Tesla Touts High-End Roadster as EV Industry Fights Slumping Demand

While everyone else looks to navigate a tepid market, Elon Musk plans to sell a $250,000 performance car next year.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

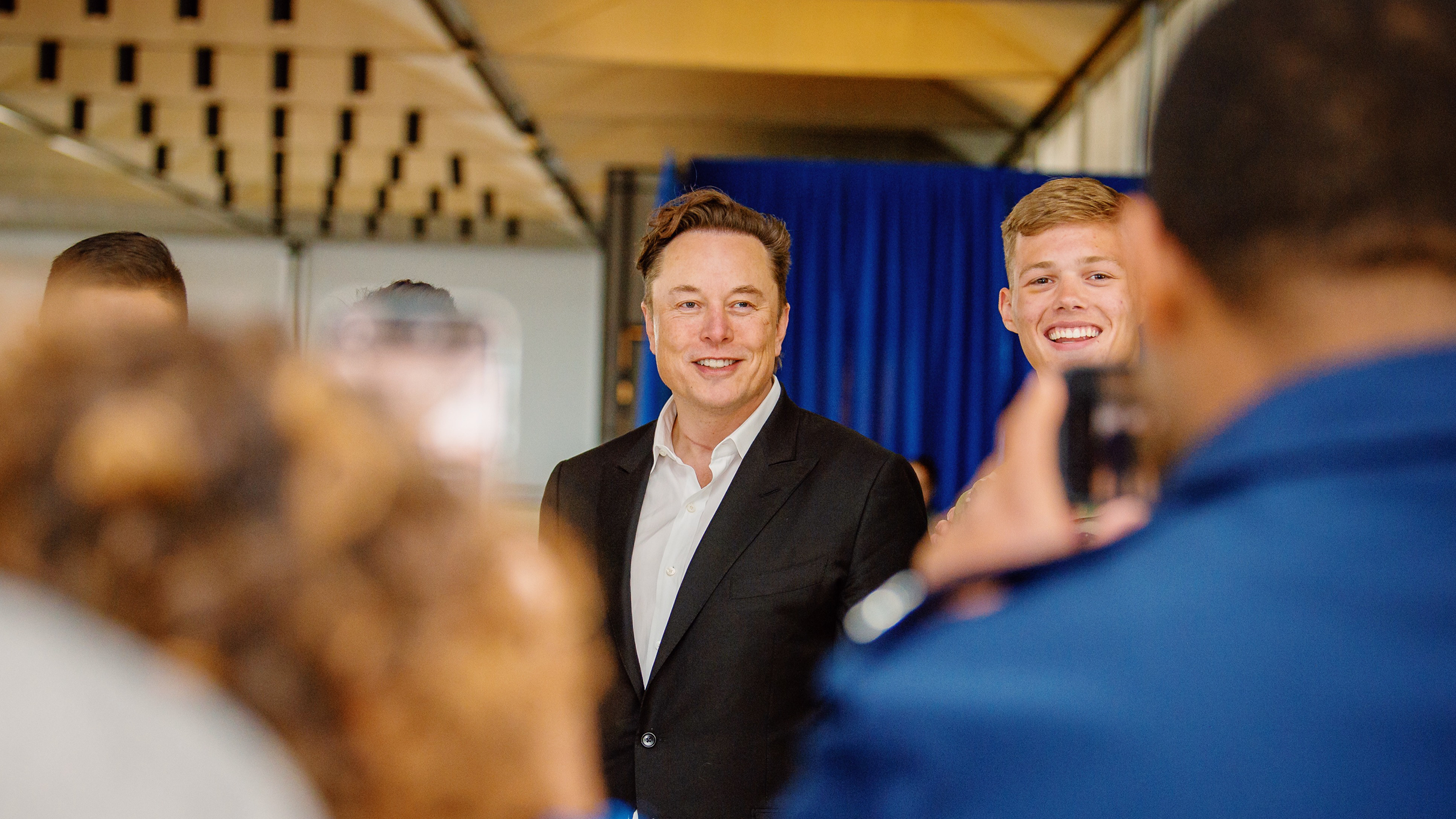

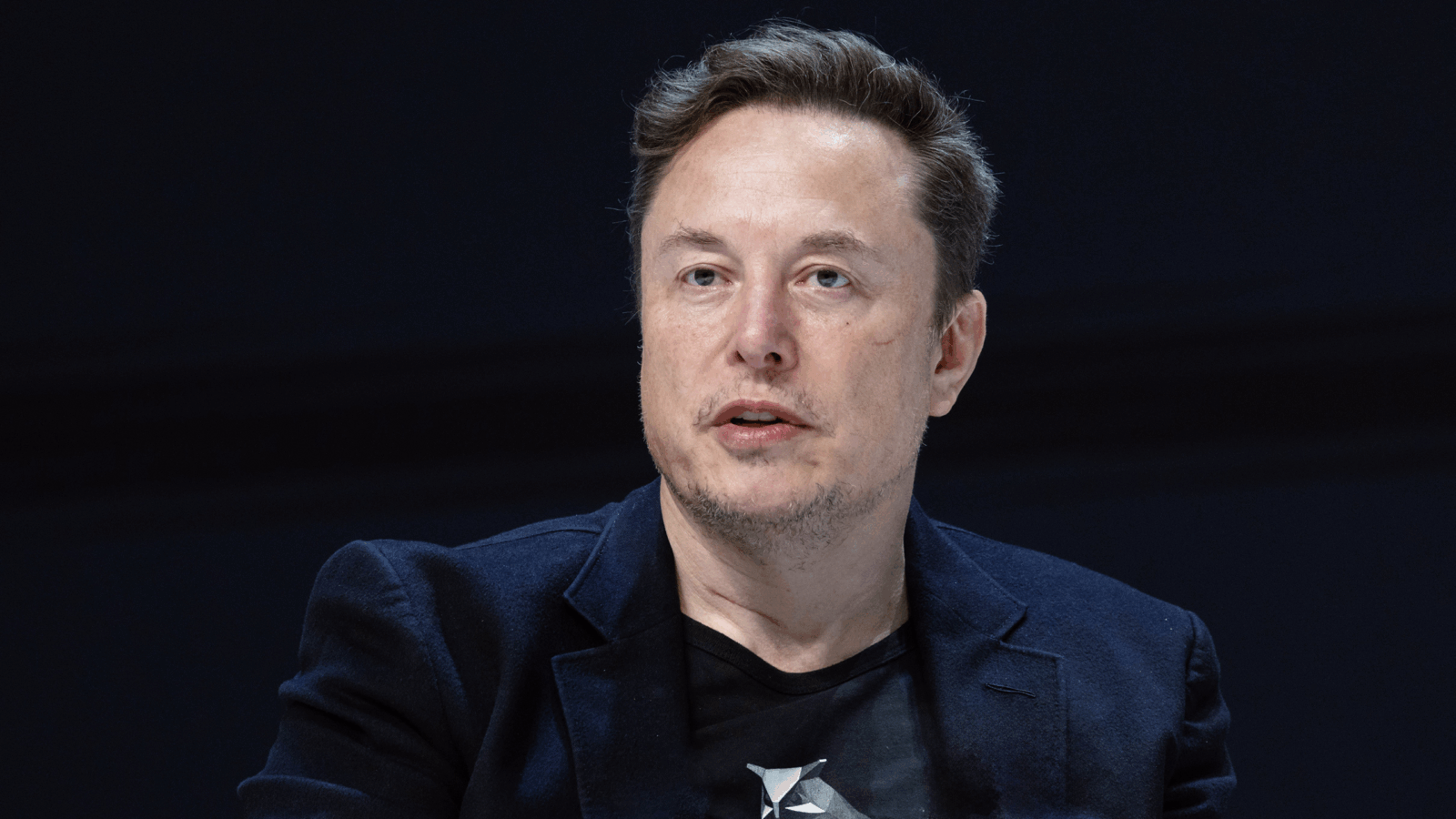

If he weren’t zigging while everyone else was zagging, he wouldn’t be Elon Musk.

The mercurial Tesla CEO made a series of posts on his X platform late Tuesday revealing plans to resurrect its high-end performance Roadster model, five years after it was originally unveiled. In his usual understated manner, Musk tweeted: “There will never be another car like this, if you could even call it a car.”

Higher than High-End

We’re pretty sure you can call it expensive. Musk’s tweet flurry was short on some specifics, namely the Roadster’s expected sticker price, but he did say the model will be a collaboration with Musk-owned SpaceX, that there will be an unveiling later this year, and that the goal is to start shipping the car next year. Based on some of the performance metrics cited by Musk, it’s easy to infer that Musk is setting up a competition with the U9 high-end vehicle just unveiled by Chinese rival BYD. That model goes for $233,000, and given that Tesla was originally charging $250,000 for reservations when it originally announced its Roadster in 2017, this is going to cost more than my Civic.

That, of course, is not at all where the rest of the industry is headed, as EV demand has slumped, causing several industry players to scramble — or roll up the road:

- Late Tuesday, Bloomberg reported that Apple is abandoning a decadelong effort to build an electric car, long considered to be one of its most ambitious projects and dashing the hopes of Apple fans and investors that it would eventually scale its hardware ecosystem into a full-sized vehicle.

- Just about every EV maker, including Tesla, has had to cut prices in an attempt to entice buyers. It’s an even more daunting route for startups like Rivian, which loses money on every car it makes.

Trust But Verify: As a profitable large business, Tesla has the luxury to both absorb price cuts as well as build $250,000 vehicles for the handful of buyers with that kind of money. That said, with Tesla’s stock down about 25% in the past five months, detaching its trajectory somewhat from the “Magnificent Seven,” the leash doesn’t seem as long for investors worried about the Roadster’s possible impact on future profit margins.