Everyone’s Joining Big Tech’s Market Rally

Through August, Wall Street began rotating into small cap companies and sectors outside the bounds of the AI trade.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

When the big dogs are away, the little guys come out to play.

After a summer-long stock market rally primarily driven by a handful of the usual Big Tech suspects, the worm is starting to turn. During August, Wall Street finally began spreading the love — rotating into small-cap companies and sectors outside the bounds of the AI trade.

Rally Caps

So what changed? A speech in Jackson Hole, Wyoming, by Federal Reserve Chairman Jerome Powell has given investors hope that an interest rate cut may be just around the corner, making both small-cap and economically sensitive stocks more attractive. Meanwhile, after going all in on Big Tech bets, the physics of finance suggest that investors have no choice but to diversify their portfolios.

And the timing is just right: According to Truist data seen by Axios, small-cap stocks tracked by the S&P 600 have underperformed large caps by 12% over the past 12 months. That’s the largest dislocation in performance this century. Meanwhile, small caps are 40% cheaper than large caps — good for the biggest discount since the dot-com bubble burst at the turn of the century. After said bubble burst, “subsequent small-cap returns were among the highest in history,” Gregg S. Fisher, founder and portfolio manager at Quent Capital, recently wrote in a note to clients. Through Friday, the small-cap Russell 2000 index has climbed nearly 9% since the start of August.

Meanwhile, among the S&P 500 big leagues, the non-tech firms have been getting the most love recently:

- The S&P 500’s consumer discretionary sector index climbed roughly 7% in August, while the materials sector climbed over 6%, and the financial sector index climbed 4.7%. The information-technology sector index climbed just 2.4% last month.

- More proof of the diversification? After trailing the benchmark S&P 500 index for most of the year, the S&P 500 Equal Weight Index rose roughly equally in August, about 3.6%.

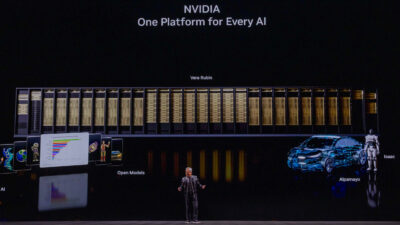

Forward Thinking: The rotation may also be causing some distortion. While Nvidia crossed the $4 trillion market cap mark in July and continued to hover at that level in August, its forward price-earnings ratio bears a striking resemblance to two stocks decidedly outside the cloud of AI hype: Walmart and Costco. Walmart had a forward PE of nearly 37 at market close Friday, just trailing Nvidia’s 40 and behind Costco’s ratio of nearly 47. A Bloomberg analysis last week noted that investors view the stocks as performing particularly well in tough economic times, as both companies’ brands communicate a value proposition that shoppers will likely find attractive. It posited, however, that a “safety paradox” now puts them at risk of correction.