Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

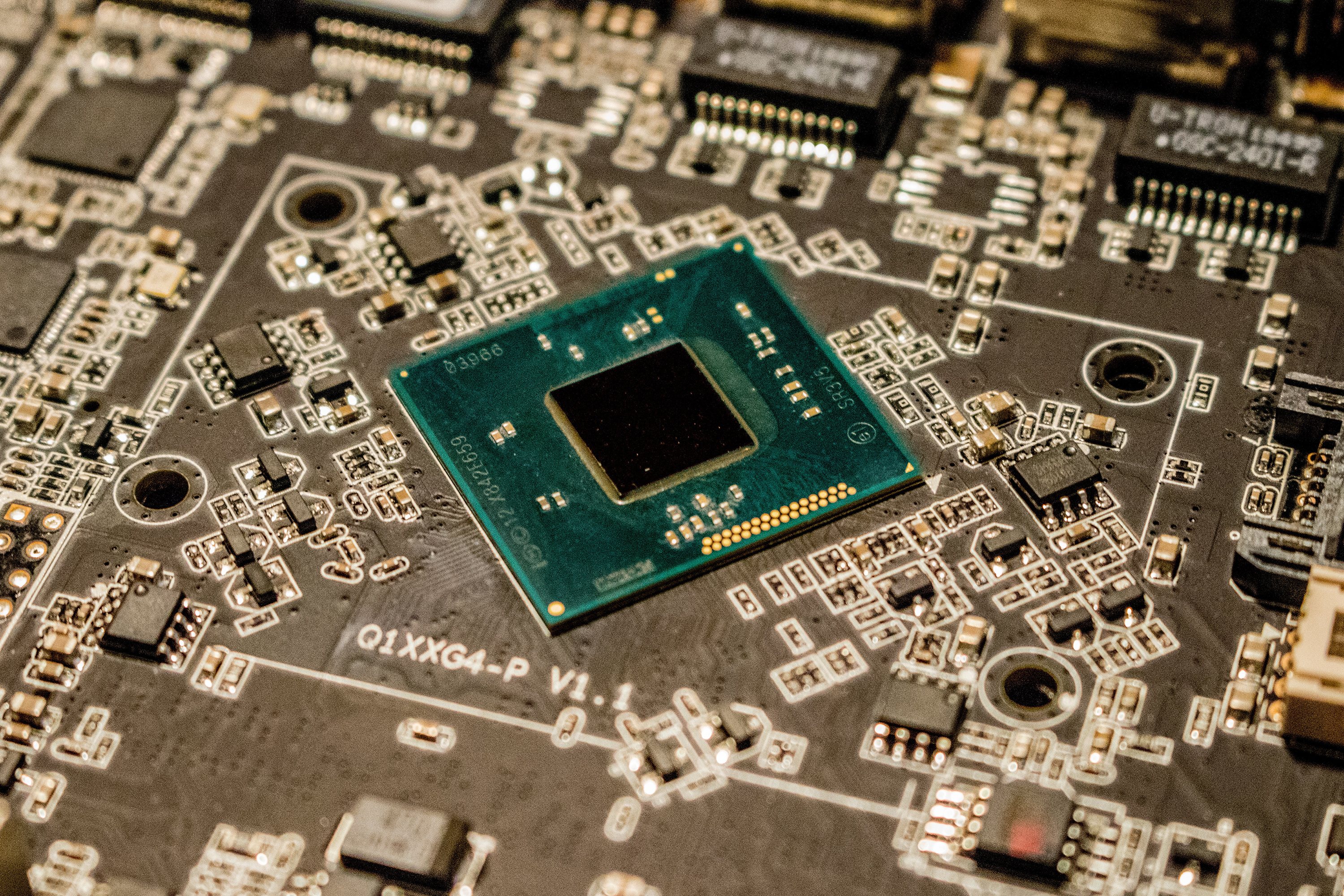

The semiconductor market is about to hit some headwinds, according to the sector’s most valuable player.

TSMC, the world’s largest manufacturer of the nano-sized tech that helps power pretty much everything, said Thursday it expects 2023 revenue to drop by more than it originally thought. Not only that, but the Taiwanese company’s plans for a factory in Arizona have been delayed by a lack of workers.

Not Feeling Chipper

In 2022, worldwide chip sales reached an all-time high of $574 billion, and it’s expected to grow to $1.4 trillion by 2029. And although demand for chips to power AI processors and large language models is high, it still may not be enough to counter a weak global economy.

“Three months ago we were probably more optimistic, but now [we are] not. The recovery of the Chinese economy is weaker than we thought, so end-market demand is not as we expected,” TSMC Chief Executive CC Wei said. In addition to China’s domestic problems, the US wants to further restrict the sale of certain chips and semiconductor technologies to the Asian nation for fear of spying and military advancement. But lobbyist group Semiconductor Industry Association warned the moves would “risk diminishing the US semiconductor industry’s competitiveness, disrupting supply chains, causing significant market uncertainty, and prompting continued escalatory retaliation by China.”

All of this has made for a particularly bearish outlook:

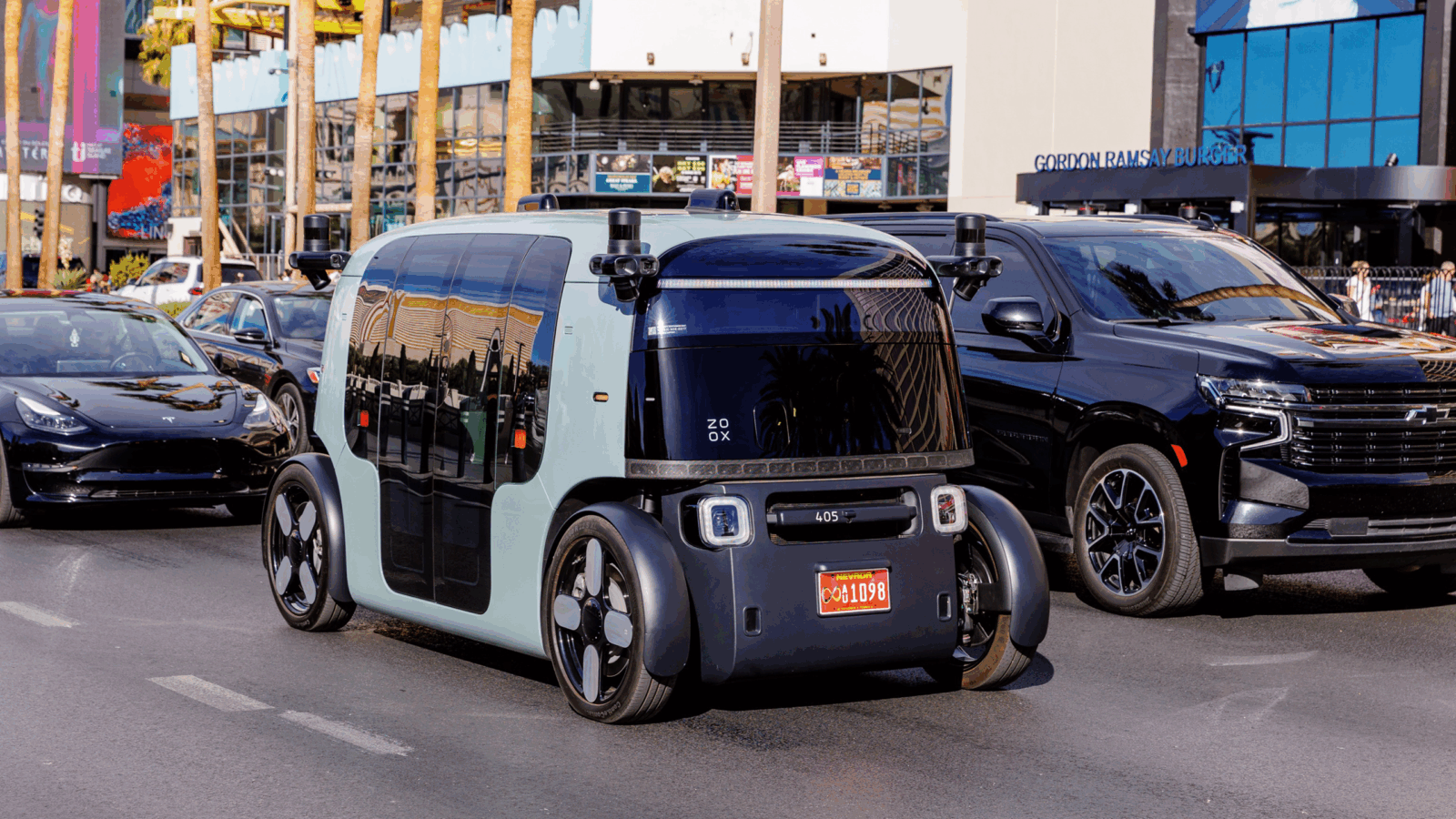

- TSMC had forecast a revenue dip of less than 5% for 2023, but it’s now expecting that to double to a 10% drop, which the company also has attributed to shrinking demand for chips among the smartphone, automotive, and industrial sectors.

- Other chipmakers are feeling the pain, too. Samsung expects a 96% profit plunge in the second quarter, and in April, Intel reported the largest quarterly loss in company history with a 133% annual reduction in earnings per share.

Best-laid Plans: TSMC expects to pump $40 billion into building two factories in Arizona, which are also likely to receive at least $7 billion to $8 billion in government subsidies through the CHIPS and Science Act. The first plant was set to open next year, but a shortage of skilled workers has delayed its opening until 2025. The upside of the chip industry’s struggles is that production is too slow to meet AI demand, so all you software engineers, writers, musicians, data scientists, and customer service workers have a little breathing room.