Apple Seeks Adaptable Model Patent as It Readies to Join AI Race

An Apple patent to train AI without eating up power highlights the advantages and headwinds the tech giant may face in the market.

Sign up to uncover the latest in emerging technology.

Apple may want its AI models to be a little more flexible.

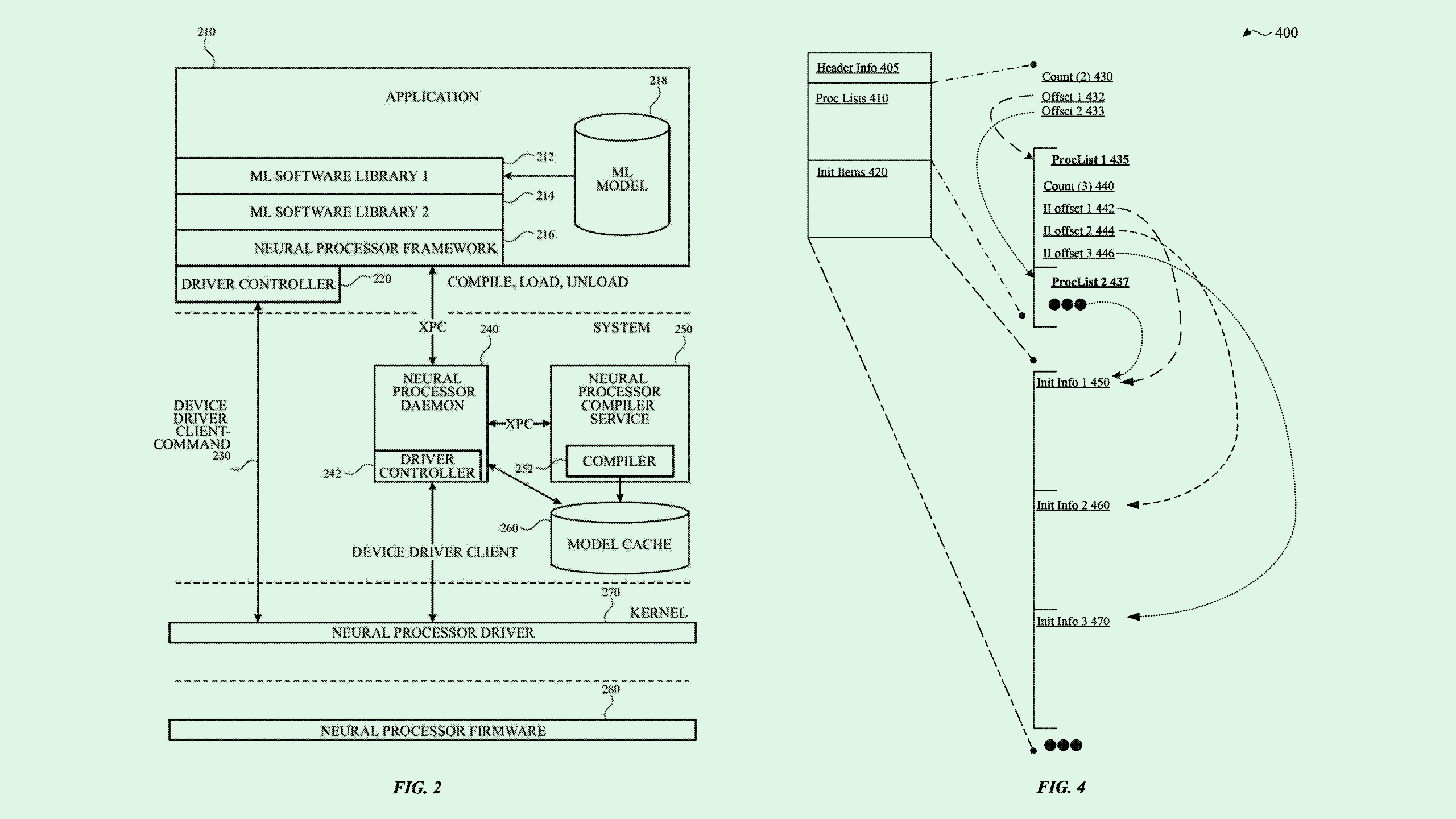

The company is seeking to patent “mutable parameters for machine learning models” during runtime. Apple’s tech aims to make it easier for neural networks to be updated as they’re being used without the need to recompile, which takes significant computational resources.

“In some instances when executing a given deep neural network, depending on the machine learning task, it may not be possible to update certain parameters for the network,” Apple said. “It may not be possible to update the parameter data in the neural network as it is running.”

To put it simply: After Apple’s system receives the neural network’s code as well as a copy of its weights (a.k.a. the things that determine how a model makes decisions), the system figures out which layers are “mutable,” or can be changed while the model is running without deeply impacting performance.

Once it figures out which parts can be changed, the system will generate metadata, which includes the new weights and specifies which layers need to be updated, as well as other instructions on changes that need to happen to properly update the model. Apple’s system finally switches out the old weights for the new ones and updates the model in real time.

In practice, Apple’s system may allow for on-the-fly updates to AI models on its devices, making them more personalized and context-aware without burning through computational resources.

As the company prepares to unleash its AI-powered operating system on the world with the launch of Apple Intelligence in October, it makes sense that Apple would seek patents to make its models faster and more personalized, said Thomas Randall, advisory director at Info-Tech Research Group.

“The key piece is to continue to push those boundaries of how fast and how accurately we can give outputs that are of a very high quality and high speeds with as minimal resources as possible,” said Randall.

Apple already has quite a few advantages on its side as it enters the market, Randall noted. For one, its large cash flow has made investors “a bit more patient with Apple’s performance” in the AI space. Its partnership with OpenAI is also “crucial to its success,” Randall said, and the sheer market penetration it has with its devices is a clear leg-up.

However, the company still faces a few significant headwinds, he said. Namely, Apple’s main AI upgrades relate to its voice assistant Siri. But there simply may not be a “public appetite for that” use case, he said. Plus, a lot of its upcoming upgrades are “nice-to-haves” rather than “radical changes to the way in which people might interact with their phone,” he said.

Demand for the new iPhone 16 may also be weaker than expected ahead of its debut on Friday. “I don’t see customer excitement to the same degree as there might have once been,” said Randall.

With all of the tech industry’s eyes on Apple and its long-awaited debut, it’s incredibly important that the company gets AI right, said Randall. Bad results, and thereby bad PR, could be a major setback in an already tight market.