Nvidia Ramps Up its Venture Capital Ambitions

Tech’s latest darling has used its rapid rise to keep fueling its chip supply and expansion into new sectors.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Nvidia is as rich as Midas, but can it turn everything it touches into gold like the mythological Greek king?

Flush with cash after the AI hype-fest rocketed its market cap to $2.1 trillion, good for the third-largest company in the US, chip-making supernova Nvidia has quietly developed an ambitious venture capital unit, according to a Wall Street Journal feature published this weekend. It’s a Big Tech rite of passage.

Venture Time

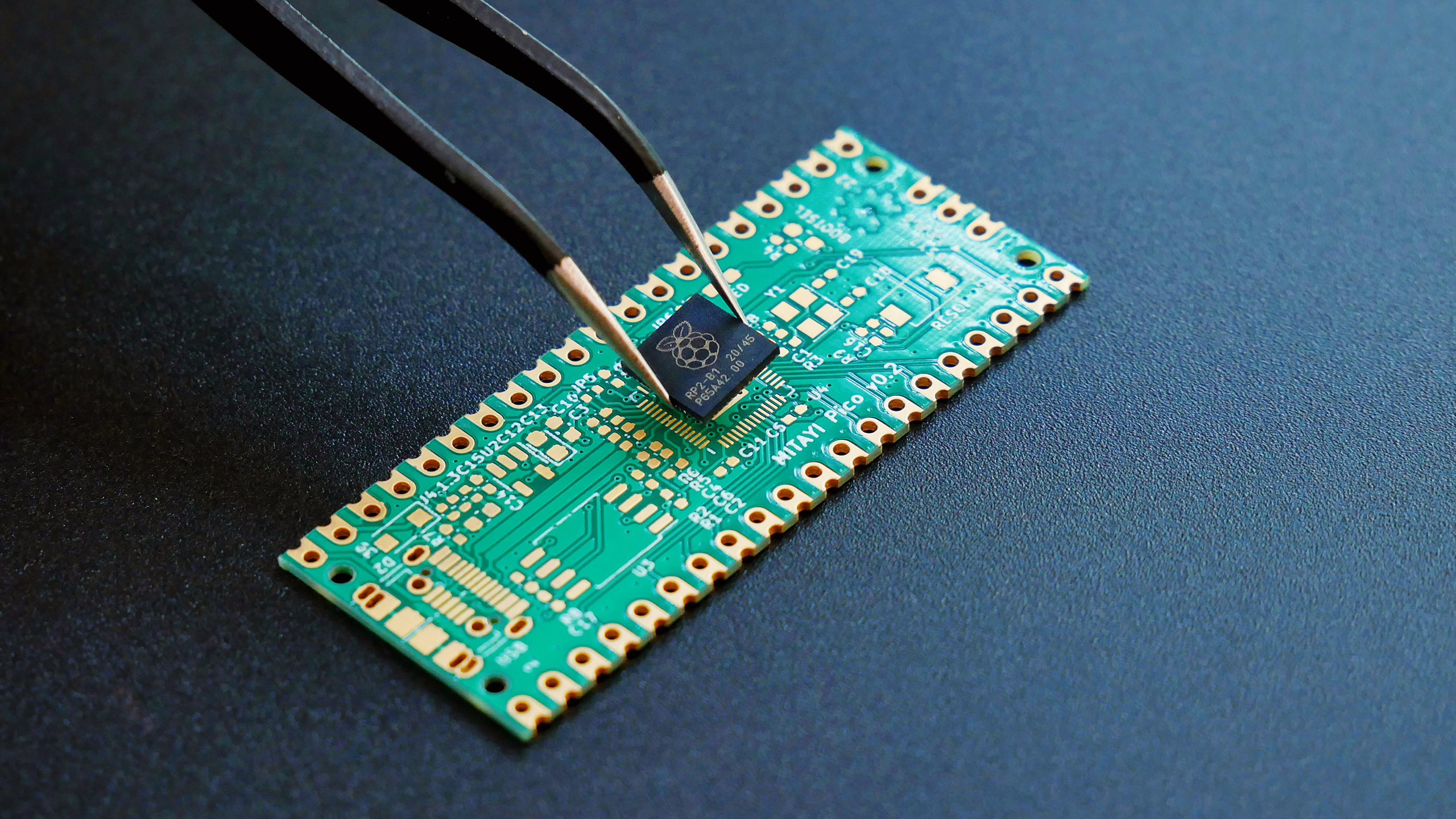

Tech giants have long repurposed their spoils toward watering the seeds of promising startups. Nvidia is no different, employing a time-tested strategy of investing in young companies that exist in industries either adjacent to or dependent on its computer chips, such as AI firms or drug-discovering biotech companies. The goal is a symbiotic relationship. Startups get capital and advice, while Nvidia gets first-hand accounts of how its chips are implemented in real-world settings — as well as the much more lucrative benefit of possibly growing or creating entirely new markets for its semiconductors.

“The [startups] that succeed will grow Nvidia as a whole, and the value of this will be way greater than the financial returns from the investment,” Avram Miller, who co-founded Intel’s similarly strategic VC arm in the 1990s, told the WSJ. “Nvidia realizes it is not a time for over-analyzing.” On the roulette board that is VC investing, Nvidia is placing its chips, literally and figuratively, on an increasingly wide array of companies:

- Last year, Nvidia invested in about three dozen companies, per Dealogic data seen by the WSJ, or around three times more than it did in 2022. The total value of its investments hit around $1.5 billion at the end of January, a massive increase from around just $300 million a year ago.

- Investments include $50 million in drug-discovery firm Recursion Pharmaceuticals, robotic surgical assistance manufacturer Moon Surgical, and Canadian AI company Cohere. Nvidia has also invested in the publicly traded voice recognition software company SoundHound AI, news of which triggered a nearly 70% rise in SoudHound’s share price.

End of an Era: Still, Nvidia’s entrance into venture capital comes just as the industry’s freewheeling days of hyper-techno-optimism are coming to a close. In 2023, VCs invested roughly $170 billion across 15,766 deals, well down from 2022’s $242 billion spread over 17,592 deals, according to a recent industry report from EisenAmper. Meanwhile, Carta, a firm that tracks and manages company share ownership and transfers, told the WSJ that 212 of the companies it tracks shuttered in 2023, the largest such figure in several years. We expect they’re in startup heaven, powered by Nvidia chips, of course.