US Retail Sales Dip in October, But It Could’ve Been Worse

According to the US Commerce Department released Wednesday, retail sales dipped slightly month-over-month in October, falling just 0.1%.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The mighty American shopper barely stumbled, let alone dropped.

According to new data from the US Commerce Department released Wednesday, retail sales dipped slightly month-over-month in October, falling just 0.1%. While that marked the first decline since March — after a carefree summer of splurging on beach vacations and Taylor Swift tickets — it still beat most analyst expectations.

Cleared For a Soft Landing

Coupled with the relatively rosy results from October (most analysts were expecting a sales decline of 0.3%) was an upward revision of data from September to a 0.9% increase from 0.7%, which had already counted as a big beat over consensus estimates. All of which is to say: American consumers are proving far more resilient (or far more in love with a little retail therapy) than most doom-and-gloom projections expected. If nothing else, it’s confirmation that the resumption of student loan payments has yet to dent spending.

A few key forces did drag down October sales: a decrease in gas prices of about 5% — according to Tuesday’s similarly sunny inflation report — played a major role, as did a slowdown in spending on big-ticket items like furniture and cars. The so-called retail control group, which counts all sales excluding gas station sales, cars, and building materials, rose 0.2%.

That coincides with relative optimism in the consumer goods and retail sectors:

- On Wednesday, Target posted a third-quarter profit that beat analyst expectations. And while comparable-store sales slipped roughly 5%, the dip stemmed from big-ticket discretionary goods, and was nearly offset by strong sales of so-called frequency goods, such as beauty products.

- Overall, The National Retail Federation projects holiday season spending, or sales from the start of November through New Years, to grow as much as 4% year-over-year – a slowdown compared to the past two holiday seasons but better-than-expected growth).

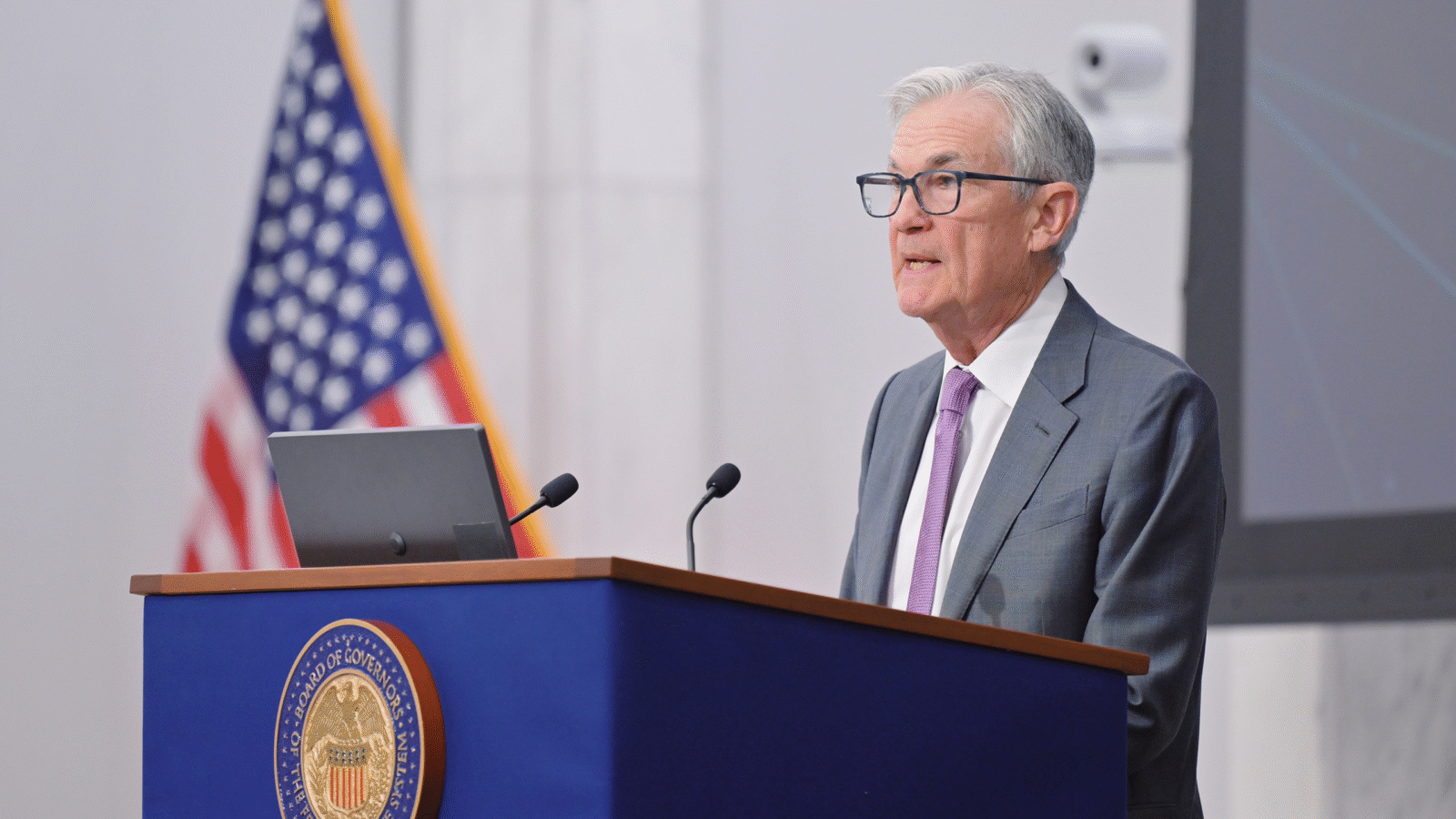

The Grateful Fed: Economists closely watch the behavior of the American consumer, which drives the broader economy. The slight downtick in spending in October is almost exactly what the Federal Reserve has been looking for — essentially showing that spending can remain strong while inflation cools, all without totally undercutting the still-strong labor market. “The summer spending surge is fading,” Kieran Clancy, senior US economist at Pantheon Economics, told the Financial Times. “But households’ balance sheets remain in decent shape, so we see no reason to expect a sudden collapse in spending anytime soon.” Did Jerome Powell read American consumers better than Wall Street?