Nvidia Is On its Way to the Top of the Market-Cap Leaderboard — Then What?

Despite the stock’s recent run, the chipmaker’s revenue and profit growth make talk of a bubble sound premature.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

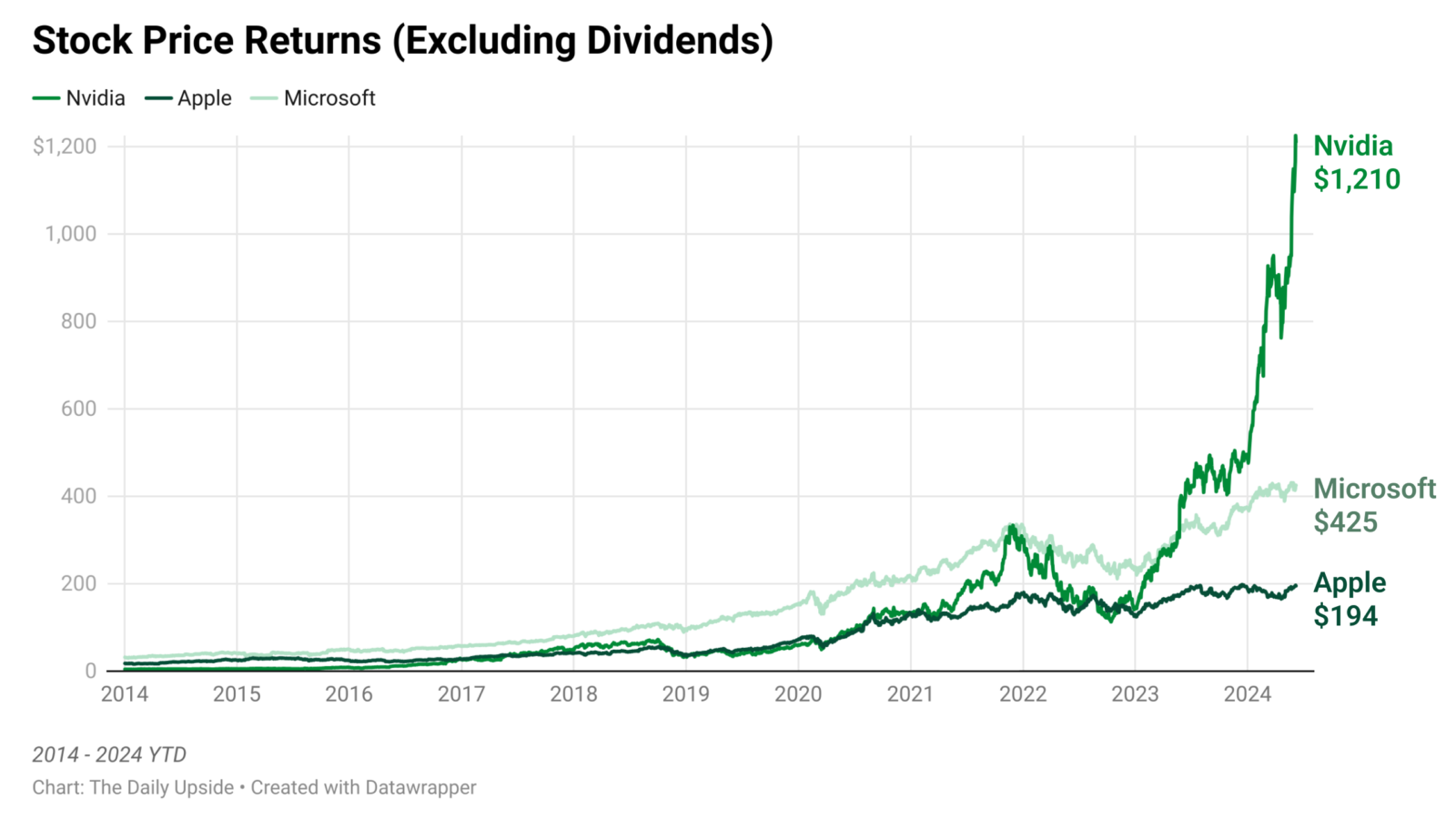

By the time Nvidia went public in 1999, Microsoft and Apple had been going at each other for two decades. But it’s more than made up for lost time.

On Wednesday, Nvidia shares closed higher to push the company’s market cap above $3 trillion for the first time ever, surpassing Apple as the second-most valuable publicly traded company in the US (it fell back below that level on Thursday).

Given how quickly it got there, it seems like only a matter of time before it makes up the $145 billion ground on Microsoft for the No. 1 spot. But should traders be celebrating or bracing for impact?

Can’t Stop, Won’t Stop

Prior to the 2010s, Nvidia’s market-leading graphics processing units built their success on PC gamer nerds trying to get Crysis — a first-person shooter that required top-of-the-line hardware — to run on their homemade rigs. But with the advent of crypto mining, cloud computing, and artificial intelligence, the GPU business has entered a new realm of never-before-seen demand. Now, they’re being used to develop machine learning and train large language models. In English: They make computers faster and more powerful. Nvidia, already a pioneer in the GPU sector, quickly ascended to rock-star status:

- Microsoft’s and Apple’s market caps increased 825% and 440%, respectively, over the past decade. That’s not bad! But it pales next to Nvidia, which has seen its market cap skyrocket by almost 28,000%. Just six years ago, this $1,200 per-share stock was trading at about $50.

- Big Tech companies account for roughly 20% of the entire S&P 500, and all three companies reached the triple-trillionaires market cap club within the last year. However, Nvidia is a younger stock, going public in 1999. Plus, it’s only been about a year since Nvidia hit the $1 trillion milestone.

Faster than a Speeding Bullet: When companies grow that much that quickly, fears of a reversal aren’t far behind. And Nvidia’s run has been so unprecedented that it’s especially nerve-racking. Not to mention that its trailing-twelve-month price-to-earnings ratio sits at about 70, nearly double the 31 or so average of the entire Nasdaq 100. And one can’t ignore CEO Jensen Huang’s disclosure that he plans to sell up to $735 million in stock over the next 10 months (yes, it’s one of those preset trading plans).

But Nvidia’s financials are walking the walk, unlike, say, Pets.com in 1999. In its most recent quarter, the company’s revenue jumped 262% and net income rose 462% to $15.2 billion (those are real numbers!) Last month, CNBC’s Jim Cramer said Nvidia will soon surpass Microsoft at the market cap peak, saying its “chips are the backbone of AI advancements,” and that its products are “increasingly becoming integral to the tech infrastructure, making it a company that could redefine the future of technology.” Just this week, Elon Musk said his companies will spend between $3 billion and $4 billion on Nvidia hardware this year. No company is too big to fail, but Nvidia is getting pretty close.