Mercedes-Benz Profits Drop More than 50% in Third Quarter

Mercedes-Benz is en route to cut costs after profits in the third quarter more than halved year-over-year due to weaker demand in China.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

When Janis Joplin sang her ode to Mercedes-Benz, the brand was the last word in automotive luxury. It’s fallen on harder times today.

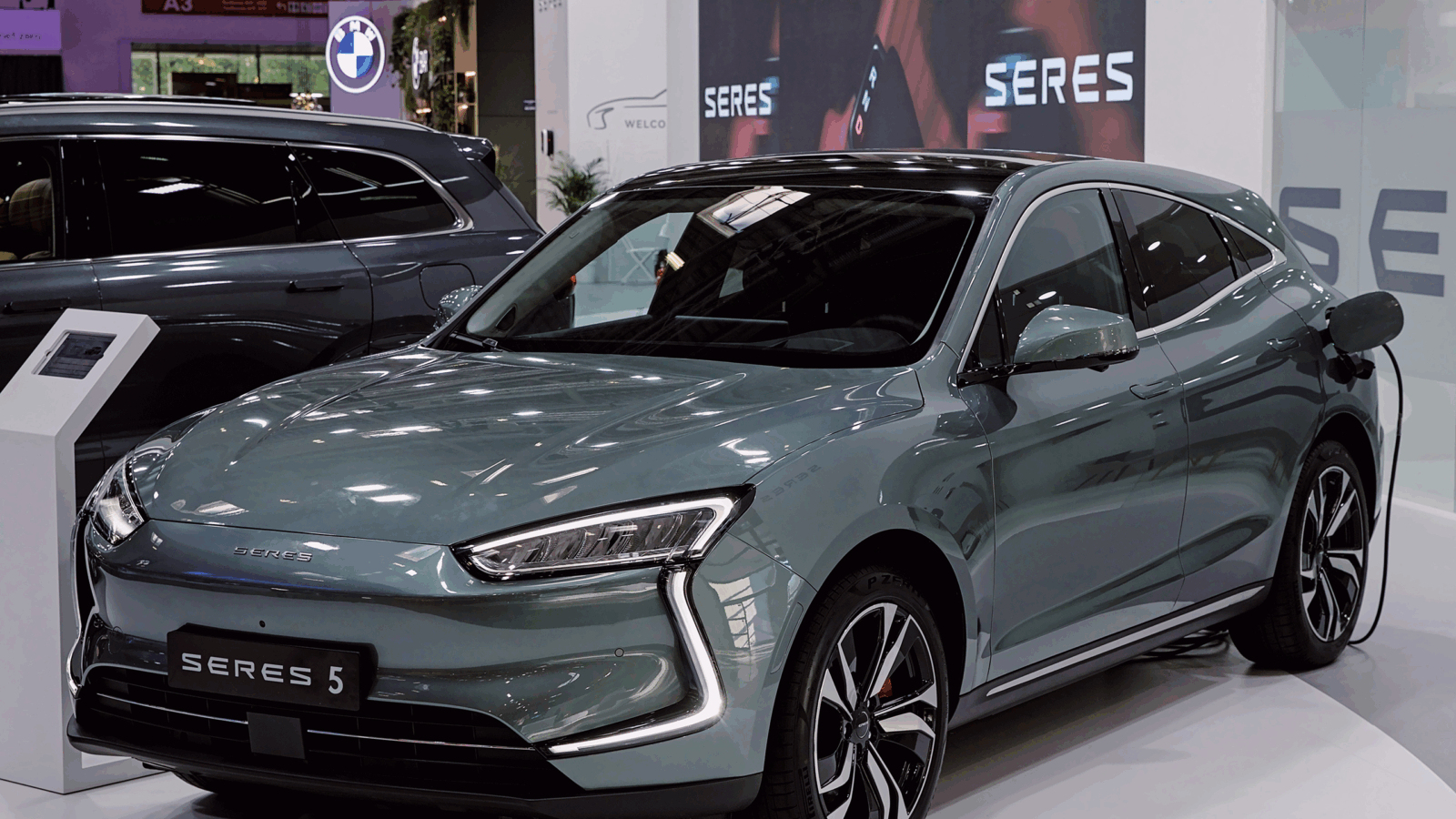

Mercedes-Benz is en route to cut costs after profits in the third quarter more than halved year-over-year due to weaker demand in China, where buyers turned to local makers like Geely and BYD. If the trade war between Europe and the Middle Kingdom continues to escalate, Mercedes won’t be the only carmaker with a concerning outlook.

Reining It In

In the third quarter, Mercedes reported €1.72 billion ($1.9 billion) in net profits, a 53% drop from €3.72 billion a year prior. Year-to-date, profits are down just over 31% compared to last year.

On a call with reporters, Mercedes CFO Harald Wilhelm said because of the less-than-stellar earnings, the company aims to reduce the cost of labor and materials that go into its cars and factories. “Is there any specific point to be made now in terms of headcount adjustment? No,” he said. Cost-cutting is old hat for Mercedes, though: Each division within the brand has been doing just that for the past five years. In fact, many European luxury brands are in cost-cutting mode because of Chinese competition:

- Porsche said it would shrink its dealership network in China after the German carmaker reported a 41% drop in Q3 operating profit year-over-year. “China is an incredible challenge, not just for Porsche,” Chief Financial Officer Lutz Meschke told reporters. “In the future, we can no longer assume that China will return to where it was for European players.”

- British manufacturer Aston Martin is scheduled to report its Q3 earnings this week, but has already signaled that profits will take a hit because of supply chain issues and weak demand in China.

The Art of Trade War: The European Union recently announced that it will move ahead with tariffs of up to 45% on Chinese electric vehicles. Though promoted as a defensive measure, many carmakers oppose the tariffs, saying the levies will only increase competition for them in an already-challenging Chinese market. And to no one’s surprise, Beijing is exploring retaliatory tariffs on European gasoline cars with large engines.