Nothing is Certain Except Death, Taxes – And Fighting About Taxes

With apologies to Benjamin Franklin, death may be certain, but taxes are eminently more complicated.

Sign up to unveil the relationship between Wall Street and Washington.

Tax season is nigh, but it’s anything but filing as usual.

This year, the Biden administration is targeting a tenfold increase in audits on America’s wealthiest taxpayers under a newly anointed strategic operating plan spearheaded by the U.S. Internal Revenue Service.

How did this come to pass? After more than 25 years of starving the IRS of capital, Congress approved boosting funds to the tax-collection agency by $79.4 billion, as part of last year’s Inflation Reduction Act, to expand the IRS’s workforce, upgrade its rickety legacy information technology systems and pursue some of the nation’s wealthiest tax cheats.

The cash infusion did not bring immediate peace to the land. While politicians have been bleating about fixing the U.S. tax system for decades, the debate has been fractious, as some members of Congress object to a “supersized” IRS and called the move a “social spending spree.”

Others, including high-ranking officials from the IRS, point out the agency has fewer auditors now than in any period in history since World War II.

Countermeasures have abounded. House Republicans voted in January to rescind the tens of billions of dollars allocated to the IRS, but the measure didn’t gain enough steam to pass in the Democratic-controlled Senate.

Not to be discouraged, some House Republicans introduced a bill to abolish the IRS entirely. In its place, they suggested imposing a heavy tax on gross payments for taxable property. A few attempted to warn Americans that tax collectors bearing sidearms would soon come banging down their doors.

“Armed, unelected bureaucrats should not have more power over your paycheck than you do,” said Rep. Buddy Carter, a Republican from Georgia, who introduced the bill, referring to the IRS.

Newly appointed IRS Commissioner Daniel Werfel moved to quell those fears. “Despite what some might think or say, these public servants within the IRS are armed only with calculators and their skills to help us address compliance issues,” he noted during his swearing-in this month. (Truth be told, a couple of thousand agents with the IRS’s Criminal Investigation division, who troubleshoot financial crimes, do carry firearms. But that hardly means agents of the IRS are likely to go full Scarface.)

The Inflation Reduction Act funds will go toward clawing back funds from a greater share of wealthy tax dodgers, buying better equipment to scan the reams of paper filed with the IRS each year, and turning the IRS into a “world-class customer service operation,” according to Werfel.

That last bit may sound very pie-in-the-sky, but the commissioner, who was confirmed to his post just days ago, is coming in hot, stating that he wants Americans to “have confidence that all taxpayers, regardless of means, are doing their part to meet their responsibilities under our tax laws.”

The IRS’s cash infusion will allow it to add 87,000 new agents to its ranks.

Still, the not-inconsequential question on everyone’s lips is: Who’s going to get audited?

There’s been a great deal of chest-beating and teeth-gnashing about this. If you believe Carter, the audits will target small businesses and middle America. If you believe Mike Crapo, the Republican Senator from Idaho, it “will inevitably lead to increased audits and investigations of every American taxpayer.”

To be sure, it is not entirely out of bounds for lawmakers to be skeptical of how a freshly capitalized IRS may wield its newfound powers – especially based on its track record.

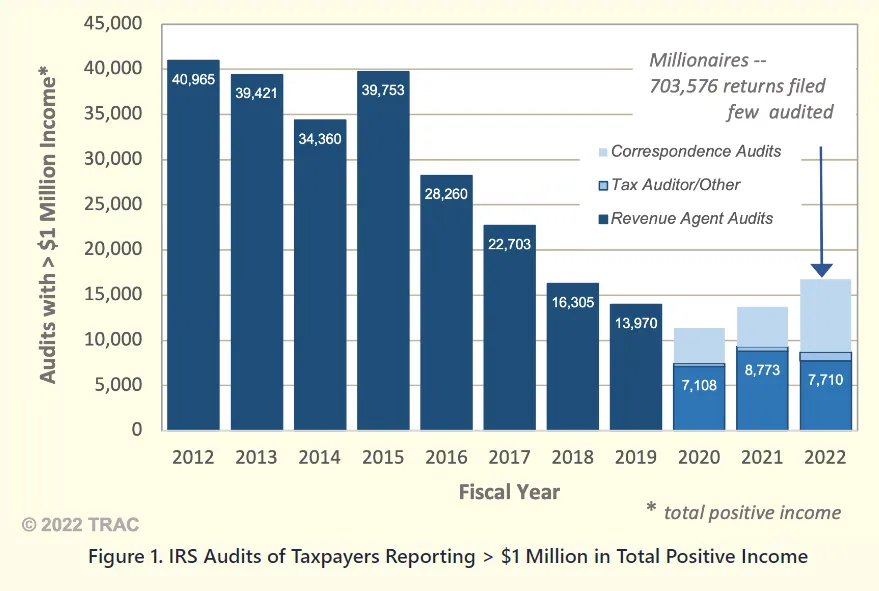

According to IRS data, only about 1.1 percent of U.S. millionaires filing taxes for 2022 were audited. And it’s not been much better over the past decade.

An analysis done by Syracuse University based on IRS data discovered that the taxpayers with the highest audit rates – “five and a half times virtually everyone else” – were low-income earners claiming the earned income tax credit designed to ease the tax burden on America’s lowest-earning workers.

“This group of taxpayers have historically been targeted, not because they account for the most tax under-reporting,” the Syracuse University report explained, “but because they are easy marks.”

In fact, the IRS audits twice as many taxpayers reporting zero positive income than taxpayers earning at least $500,000.

Syracuse University released a chart showing that, after years of cutbacks, audits of millionaires by the IRS fell dramatically over the past decade, from a high of 40,965 audits of millionaires’ returns in 2012 to a low of just above 7,000 millionaire audits over the past three years.

Last year, more than 164 million individual tax returns were filed. But that is still less than half of the U.S. population.

The University of Syracuse scours data from internal IRS management reports released each month under a court following litigation under the Freedom of Information Act.

“One of the things that people talk about when they say that the tax code is unfair is, if you’re low-income, you’re more likely to be audited than if you’re wealthy,” said U.S. Deputy Treasury Secretary Wally Adeyemo in a recent interview. “That is not consistent with tax fairness.”

Adeyemo added that he hopes the IRS will boost audit rates on the wealthy.

He is not alone. A letter sent in March to the IRS’s Werfel and U.S. Treasury Secretary Janet Yellen signed by 21 senators made it clear that who gets audited will be top of mind as the IRS beefs up its enforcement.

“We agree with the Biden administration’s and Treasury’s commitments to increase audits of the wealthy and large corporations, while not raising audit rates above historic levels for households earning less than $400,000,” they wrote. “We also strongly encourage the IRS to examine its processes and procedures to strengthen taxpayers’ rights, to improve taxpayer service and to close the tax gap by ensuring wealthy individuals pay their fair share.”

The letter sought to underscore that any “misinformation” about small businesses or households earning $400,000 a year or less would “not see an increase in the chances that they are audited” and that instead, “enforcement resources will focus on high-end noncompliance.”

In short, it directed the IRS to cease chasing after small-ball tax returns where the juice is barely worth the squeeze.

It sounds like that is exactly what it will have to do to meet expectations. The Congressional Budget Office has estimated that for every $1 of increased spending on IRS enforcement activities, the agency stands to reap a “peak” return on investment of six- to sevenfold. In light of that data point, investing in IRS audits seems like a no-brainer for filling U.S. coffers.

In a statement ahead of the April 18 Tax Day, Patriotic Millionaires, a Washington-based nonpartisan organization of high-net-worth Americans, urged policymakers to “stop trying to appeal to anti-tax millionaires crying wolf and instead recommit themselves to taxing the rich.”

The group added that lawmakers and policymakers “should not worry that millionaires will pack up their bags for low-tax havens if they implement more progressive taxes, as all evidence points to the contrary…What should concern them is the health and well-being of their constituents.”

The drive to right-size taxes on the ultra-wealthy comes as the U.S. braces for potential economic calamity over the debt ceiling, which is past its limit at $31.7 trillion and is unlikely to be sustainable beyond early June.

At the same time, the IRS is hunting down U.S. households that are stowing what it estimates to be $2 trillion of wealth in offshore tax havens.

Even U.S. presidents are finding themselves unable to duck the IRS. While former president Donald J. Trump’s tax returns and seemingly endless audits were famously debated during his time in office (and to this day, still do not seem to be resolved), President Biden and his wife also were audited by the IRS for 2020 and 2021.

The verdict: The Bidens owed $13 for 2021 – and paid it – but were due an additional federal income tax return for 2020. In other words, it appears the IRS ended up losing money in that exchange. It makes you wonder, would it not be a tad wiser for it to focus on audits where it can make some money?

Of course, taxes aren’t everything. While Benjamin Franklin came up with the pithy quote, “In this world nothing is certain, except death and taxes,” his money still continued to be battled over long after his death.

In a convoluted set of final wishes, Franklin bequeathed his riches to the cities of Boston, where he grew up, and Philadelphia, where he lived and died in 1790. But there was a catch. He stipulated the full funds could not be spent until 200 years after his death, which led to many spirited debates in 1990 over how to properly spend it.

It appears what outlasts everything isn’t death or taxes. It is fighting over money.

Power Reads

Some of our favorite reads, for your weekend gratification.

Still seething from third-party embarrassment over the Trump charges

Do you remember a former U.S. president was indicted last week? It already feels like a long time ago, but some legal analysts are still steaming about it, asserting that the case against Donald J. Trump is anything but solid and deserves another tire-kicking. The New Yorker’s Isaac Chotiner speaks with Jed Shugerman, who teaches law at Fordham and Boston University about why the case against Trump is, as Shugerman puts it, a “legal embarrassment.”

SBF, utilitarianism and risk management

OK, admitting up front this is not a recent read, but in light of how the FTX cryptocurrency disaster is playing out, this piece by The Diff’s Byrne Hobart is worth re-reading. In it, he considers the true intentions of FTX’s founder and former CEO Sam Bankman-Fried (SBF), musing:

“A plausible, but boring, theory is that SBF was a scam artist the whole time. If that were true, he probably would have blown up earlier, and at a smaller scale, or would have retired to the Bahamas instead of moving there for tax/regulatory purposes and sleeping in a beanbag chair in the office.

Instead, let’s explore a plausible and exciting theory, where SBF and other FTX/Alameda employees were brilliant, idealistic, and just made some fundamental mistakes—including fraud eventually, but not right away.”

What I like about this one is that it closely examines how SBF’s fixation on utilitarianism likely played what Hobart calls an “action-guiding” role in some of the faulty decision-making that led SBF – and his company – into bankruptcy, criminal charges and losing billions of dollars.

Really never thought when I learned about utilitarianism in school that it could one day be hailed as a Wall Street supervillain toxic trait.

Are there parallels between Dungeons & Dragons…and taxes?

This McSweeney’s piece by Amanda Lehr says yes. And it does not disappoint.

Examples: “You’ll either be rewarded with great riches or imprisoned for your follies.” “You should really familiarize yourself with the charts and appendices. (But you won’t.)” And, the fatalistic, “Tread carefully. Traps are everywhere.”

The views expressed in this op-ed are solely those of the author and do not necessarily reflect the opinions or policies of The Daily Upside, its editors, or any affiliated entities. Any information provided herein is for informational purposes only and should not be construed as professional advice. Readers are encouraged to seek independent advice or conduct their own research to form their own opinions.