Buffer ETFs Cost Clients More Than You Think: Vanguard

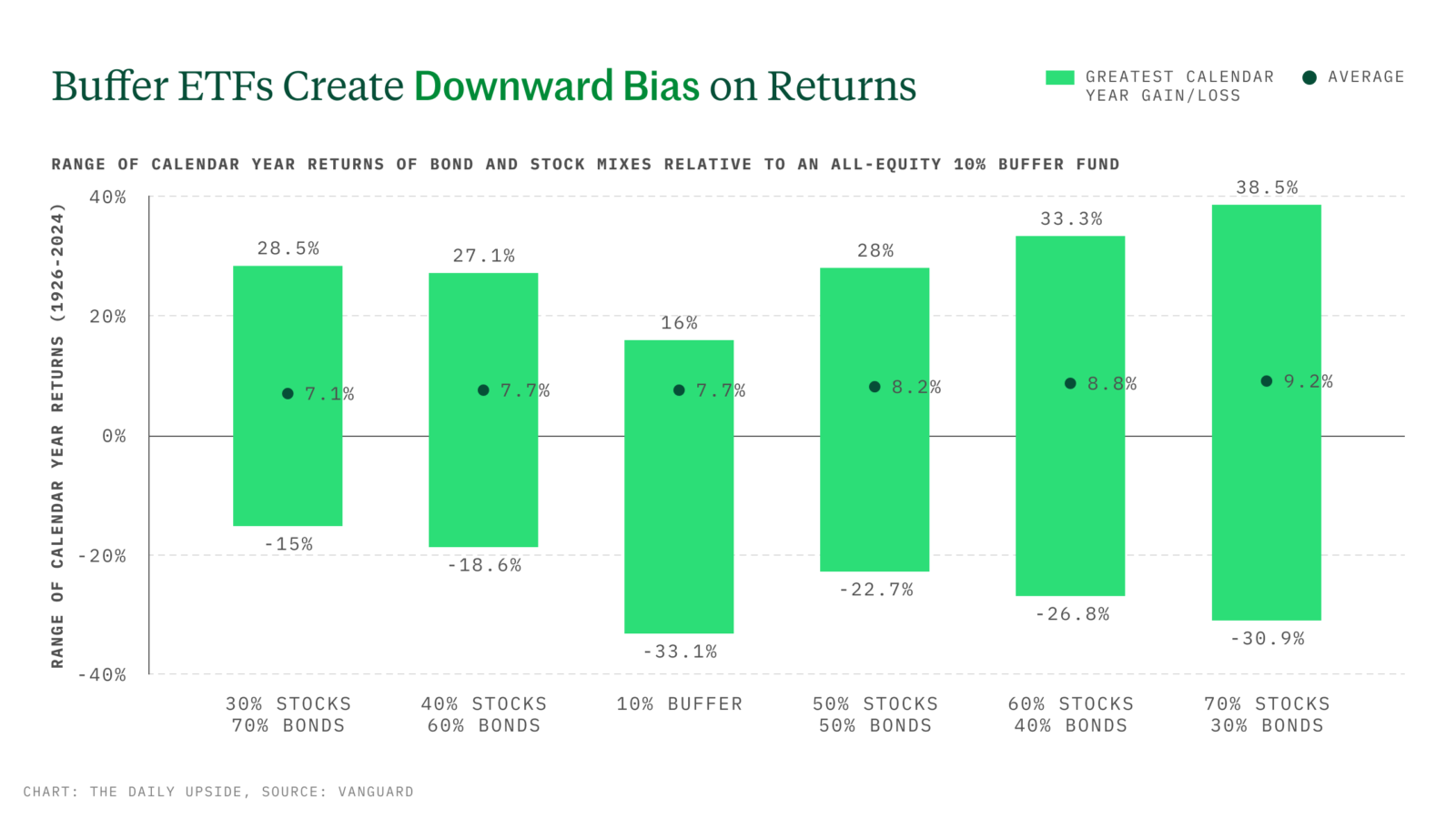

A Vanguard report found buffer funds exhibit a negative skew in returns over time, leaving plenty of money on the table.

Sign up for market insights, wealth management practice essentials and industry updates.

Those buffer ETFs could be costing clients more than you think.

Buffer ETFs — funds that use leverage to protect investors from losses of upwards of 100% in some cases — might sound like the perfect product for more risk-averse clients. However, they also come with significant caps on potential gains, and in the long run, that can mean leaving a lot more money on the table.

A new report from Vanguard found the funds can exhibit a negative tilt in returns over time. Buffer funds come with caps typically in the teens, but over the past 99 years, the S&P 500 topped gains of 16% about half of the time. Add in their typically higher expense ratios, and advisors might start to question: Are buffer ETFs even worth the safety?

Half in the Bag

It can be easy to have clients who are timid about the market these days: DeepSeek just shook up the AI sector and the president is back on his tariff game. But there is such a thing as being too cautious.

“There would have to be really specific reasons to want buffer ETFs in a portfolio, and I have not figured out what those are,” said Chris Tidmore, senior investment strategist at Vanguard, adding that even if investors are slightly nervous about the economy, the market generally trends upward:

- In the report, Vanguard looked at a hypothetical buffer fund totally invested in stocks with 10% downside protection and a 16% cap and compared it to the performances of different stock and bond mixes over the past century.

- In many cases, the buffer ETF was not optimal for returns. For example, last year, when the S&P 500 soared about 25%, that fund would’ve missed out significantly.

From Time to Time: Buffer funds did come in handy in 2022, as both stocks and bonds plunged. However, that doesn’t happen often and was the result of rapidly rising interest rates, Tidmore told The Daily Upside. The more likely future market shakeup would be something like the dot-com bubble, when equities did poorly, but fixed income performed well, he said. But, even in that scenario Tidmore questioned the effectiveness of the products: “Buffer funds wouldn’t have helped much, if at all,” he said.