Some EV Startups Are Seeing Their Cash Running on Empty

Many of the EV startups flush with investor cash and confidence just a few short years ago are now struggling to keep the lights on.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

A flat EV world is fine if you’re Tesla, but it’s murder on startups.

An analysis from The Wall Street Journal found that many of the EV and battery startups that were flush with investor cash and confidence just a few short years ago are now struggling to keep the lights on.

EV Headwinds

Even with industry-wide challenges like supply-chain issues and slowing EV adoption rates, Tesla has still sold more than 4 million cars and is one of the top 10 largest companies in the world by market cap. The journey has been somewhat different for other startups hoping to recreate Tesla’s juggernaut success.

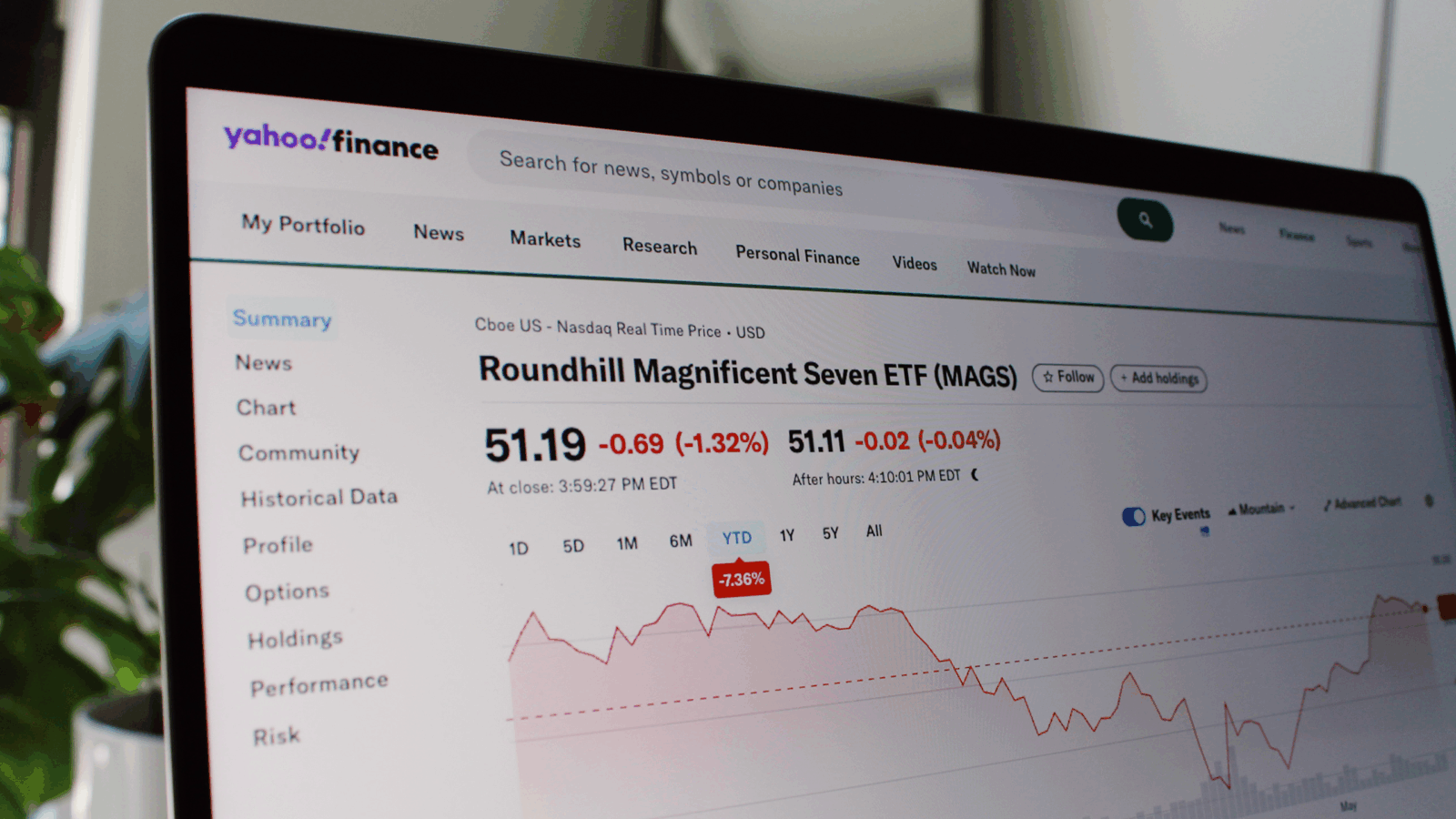

At least 18 publicly traded EV and battery startups are at risk of running out of cash by the end of 2024, the WSJ found. The majority of startups that went public between 2020 and 2022 did so via special-purpose acquisition companies, which can access public markets faster than IPOs but also tend to be more opaque, riskier, and underperform. The stocks of 43 companies that the WSJ evaluated are down an average of more than 80% from their market debut.

That quick rise and fall is being felt across the sector, as many EV startups look to reduce costs and raise new capital:

- It’s even tougher today at scandal-hog Nikola, an Arizona-based semi-truck maker whose founder Trevor Milton was just sentenced to four years in jail for defrauding investors. When it went public in June 2020, Nikola was trading at $66, but now it’s under $1.

- Automakers like Rivian and Lucid — both of which produce vehicles with price tags above the average American’s salary — have enough cash on hand to make it past 2024, but they’re still facing low sales. For others, the race is already run: Lordstown Motors, Proterra, and Electric Last Mile Solutions all filed for bankruptcy in the past two years.

Rethinking EVs: The big guys are feeling some pressure, too, that’s why so many major automakers are tempering their EV efforts. Ford recently delayed $12 billion in EV investments, GM is waiting to start selling multiple electric models, and Stellantis has yet to begin selling any all-electric vehicles in the US. The silver lining is that hybrid cars are having a moment — more than two decades after Larry David made them his car of choice in season two of Curb Your Enthusiasm.