Sign up to unveil the relationship between Wall Street and Washington.

Can the monster bank’s CEO get his groove back?

Gone are the days of Goldman Sachs being labeled as a “planet-eating Death Star” or a “great vampire squid wrapped around the face of humanity.”

In its place are stories of an iconic Wall Street bank rife with infighting, lawsuits, layoffs and a weakened chief executive whose side gig as a DJ was recently gleefully derided by his predecessor as, to put it kindly, dilettantish.

Goldman’s CEO David Solomon, who goes by the DJ name “D-Sol,” when he’s spinning house music, has come under fire from almost every direction, drawing reproof from senior management, as well as Goldman’s former chief, Lloyd Blankfein, who bemoaned Solomon at a Miami gathering of the bank’s partners earlier this year as “spending too much time away from his day job, jetting around on Goldman’s private planes and DJ-ing at nightclubs and festivals,” according a story out this month in The Wall Street Journal. Solomon was not present for that gibe.

Goldman this week began laying off what is expected to be 250 employees, including around 125 managing directors, including investment bankers, as Wall Street braces for another round of interest rate hikes this year and deal flows remain in an interminable slump.

The downsizing comes on the back of news last month that Goldman agreed to shell out more than $215 million to settle a class-action lawsuit brought by former employees of the investment bank alleging widespread bias against women in both pay and promotions, according to a joint statement from Goldman and the plaintiffs.

In addition, Goldman had to pay $12 million to settle a departing female partner’s claims of a sexist work environment, which included an account of Solomon making vulgar or dismissive remarks about women at the bank, according to a widely cited story in Bloomberg.

This month, Goldman’s managing directors were told to slash around $1 billion in costs as hopes of an economic recovery fade for 2023 and investment banking revenue sinks around 46 percent in the second quarter, compared with the prior year, according to preliminary data from Dealogic.

Still, amid all the belt-tightening and withering criticism, Solomon may be so lowly rated as to be underrated. According to one banking source on Wall Street, much of the animus against him right now seems to be arising as much from Goldman’s troubles as the overall sour mood in a “very tough” dealmaking environment. “People are feeling threatened and looking for a scapegoat,” he says.

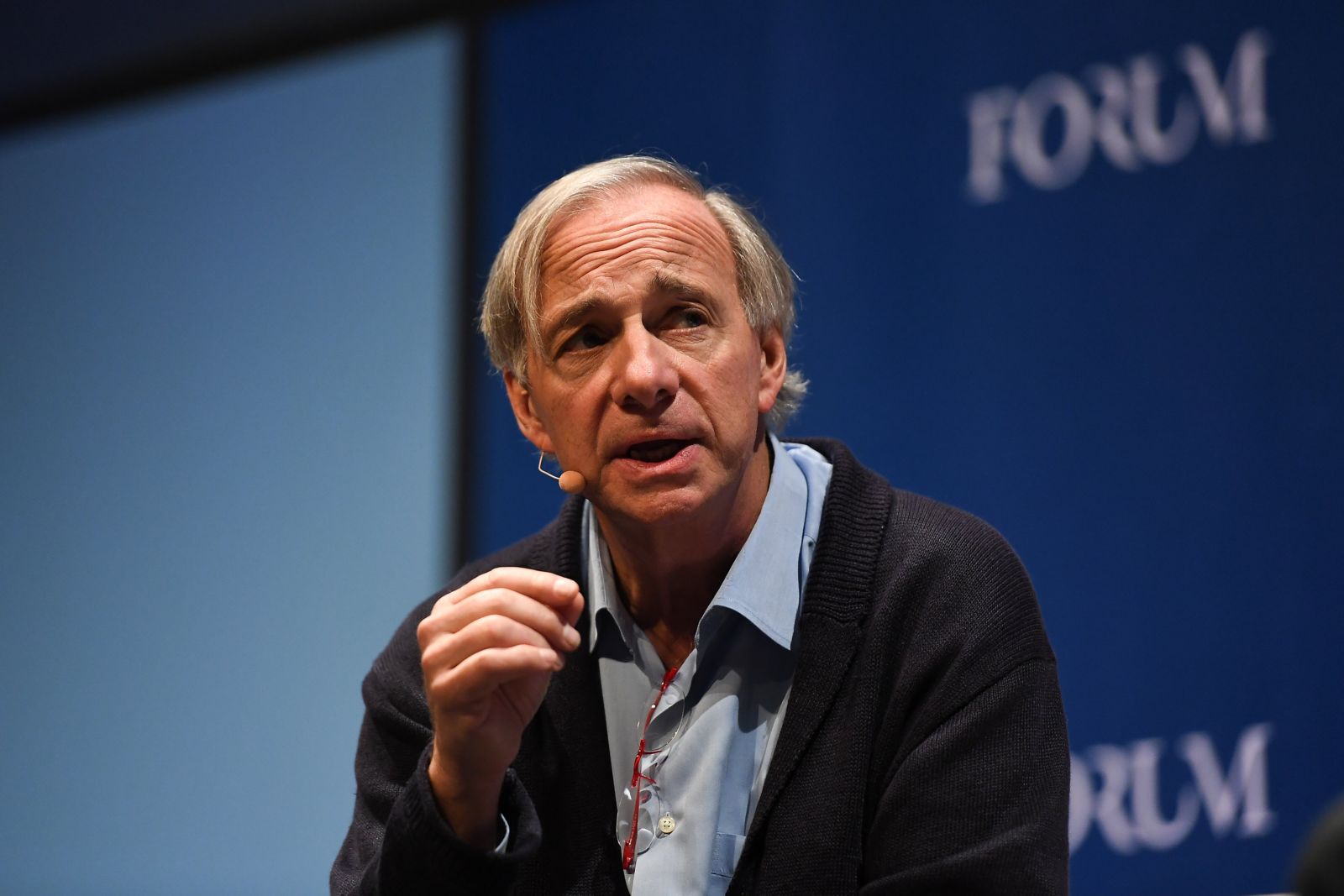

Perhaps looking to show he’s not all about private jets and music festivals, Solomon posted a selfie (see photo, top) from the United Kingdom in recent days, traveling in slightly more “downmarket” digs: the London Tube.

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.