Did Streaming Kill the Music Industry?

Music streaming services that offer more or less all the recorded music in history. So how is the industry supposed to grow?

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

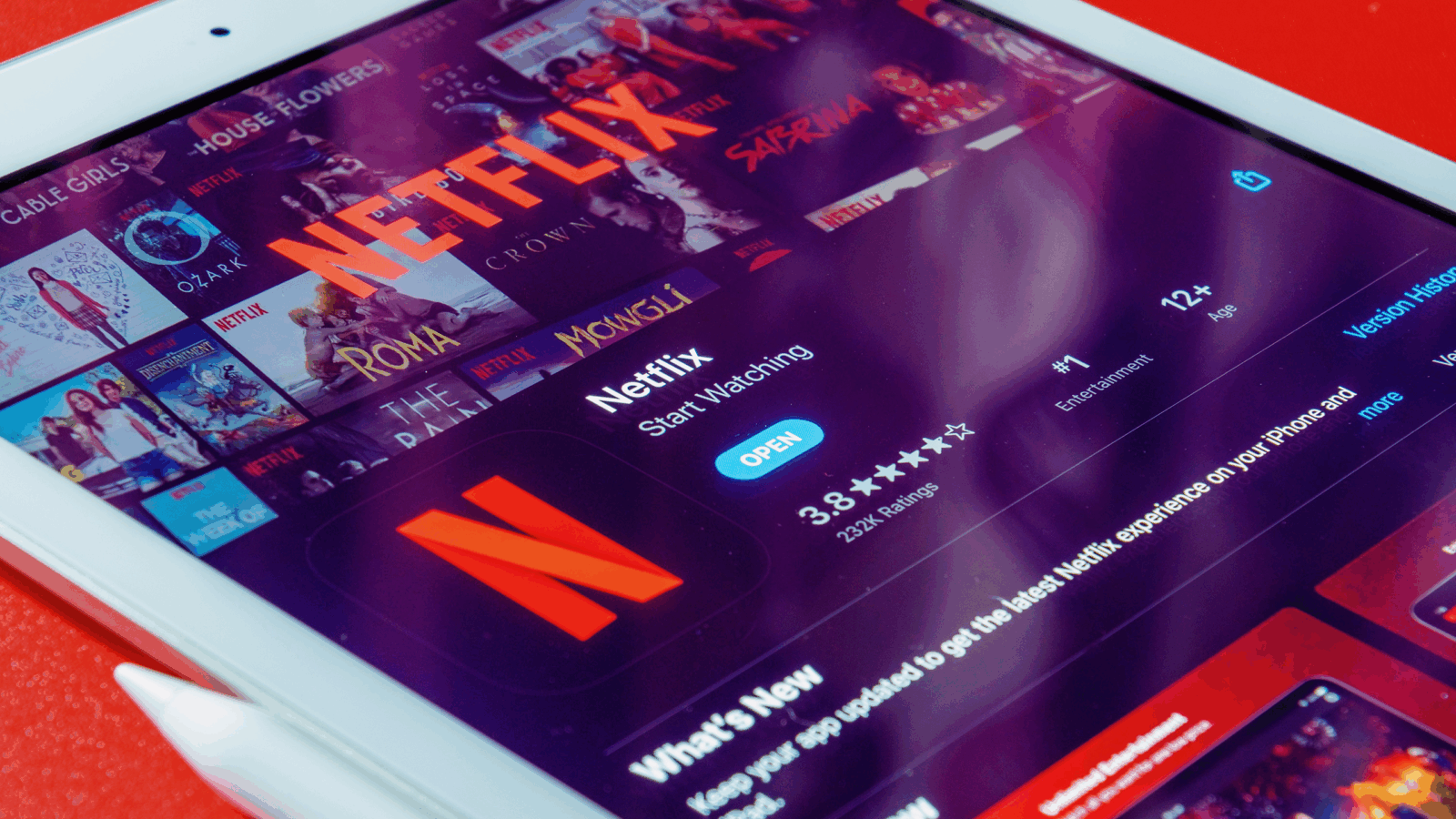

Cast your mind back to the 2000s and you’ll remember music piracy was even more rampant than swoopy haircuts. It was the freewheeling era of LimeWire and Napster, and it was against this backdrop that Spotify reared its head in 2006. Founder Daniel Ek told The Telegraph in 2010 that the idea for Spotify came in direct response to the prevailing klepto culture of the time. “The only way to solve the problem was to create a service that was better than piracy and at the same time compensates the music industry — that gave us Spotify,” Ek said.

Ek was vindicated for a while, with piracy rates steadily dropping from 2016 until 2023, according to industry research firm Muso. But streaming hasn’t been quite the thief-killer it promised it would be; piracy has started to tick back up again. At the same time, streaming’s impact on the business has been profound, transforming how music is monetized and consumed. “Streaming has turned music into tap water,” Hanna Kahlert, a music industry analyst at MIDiA Research, told The Daily Upside. “It’s just a utility that people don’t even think about.”

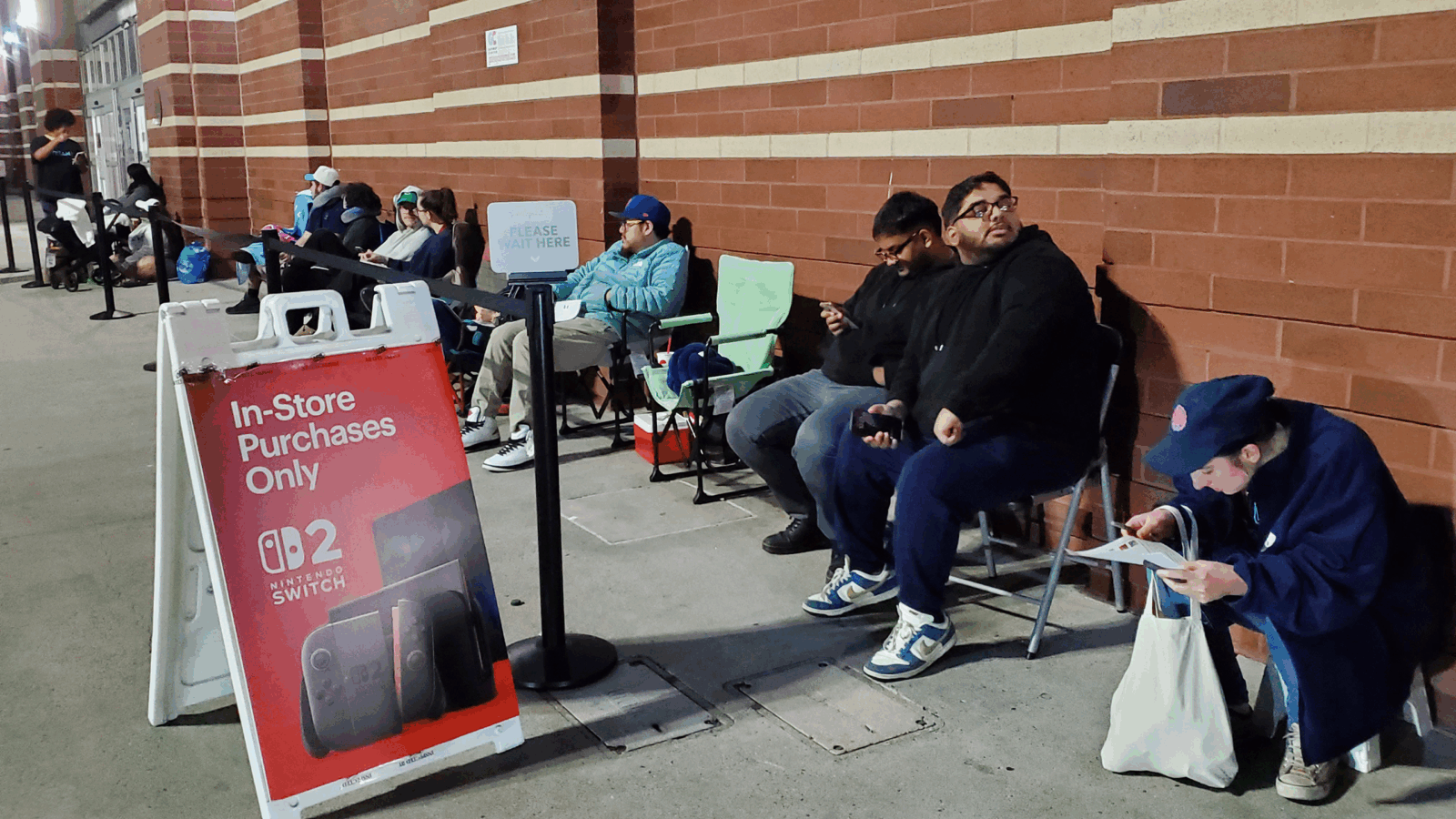

There are now a variety of music streaming services that offer more or less all the recorded music in history — or at least, close enough for the average consumer. The unanswered question reverberating from the boardrooms of mega music labels all the way down to the garage of your friend from college’s punk-rock-metal-fusion band? How the industry is supposed to grow.

Money For Nothing

Spotify isn’t a particularly generous remunerator. Singer Lily Allen grabbed headlines last week after tweeting that she makes more money from selling pictures of her feet on OnlyFans than from millions of Spotify streams. But Bill Werde, director of the Bandier music-business program at Syracuse University, former editorial director at Billboard, and author of the industry newsletter Full Rate No Cap, says Spotify isn’t really the problem. “There’s a reason why the biggest stars keep their music on Spotify,” he told The Daily Upside. “Spotify is paying out a reasonable amount,” but the raw payout from an artist’s streams doesn’t just go to the artist, it gets split between producers, managers, middlemen, tambourine men, and so on.

For artists, exactly how lucrative music streaming is for you depends on where you are in your career:

- According to MIDiA research, the average music creator makes just under $9,000 a year from their craft.

- For early-career musicians, who make between $3,000 and $4,000 in a year, streaming comprises 30% of their income. For professional musicians who make over $30,000 per annum, streaming only accounts for about 13%.

The big problem for Spotify now is, where does it go from here? The company has enjoyed a fairly profitable year because it cut 17% of its workforce and raised prices on its subscriptions, but Werde thinks this level of profitability will be short-lived because there’s simply no one left to sell subscriptions to. Data from the Recording Industry Association of America shows that subscriber growth in the US has slowed 73% since 2020.

The logical next step for streamers like Spotify is to find emerging markets across the globe, but that comes with two challenges. The first is that huge markets like China and India already have their own favorite music streamers. In India and other Southeast Asian countries, YouTube Music rules supreme — but it’s tricky even for YouTube. The company has courted users in those markets with a freemium ad-supported model, and converting them to paid subscribers won’t be easy. “The average revenue per user in these markets is really low. The amount of disposable income in these markets tends to be much, much lower than the West,” Werde said.

Label Makers

Market saturation isn’t just a problem for Spotify. Big music labels are suffering as well. Universal Music Group’s share price plunged around 25% in July off the back of its second-quarter financial results because they revealed a substantial slowdown in streaming growth. Now labels are having difficulty re-negotiating their licenses. “The music business waited way too long to demand higher prices,” Werde said, pointing to the skirmish between Universal and TikTok earlier this year, where Universal pulled its music from the app but later reached a deal with TikTok after Taylor Swift, who holds the copyright to her songs, crossed the picket line. “TikTok basically looked at this game of chicken, and said, ‘We’re way bigger than you. You need us more than we need you.’ And they didn’t blink,” Werde said.

Social media holds the potential to muscle in on music streaming’s turf without actually getting into the business of streaming itself. Kahlert said she believes TikTok shut down its fledgling streaming service this year after it realized it doesn’t really need an actual streaming platform to benefit from the music business. It just needs to keep music consumers on its core platform. Werde thinks it’s also possible TikTok just realized streaming isn’t a particularly lucrative business. “It’s a ton of work, and it’s a small-margin business, and it’s a saturated marketplace,” he said.

Now Please, Grow for Me

The big publicly-traded music labels like Universal and Sony are holding up fine, but it’s not at all clear how they can turn up the volume. “Universal, Sony, [in] their most recent public filings, they’re still really profitable businesses, but that’s not good enough,” said Werde. “They have to tell this growth story, and that’s where it gets tricky.”

Labels are now talking up emerging markets and monetizing so-called super fans as growth opportunities, but will those generate enough momentum to please investors? Possibly not fast enough. “It doesn’t seem at all to me like the super fan conversation or the emerging markets conversation is going to make up for stagnating growth rates in the West any time in the next couple years,” Werde said.

Don’t worry: If the bottom falls out of the streaming market, you can just go and enjoy your favorite artists live. How does a dynamically-priced $1,200 ticket sound?