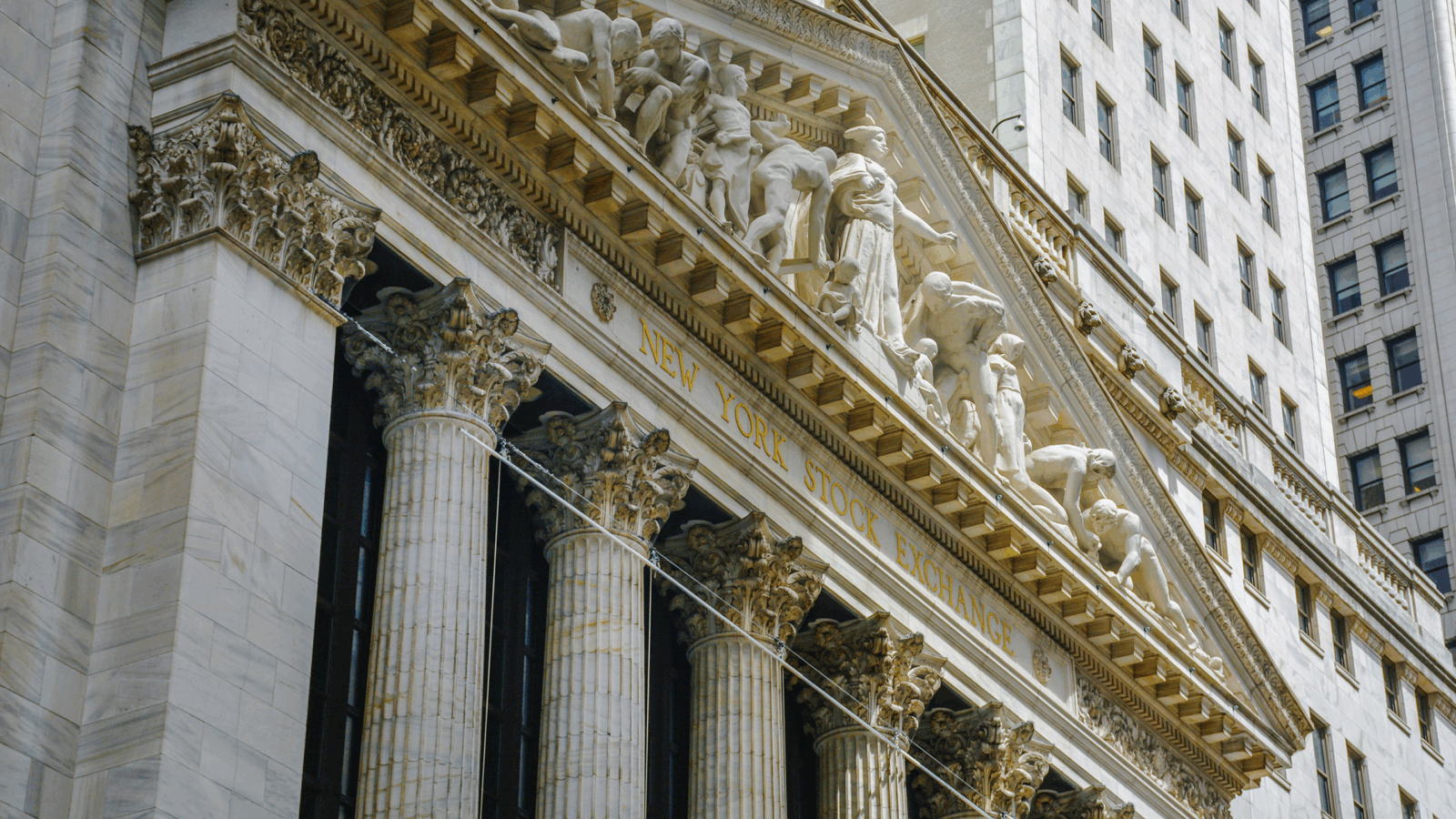

Amazon Scores Big Win in EU Tax Fight

In a prime legal win for Amazon, the European Union’s top court ruled that it does not have to pay €250 million in alleged back taxes.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Justice was delivered from Amazon’s perspective, even if it wasn’t exactly same-day delivery.

In a prime legal win for the megacorporation on Thursday, the European Union’s top court ruled that Amazon does not have to pay €250 million in alleged back taxes. That ends a bit of a legal losing streak for Big Tech in Europe.

A Tax to Grind

The case first surfaced in 2017, when the European Commission’s antitrust czar Margrethe Vestager alleged that Luxembourg — where the US Big Tech firm keeps its EU headquarters — granted Amazon illegal tax benefits. Essentially, Vestager argued that the company dodged taxes on roughly 75% of its profits between 2006 and 2014 by shifting profits from a tax-subjected company to a tax-exempt holding company.

“In other words, Amazon was allowed to pay four-times less tax than other local companies subject to the same national tax rules,” Vestager charged at the time, adding “This is illegal under EU state aid rules. Member states cannot give selective tax benefits to multinational groups that are not available to others.”

Six years of lengthy appeals processes later, Amazon is getting let off the hook:

- In 2021, a lower EU court sided with Amazon, saying the commission failed to prove Amazon was granted illegal benefits. The EC appealed the ruling, sending the case to the EU’s highest court, which ruled Thursday in Amazon’s favor once more; the case can not be appealed again.

- “The Court of Justice confirms that the commission has not established that the tax ruling given to Amazon by Luxembourg was a state aid that was incompatible with the internal market,” the court said in a statement.

Apple in their Eye: Amazon’s tax bill in this case is but a crab apple compared to what another mega US tech firm may be on the hook for in Europe. In a similar case stemming all the way back to 2016, Vestager and the European Commission are seeking €14 billion in back taxes that Ireland — the EU’s relative tax haven preferred by many US firms — allegedly failed to collect from Apple. Europe’s Court of Justice is expected to make a final ruling next year. For big US tech firms, you’re nobody if you’re not receiving antitrust scrutiny from the EU.