April’s Inflation Report Finally Hints at Progress

The CPI rose just 0.3% from the previous month. Perhaps most importantly, the annual core rate fell from a year earlier.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The wealth-devouring monster is not dead, but it may be gravely wounded. Inflation showed signs of easing slightly in April, and core prices — which exclude food and energy — slowed to their lowest increase since April 2021.

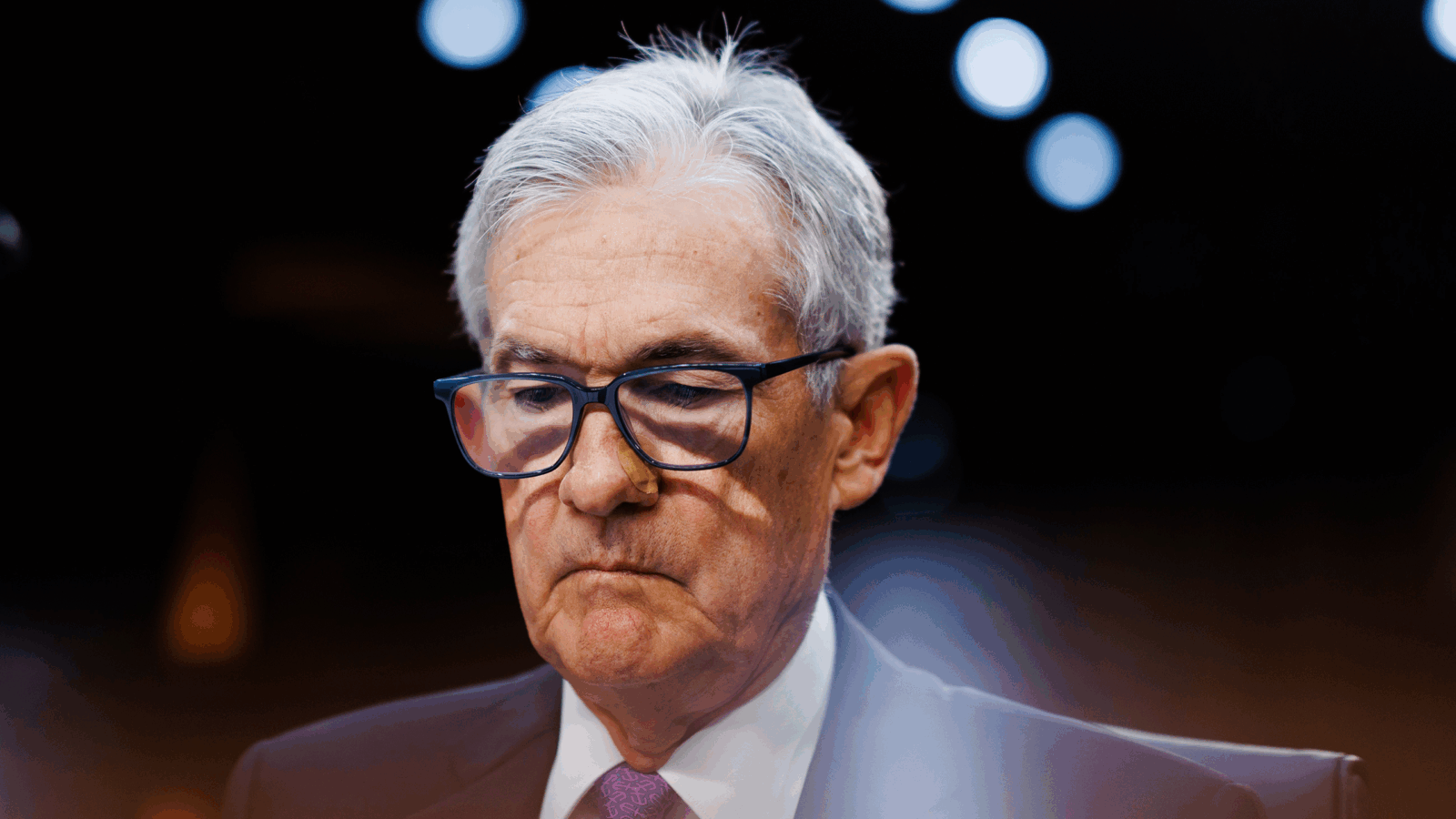

While the Federal Reserve will likely want more evidence of slowing before cutting interest rates, it’s probably safe to assume they’re not thinking about raising them anytime soon.

Pain in the Wallet

The scourge of inflation means the average American needs an extra $1,000-plus a month just to afford the basics compared to three years ago. Its tentacles have touched most people via an expensive housing market, pressure at the gas pump, and mounting credit card debt. But the Fed sees a 2% inflation rate as healthy, and that’s what it’s been shooting for with the 11 rate hikes it’s instituted since early 2022.

The latest consumer-price index report for April shows that we’re nowhere near that 2%, but we’re maybe getting on the right track:

- In April, the CPI rose just 0.3% from the previous month, and core prices progressed at a rate of 3.6% annually, both in line with economists’ expectations. Perhaps most importantly, the annual core rate was down from 3.8% in March.

- The price of shelter increased 0.4% month-over-month in April and was the largest factor in the index’s overall rise. Car insurance costs rose 1.8%. Energy went up 1.1%. And medical care, hospital services, and prescription drug costs all jumped as well.

Food, Glorious, Expensive Food: Food prices were finally flat month-over-month in April, but they’ve climbed roughly 26% since 2020. The Biden administration wasted no time in continuing to message that price-gouging is driving inflation, and called on “grocery chains making record profits to lower grocery prices for consumers.” It echoed a similar blast posted on X in March by former Clinton administration Labor Secretary Robert Reich aimed at Walmart, the country’s biggest grocery retailer, for boosting prices on its Great Value food brands before its net income “spiked 93% towards the end of 2023.”

Meanwhile, the reality is that eating out may be the real food-inflation problem. While food-at-home prices are up 1.1% from a year ago, food away from home is 4.3% more expensive than last year.

Despite the price-gouging accusations, Walmart is expected to report steady if unspectacular revenue growth of 5% but its status as the biggest company in the US by revenue is in jeopardy as Amazon closes in with a historically higher growth rate, according to The Wall Street Journal. If only Walmart had thought of a cloud-computing side hustle before Amazon started up AWS.