After Oil, the UAE Wants to be a Renewables Giant

With oil in decline, Masdar, the United Arab Emirates state-backed renewables company, is on an acquisition shopping spree.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

At least one OPEC nation sees a future for itself weaning us off oil.

After announcing a deal to acquire the biggest renewables company in Greece last week, Masdar, the United Arab Emirates state-backed renewables company, is on the hunt for more deals, the Financial Times reported this weekend. The timing couldn’t be better.

Headwind Power

Depending on who you ask, peak oil consumption has either already happened or is soon on the horizon. But that hasn’t exactly spelled opportunity for the renewable alternatives. Despite global renewable energy capacity increasing by 50% last year, the industry faces tremendous headwinds — particularly as high interest rates kneecap even further growth.

That’s contributed to a valuation haircut across the fast-growing sector’s biggest firms. In turn, that’s led Masdar — which happens to be led by the same Emirati official, Sultan Ahmed Al Jaber, who also heads the petrostate’s oil firm — to embark on an acquisitions shopping spree. Call it a case of throwing good (for the environment) money after bad:

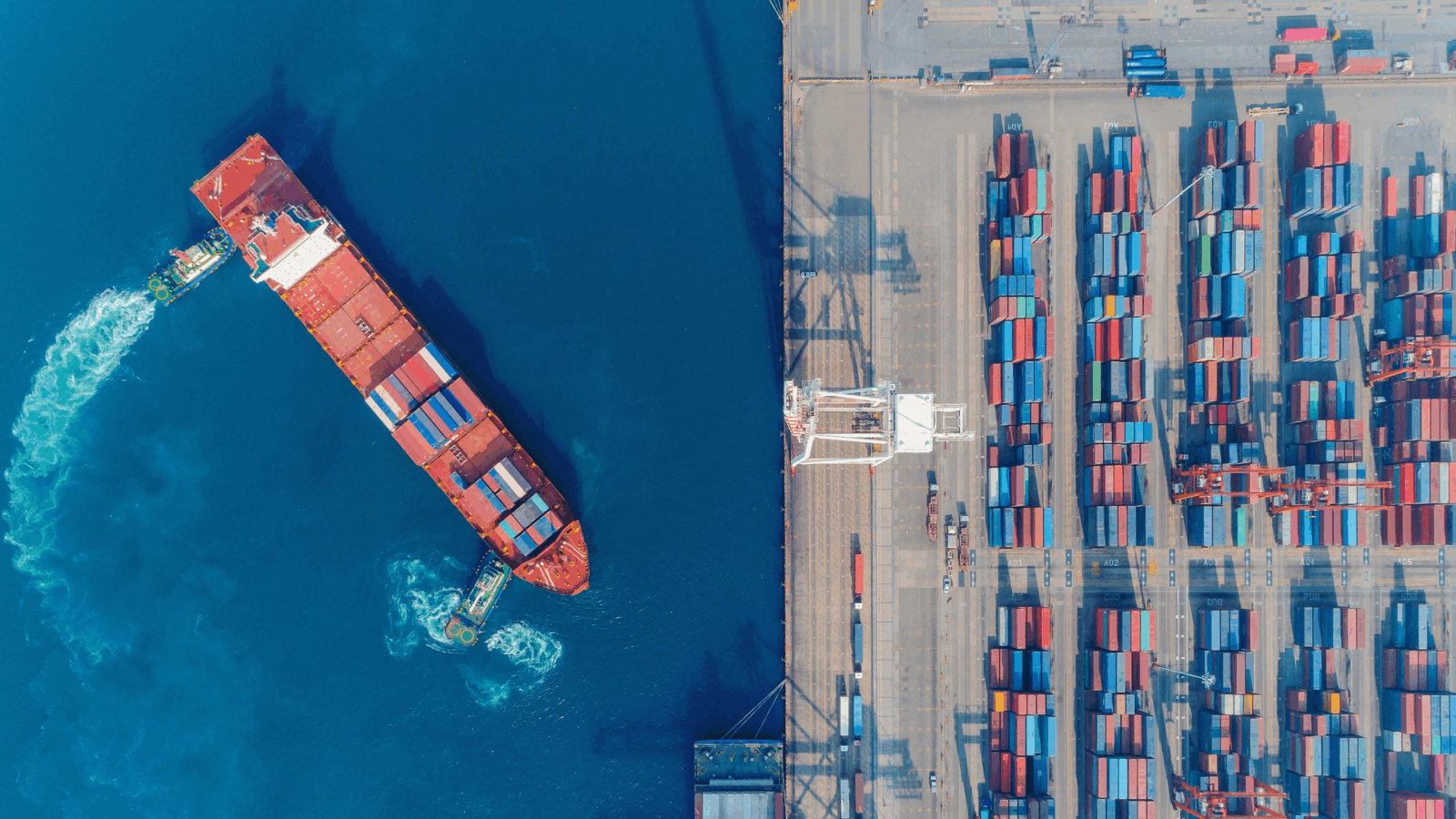

- Masdar on Thursday announced it would acquire a 67% stake in Greek renewables giant Terna at a €3.2 billion valuation, with plans to launch an all-cash offer for remaining shares upon completion of the deal.

- In March, Masdar finalized its €1.6 billion acquisition of a 49% stake in Spanish energy giant Iberdrola’s Baltic Sea wind farm, and announced a deal to acquire Energy Capital Partners’ 50% stake in San Diego-based Terra-Gen Power.

Easy Being Green: Masdar, backed in part by the UAE’s $300 billion Mubadala sovereign wealth fund, isn’t the only player busting into the renewables space while claiming to have the deep pockets needed to fuel the sector’s next stage of growth. KKR is in the midst of a €2.8 billion takeover of German-based Encavis, while Singapore’s Temasek state investment fund, along with Canadian investment firm Brookfield, said last month they’ve entered talks on a €6.1 billion takeover of French wind and solar firm Neoen. Being green is easier when there’s green attached.