Chinese Carmakers Face Potential EU Tariff Hike. Most Don’t Look Too Scared.

One market research firm said even duties in the range of 15%-30% won’t keep most of the country’s carmakers out of Europe.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

With China’s electric vehicle makers facing tariff hikes in the EU, Great Wall Motors said this past weekend it would close its European headquarters in Munich this August and lay off roughly 100 workers. But the exit has more to do with Great Wall’s lack of appeal than it does with tariffs, which fellow Chinese EV makers have mostly greeted with a yawn.

Made in China

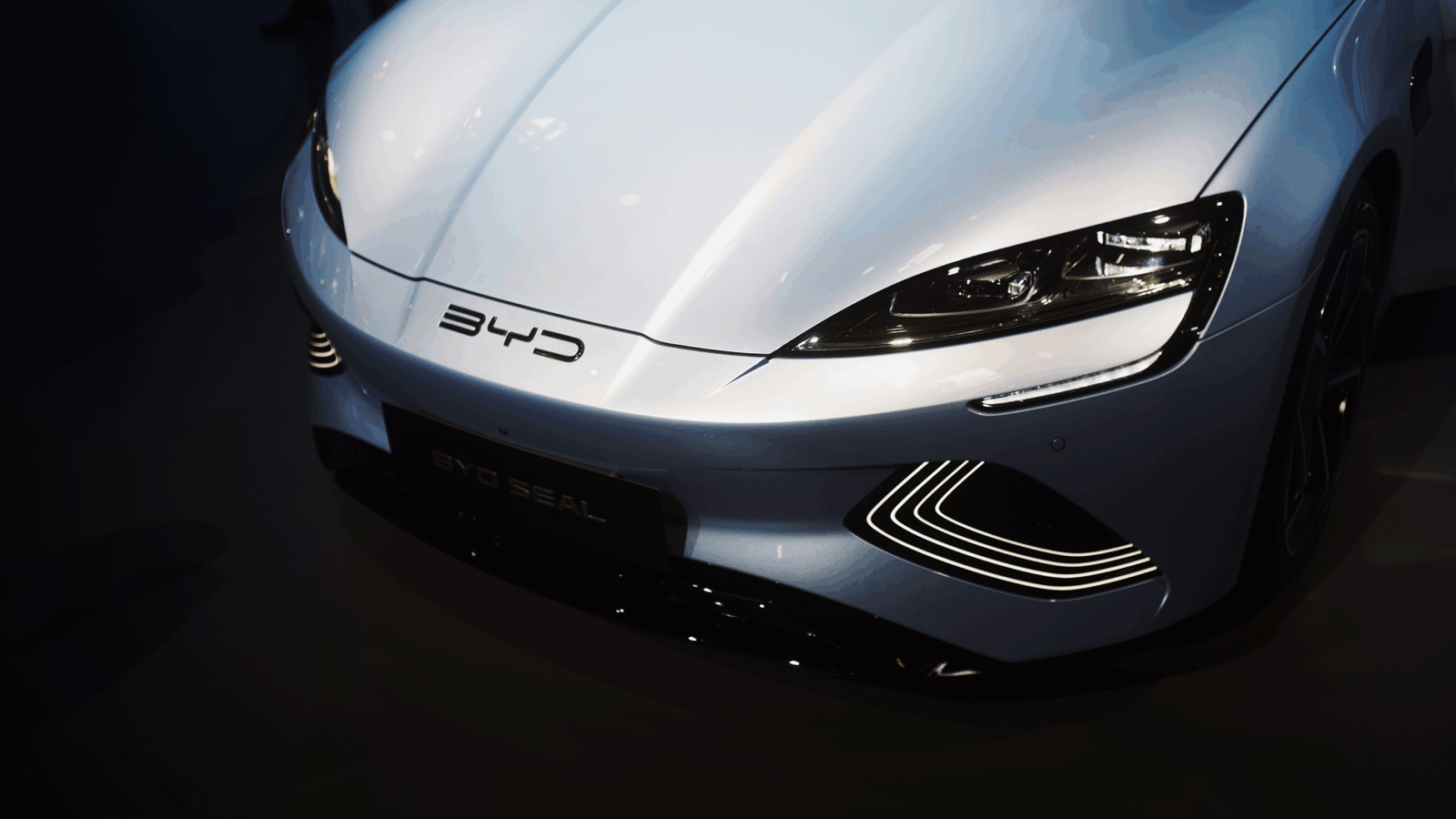

We’re not gearheads, so we can’t tell you which country makes the best electric vehicles, but we can tell you which makes the cheapest. China’s government heavily subsidizes production to the point where BYD, the world’s largest EV maker, can price its Seagull model at just $10,000. That’s a nightmare for auto manufacturers in Europe struggling to hook drivers with their battery-powered lineups.

The share of made-in-China cars is expected to account for just over 25% of all EV sales in the EU this year, according to the European Federation for Transport and Environment. That’s way too high for many local manufacturers and EU policymakers. So if China plans to help its companies with cost, the European Union is going to make the cost of entry higher:

- In October, the European Commission launched an anti-subsidy probe that could result in raising the duty on Chinese-made EVs to 20%. According to Germany’s Kiel Institute for the World Economy, that would likely mean a 25% drop in the volume of EVs imported from China, cutting out about $4 billion in trade for Beijing.

- Regardless of tariffs, Great Wall, China’s largest independent auto company, just never made much of a splash in the West. Last year, it sold only about 6,300 cars in Europe, excluding Russia.

Not Going Anywhere: While Great Wall might be in retreat, other Chinese companies aren’t exactly cowering at the threat of tariffs. Last month, BYD said it would consider building a second assembly plant in Europe by 2025, Nio opened a showroom in Amsterdam, and Zeekr says it’s expanding into six new European markets by the end of the year. It all comes down to profit margins. Market researcher Rhodium said duties in the range of 15%-30% can’t keep a company like BYD out of Europe. Heck, 50% is likely not enough, either. The EU could take the scorched-earth approach of the US and raise the tariff to 100%. However, that would probably spark retaliatory tariffs, destroying the potential for cost-cutting EV partnerships and cutting European makers like Volkswagen out of Chinese markets. Trade wars are complicated.