Intel’s CEO Lands in a Political Hot Seat Over Connections With China

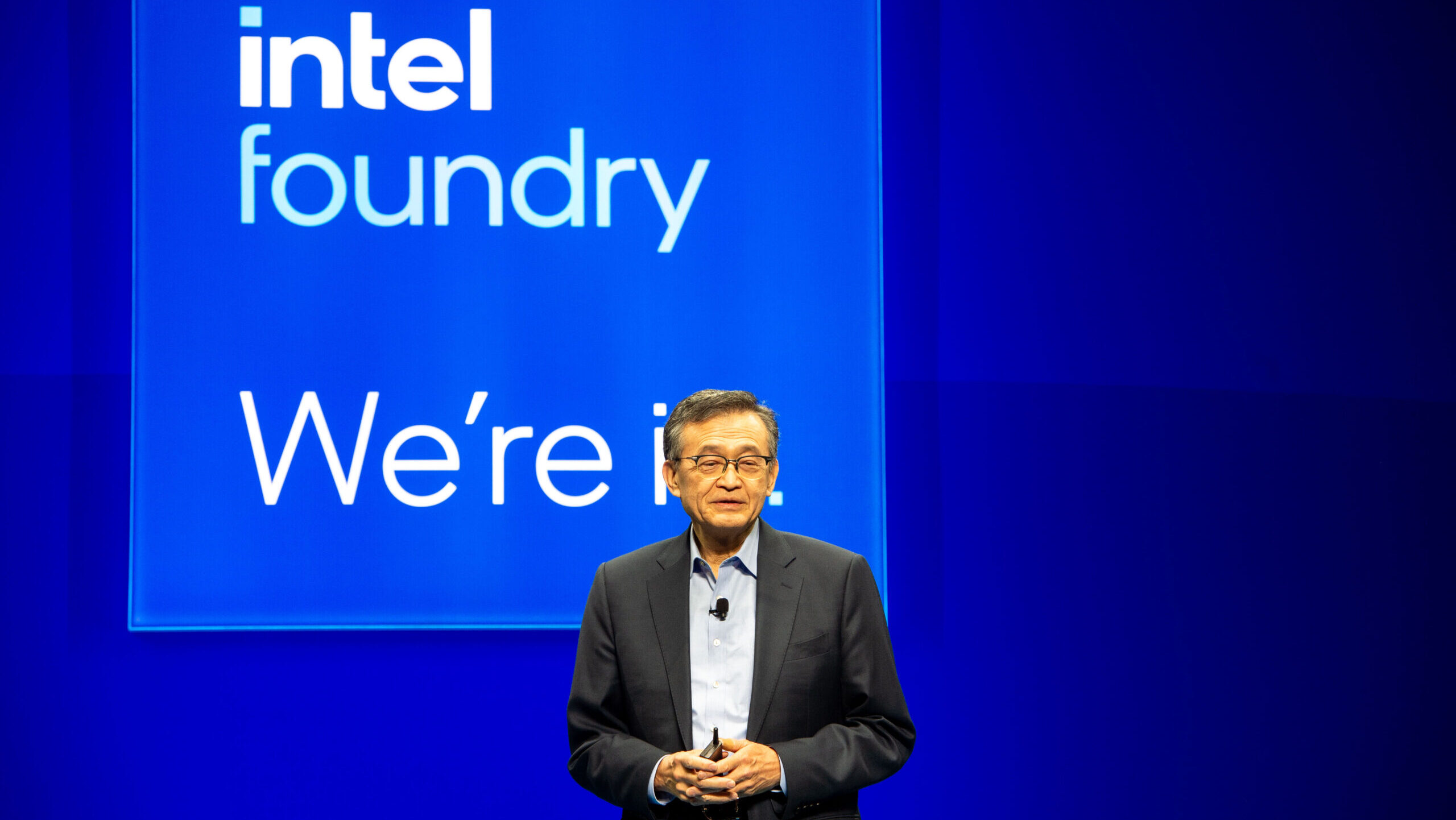

Chip industry veteran Lip-Bu Tan was supposed to fix the company’s problems. Now, Tan has become the company’s problem.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

When chip industry veteran Lip-Bu Tan joined Intel as CEO back in March, he was supposed to fix the company’s problems. Now, Tan has become the company’s problem.

That’s thanks to some social media musings from America’s commander-in-chief, who alleged Thursday morning that Tan is “highly CONFLICTED” and demanded he resign “immediately.” So what now for Intel, one of only a handful of US chipmakers that makes its product in America?

Intelligent Design

While the president’s social media post offered no specific reason for Tan to resign, it did come just after Republican Senator Tom Cotton sent a letter to Intel Chairman Frank Yeary inquiring about Tan’s alleged control of “dozens of Chinese companies” in the chipmaking space including at least eight with ties to the Chinese military, citing a Reuters report from earlier this year. More specifically, POTUS’s call for resignation followed a Fox Business segment on Cotton’s letter to Yeary by mere minutes.

Cotton’s letter also pointed out that from 2009 to 2021, Tan served as CEO of Cadence Design Systems, which just last week agreed to plead guilty to a conspiracy charge and pay the US government $140 million to settle claims it sold chip design hardware and software to a Chinese military university between 2015 and 2021.

While we’d say an out-of-the-blue political firestorm isn’t ideal — after all, it’s not every day that a sitting US president calls for the resignation of a major private corporation — Intel has been an economic piñata for roughly the past decade:

- In fact, earlier this week, Reuters reported that Intel is struggling to perfect its so-called “18A” high-end chip manufacturing process, pitched as a key step to closing the technology gap with industry frontrunner TSMC and a way to score new clients.

- The setback comes just after the company warned in its most recent earnings call in July that it could abandon the advanced chipmaking space altogether if it can’t attract major new customers. Meanwhile, its planned chipmaking plant in Ohio — funded in part by more than $8 billion in federal grants — continues to face delays.

Good POTUS, Bad POTUS: Meena Bose, executive dean for public policy and public service programs at Hofstra University, told The Wall Street Journal that the White House insisting that a CEO resign is “at the very least unusual, if not unprecedented.” (The Obama administration ousted GM’s then-CEO Rick Wagoner during auto industry bailouts in 2009, and the George W. Bush administration forced out then-AIG chief Robert Willumstad during the financial crisis.) The rest of the tech industry, meanwhile, is scrambling to stay on President Trump’s good side after he announced a 100% tariff on semiconductor imports Wednesday, with exemptions given to companies that invest in US manufacturing — a la Apple’s $100 billion commitment.