Investors Brace for Revelations in New AI Bellwether Oracle’s Latest Report

Deals with Meta, Nvidia and Softbank underscore concerns that Oracle is overexposed to a possible AI bubble.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

When tech giant Oracle, a linchpin of the artificial intelligence boom, reports quarterly earnings today, investors expect it to live up to its name — which in antiquity referred to a medium providing insight into the unknown.

The unknown being where AI, an increasingly agita-prone trade, is heading in 2026.

Shares and Swaps

For decades following its 1977 founding, Oracle was known for enterprise software: In a 1993 cover story, Fortune dubbed chairman Larry Ellison “software’s other billionaire” after Microsoft’s Bill Gates, featuring him in a full-cut suit with peak lapels that screamed industry titan of the late 20th century. This year, Oracle vaulted to the forefront of the new century by pivoting to data centers and cloud infrastructure to support the artificial intelligence boom. Its share price, up 33% in 2025, made Ellison the world’s wealthiest man for a brief stint.

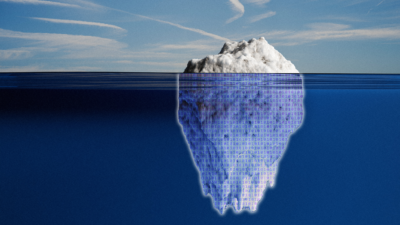

But a certain calculus worries some investors. In September, Oracle announced a $300 billion deal with OpenAI that would see the ChatGPT-maker buy computing power over five years starting in 2027. Building out the capacity to provide that power, however, requires piling up more debt than can fit in a full-cut early ’90s power suit. After the deal was announced, Oracle raised $18 billion from a bond sale and now carries over $100 billion in debt. Deals with Meta, Nvidia and Softbank underscore concerns that Oracle is overexposed to the AI bubble. Those worries have manifested in two ways.

First, as of Tuesday’s close, Oracle’s share price is down 32% from its record September high. Second, options traders piled into the company’s credit-default swaps in recent months as the price to guard against Oracle defaulting on its debt tripled (no one expects that to happen, but if AI bubble fears push the swaps up more, those traders could profit). Which sets the stage for today’s earnings, now considered a test of the market’s confidence in the AI trade. Many analysts think the worst fears are overblown:

- “While we await more certainty on the magnitude of capex/debt, we view the concerns around Oracle’s debt health (rising default risk implied CDS prices) to be overstated as more of a thematic AI hedging dynamic,” wrote Citi analysts, who recommend Oracle stock as a buy and expect to see “strong” AI bookings reflected in today’s report.

- “Based on our very rough sum-of-the-parts analysis, we believe there is little to no value from the OpenAI deal baked into Oracle shares at this point, which would seem to create some upside optionality from current levels,” wrote Evercore ISI analysts, who maintained their outperform rating. Overall, Wall Street analysts expect 15% revenue growth to $16.2 billion in the quarter.

An Assist from Altman: Evercore advised investors to exercise “some patience as turning sentiment will take time,” adding that OpenAI could lend a helping hand if, as expected, it soon puts out an updated version of its chatbot that rivals or surpasses Google’s latest Gemini release.