Biden Proposes Boosting Minimum Tax Rate on Big Corporations

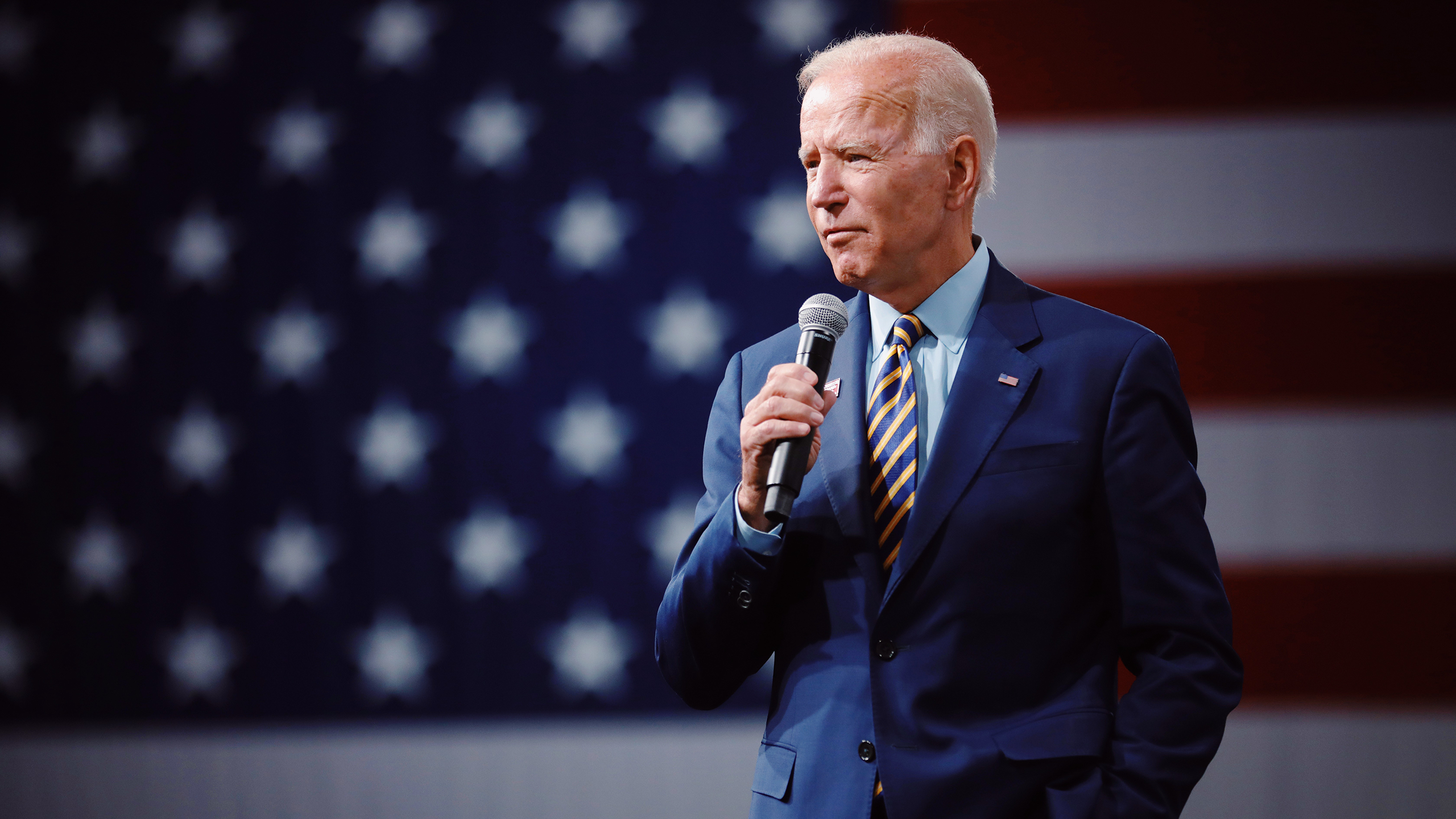

During Thursday’s State of the Union address, President Biden proposed increasing minimum tax rates for billionaires and large corporations.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

There are 735 billionaires in the US, according to Forbes. That’s a lot of wealth but not a lot of votes, which is good news for President Joe Biden.

During Thursday’s State of the Union address, Biden proposed increasing minimum tax rates for billionaires, as well as large corporations, while lowering them for less wealthy households.

Going After Fat Cats

Although the US has a base corporate tax rate of 21%, plenty of loopholes, breaks, and deductions exist that allow many of the biggest companies — like Amazon, Nike, and Salesforce — to avoid paying federal taxes altogether. Wealthy individuals also enjoy similar advantages.

As much as immigration, climate change, and candidate age are already hot-button issues in the lead-up to this year’s presidential election, the US economy, inflation, and taxes weigh heavily on voters’ minds. In his State of the Union address, Biden took aim at the richest of the rich Americans and corporations with the intention of making them pay their “fair share”:

- The Inflation Reduction Act, which Biden passed in 2022, set a 15% minimum tax on corporations that report annual profits of $1 billion or more. On Thursday, he proposed raising that even further to 21% and bumping the overall corporate tax rate to 28% from 21% as well. He also asked lawmakers to increase the tax that companies pay on stock buybacks to 4% from 1%, with the goal of encouraging companies to put more money into their employees and facilities.

- Biden proposed increasing the minimum tax rate to 25% for individuals worth more than $100 million. He also intends to crack down on corporations and individuals who use non-commercial planes by increasing fuel taxes on their private jet travel. On the opposite end of the wealth spectrum, Biden intends to cut taxes for middle- and low-income Americans by $765 billion over 10 years by increasing the Child Tax Credit and making lower, affordable healthcare premiums permanent.

(Not) All Things Must Pass: All of these stick-it-to-the-rich initiatives should excite Biden’s more progressive supporters, but they don’t stand much of a chance in Congress. Bloomberg’s Akayla Gardner and Laura Davison described his billionaire tax hikes as a “political longshot.” What isn’t these days?