AI is Passing the First Stage of its Antitrust Era

It’s not a hallucination: Artificial intelligence companies have actually managed to placate at least one national regulator.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It’s not a hallucination: AI companies have actually managed to placate at least one national regulator.

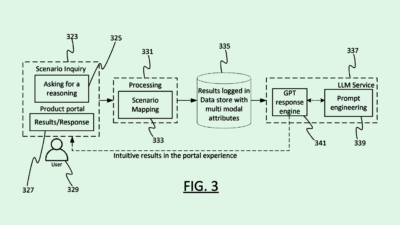

The UK’s Competition and Markets Authority (CMA) has given the go-ahead to two big AI deals this month that saw Big Tech companies invest in smaller generative AI startups — which critics clocked as looking suspiciously like acquisitions in disguise. It’s a methodology that’s under intense scrutiny from US regulators as well, and while the UK’s CMA doesn’t quite have the same clout, it did have the potential to make life difficult for Big Tech companies with big AI hopes.

The British Aren’t Coming

Big Tech companies have long housed their own AI departments, but post-ChatGPT, many large tech companies opted to take big stakes in smaller AI startups — for example, Microsoft’s stake in OpenAI. Regulators, including the US Federal Trade Commission and Department of Justice, raised their hackles: They think these strategic investments might amount to mergers and acquisitions, but have sidestepped all the attached paperwork and laws.

The CMA has been a thorn in the side of Big Tech acquisitions before. Its judgment on Meta’s proposed acquisition of Giphy forced the Silicon Valley giant to unwind the deal. As such, the CMA’s investigations into AI investments hold some existential threat, but so far, it has decided that Big Tech’s big bets on AI startups are actually above board:

- On Friday, the CMA cleared an investigation into Amazon’s $4 billion investment into AI startup Anthropic. That’s in large part because Anthropic doesn’t make up a big enough slice of the UK AI market for the CMA to really worry about it — the deal is still under investigation by the FTC.

- Earlier this month, the CMA also cleared Microsoft’s investment in startup Inflection AI, which was widely seen as an “acqui-hire.” The deal wasn’t even probed by the European Union, which is normally pretty swift to bring down the ax on Big Tech.

Tech companies certainly aren’t slowing down with their acqui-hiring; if anything, they’re getting more bombastic. The Wall Street Journal reported last week that Google acquired Character.AI, the company of former employee Noam Shazeer, just because it wanted Shazeer himself back in its stable. The price? A mere $2.7 billion, sources said.

Friends Old and Newsom: On Sunday the AI industry breathed another small sigh of regulatory relief as California Governor Gavin Newsom vetoed a bill that would have brought in mandatory safety measures for large AI companies. Newsom said he thought the bill was “well-intentioned” but ultimately too restrictive.

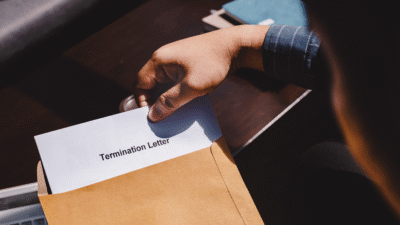

Exodus Continued: While Google is pouring money into AI talent, AI talent is pouring out of OpenAI. Last week three OpenAI executives, including Chief Technology Officer Mira Murati, departed the company, which has seen a steady trickle of top hires leaving this year. Don’t forget, it’s not quite a year since CEO Sam Altman was briefly fired then re-hired, and according to a Friday report from the WSJ, the company is experiencing severe growing pains as it transitions from a nonprofit research lab to a for-profit company that, per the WSJ, still loses billions a year.