the next six years.

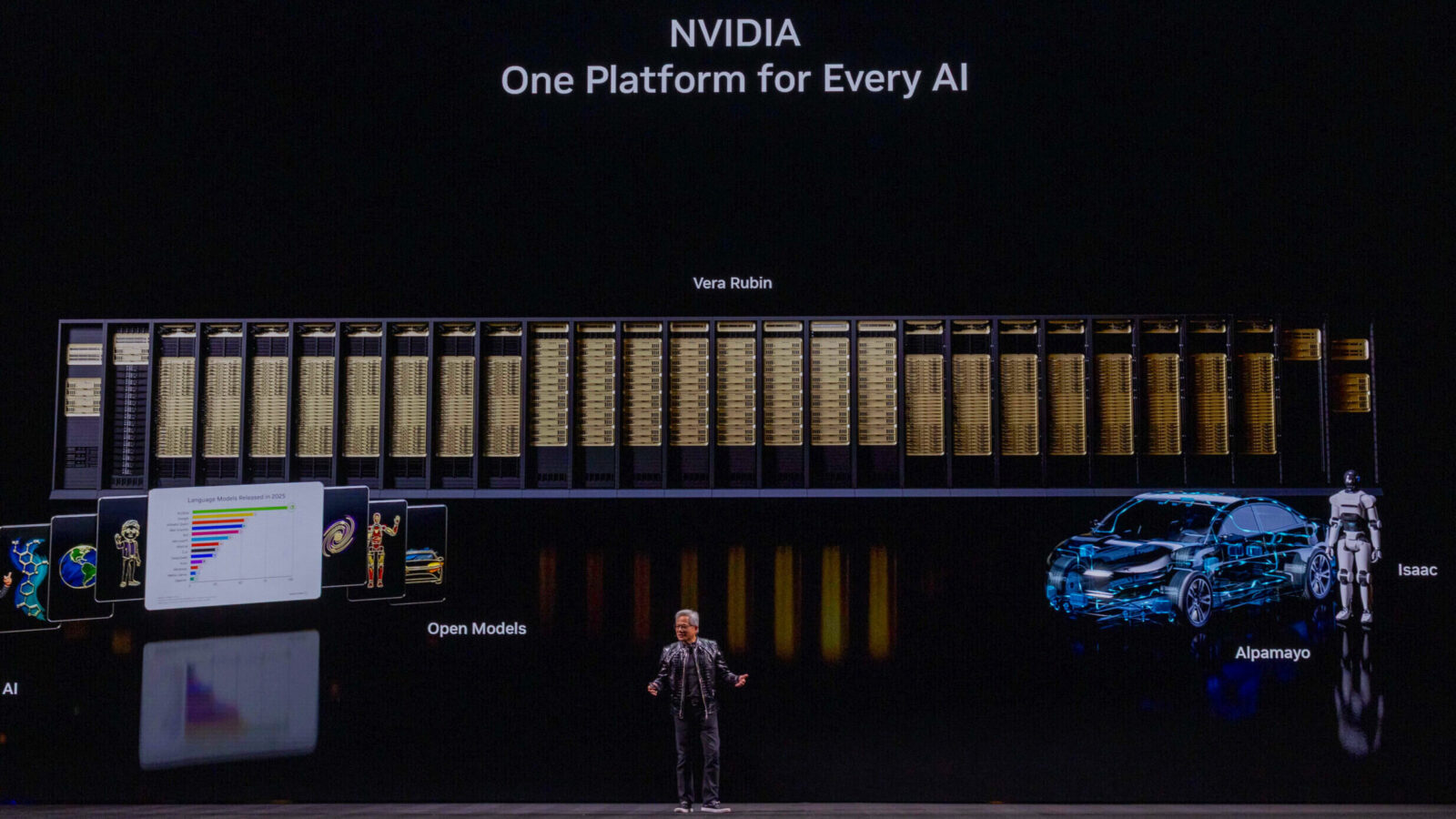

Farming Returns: Last month, Bank of America analysts predicted the autonomous vehicle market could be worth $1.2 trillion by 2040. Apart from the obvious stocks set to benefit, such as Tesla and Waymo-owner Alphabet, they also flagged insurance providers like Progressive as under-the-radar beneficiaries. Sensor-makers, including Aptiv and Mobileye, are poised to rake in cash as well, as is $4 trillion chip giant Nvidia, which counts most major robotaxi and autonomous vehicle companies among its customers. BofA also flagged farming, construction and equipment manufacturers — Caterpillar and John Deere are already making and testing autonomous trucks and tractors.