Active ETFs to Reach $11T by 2035, Deloitte Says

Low costs, a flight from active mutual funds, and tax efficiency have boosted assets in US-listed active ETFs.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

Active ETFs have gone from being a blip on the ticker to boasting over $1 trillion in assets — more than the combined wealth of Elon Musk, Jeff Bezos, Mark Zuckerberg, and Larry Ellison. These days, that has to count for something.

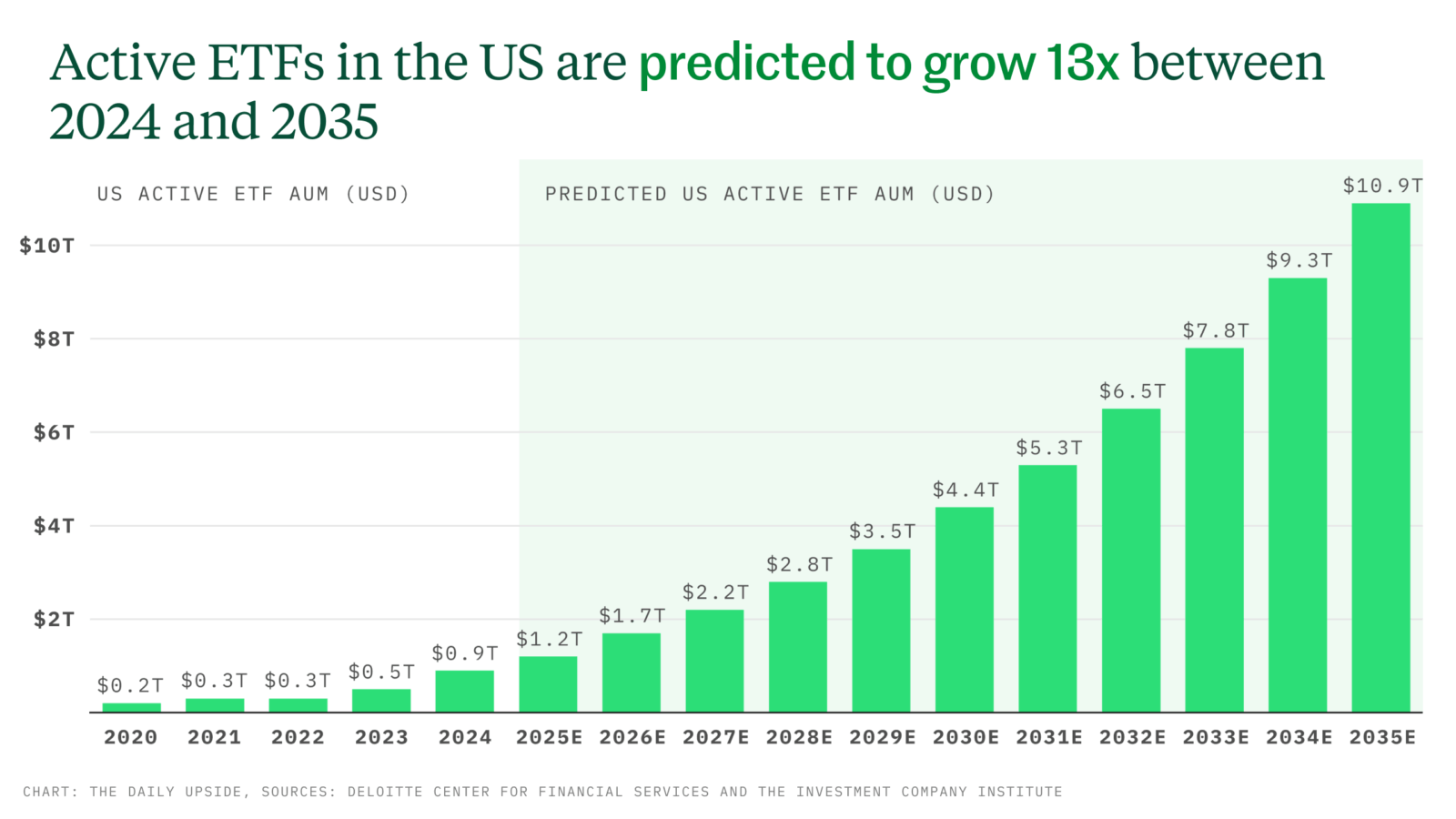

And though it’s been less than a month since active exchange traded funds hit that milestone, they apparently are just getting warmed up. In 10 years, active ETFs will reach $11 trillion, according to a prognostication late last week from Deloitte, which compared the vehicles to an “untapped goldmine.” By 2035, active ETFs will represent over a quarter of all ETF assets and 17% of all open-ended long-term fund assets, the consulting firm stated. The reasons for that growth are the same ones prompting many people to opt for ETFs today — low fees, tax efficiency, and transparency, according to Deloitte.

“On average, actively managed equity and bond ETFs have expense ratios of 22 basis points and 11 basis points lower than their respective actively managed mutual fund counterparts,” according to the company’s report.

ETF Everywhere All at Once

If there’s an investment strategy you want, odds are you can find it in an ETF. And if not, wait a bit. ETF issuers have been bringing hundreds of new products to the market every year, expanding into new categories like crypto and private debt, to say nothing of the thematic funds that account for many new filings with the Securities and Exchange Commission. There have been nearly 300 new US-listed ETFs this year, setting 2025 up for a record pace. Add to that the likelihood that the SEC will approve dual share class structures this year, and the trend could accelerate.

“Active ETFs gathered more than a quarter of the net inflows in 2024 and have been off to a great start in 2025,” said Todd Rosenbluth, head of research at TMX VettaFi. “We have seen demand for options-based active ETFs and security selection-based active ETFs. Firms like Capital Group, Fidelity, PIMCO, and T. Rowe Price are proving that there’s interest in active ETFs to support the core of the portfolio.” Companies like JPMorgan and NEOS Investments are showing that options-based ETF strategies can prove successful, he noted.

Data from Neuberger Berman and Cerulli Associates show:

- Assets in and net flows to active ETFs achieved over 50% compound annual growth rates between 2015 and 2024.

- ETFs will benefit from more inclusion in separately managed accounts as well as from assets being converted from SMAs to ETFs. Of Cerulli’s estimated market size of $2.7 trillion in SMAs, $1.6 trillion is in wirehouses and less than $500 billion is with RIAs.

Actively Changing: If there’s anything that active managers say shows their value, it’s a down market. And this year is shaping up to be an ideal time for active management to prove its worth. “Many people still prefer active management for the fixed income exposure and we have lots of strong choices today,” Rosenbluth said. “While ARK helped put active ETFs in vogue with thematic ETFs years ago, the strength of the active ETF market is so much more.”