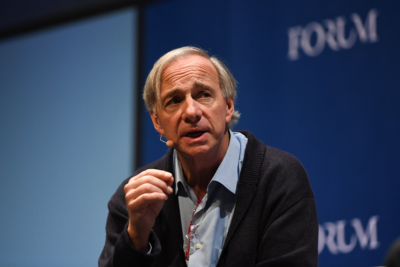

The Battle Hymn of Billionaire John Paulson

John Paulson, of “The Greatest Trade Ever” fame, is suing a former business partner tasked with running an investment empire for Paulson valued at up to $1 billion in the booming tax shelter of Puerto Rico.

Sign up to unveil the relationship between Wall Street and Washington.

It is starting to get truly tiresome how many financial shenanigans seem to devolve into finger pointing over who bought too much Chanel or Louis Vuitton.

This time, it comes in the form of the curious case of John Paulson of “The Greatest Trade Ever” fame, who is suing a former business partner tasked with running an investment empire for Paulson valued at up to $1 billion in the booming tax shelter of Puerto Rico.

Paulson, the legendary hedge fund billionaire best known for making an estimated $20 billion for his eponymous firm, Paulson & Co., by gaming the 2008 global financial crisis, has been busy in the years since. He closed his hedge fund, formed a family office (the cool, not-so-new way to show you’re ultra-wealthy) and built a real estate empire on the Caribbean island, amassing luxury hotels, resorts and, it seems, a splashy auto dealership that sells high-end cars.

Paulson is accusing his former Puerto Rico business partner, Fahad Ghaffar – a Pakistani-born real estate investor – as well as Ghaffar’s family members and close friends, of embezzling millions of dollars and splurging on Chanel and Louis Vuitton goods, private jets and travel to Dubai. Paulson is seeking more than $189 million in damages.

His suit, which alleges racketeering and fraud involving the use of shell companies and other entities to drain away Paulson company money, comes just weeks after Ghaffar filed his own lawsuit against the billionaire, alleging securities fraud and breach of contract and asking for $50 million in damages.

The timing for Paulson is not serendipitous. He is also embroiled in a thorny dispute with another former partner – his wife – who is alleging in their divorce that he used one of his Puerto Rican properties to siphon an estimated $10 million from a family trust intended for his children.

What’s really going on remains to be seen, but Power Corridor notes this is not the first run-in Paulson has had with an island tax shelter. His infamous Abacus deal with Goldman Sachs, which won him billions of dollars during the 2008 financial crisis was arranged on the island of Jersey, a UK Crown dependency and a tax haven also known for its financial shenanigans.

That deal may have made Paulson a fortune, but it also resulted in Goldman Sachs shelling out half a billion dollars to the U.S. Securities and Exchange Commission in a settlement for misleading its investors.

It’s unclear where this is all heading, but real estate, car dealerships, shell companies, family trusts and tax shelters historically make for a toxic brew.

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.