Mastercard Wants to Create a Back-up Plan for Lost Crypto

This signals that financial institutions are seeking to make blockchain safer, though it challenges the decentralized nature of the tech.

Sign up to uncover the latest in emerging technology.

Are you still there? Don’t forget your crypto on your way out the door.

Mastercard wants to patent a “failsafe mechanism” for blockchain wallets that haven’t been used in a while. The credit card company wants to prevent users from losing access to all of their digital assets in the event that their private key is lost.

“One of the side effects of the anonymity granted by using a blockchain is that there are no mechanisms for the recovery of a lost or stolen private key,” Mastercard said in its filing.

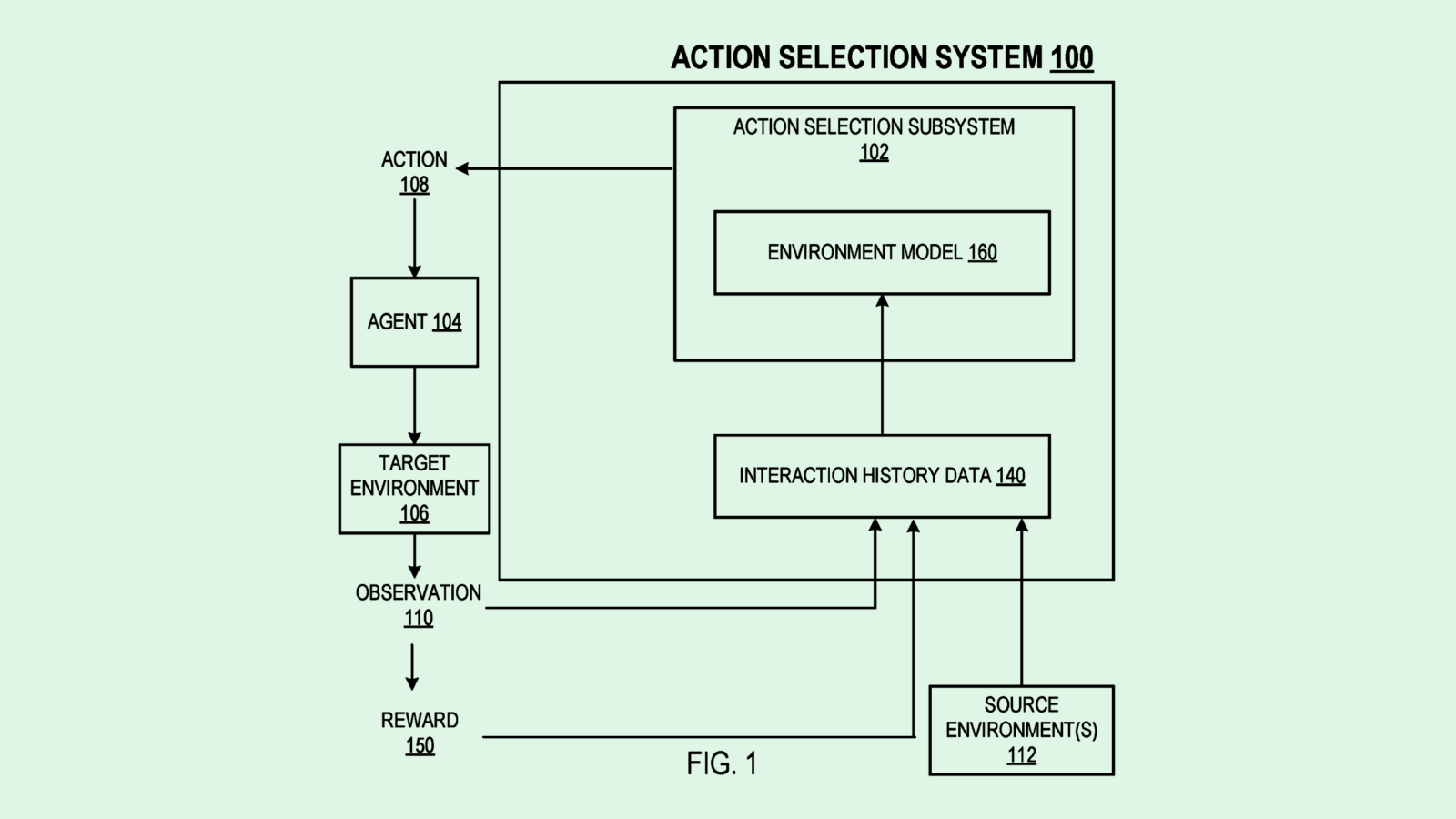

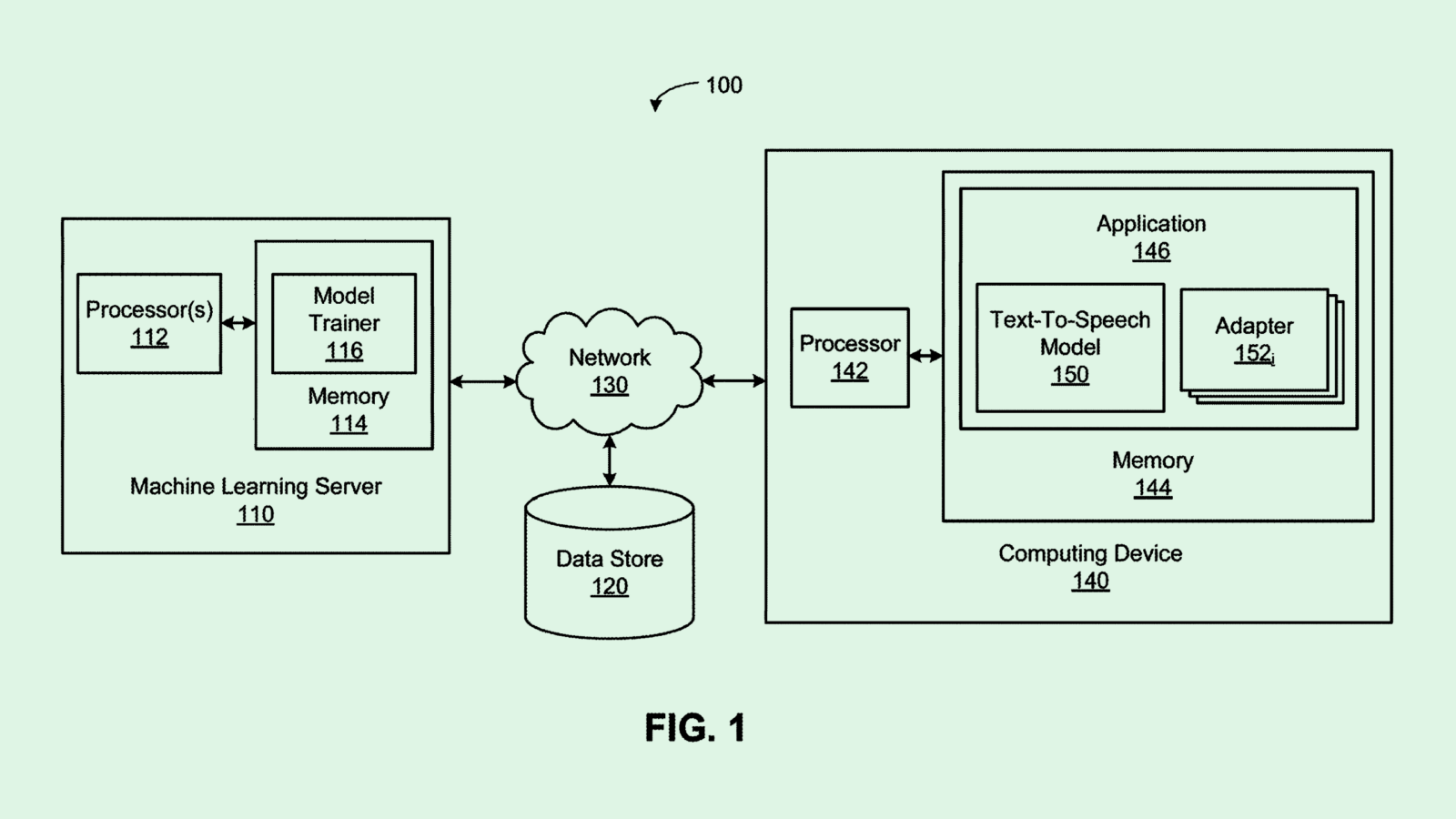

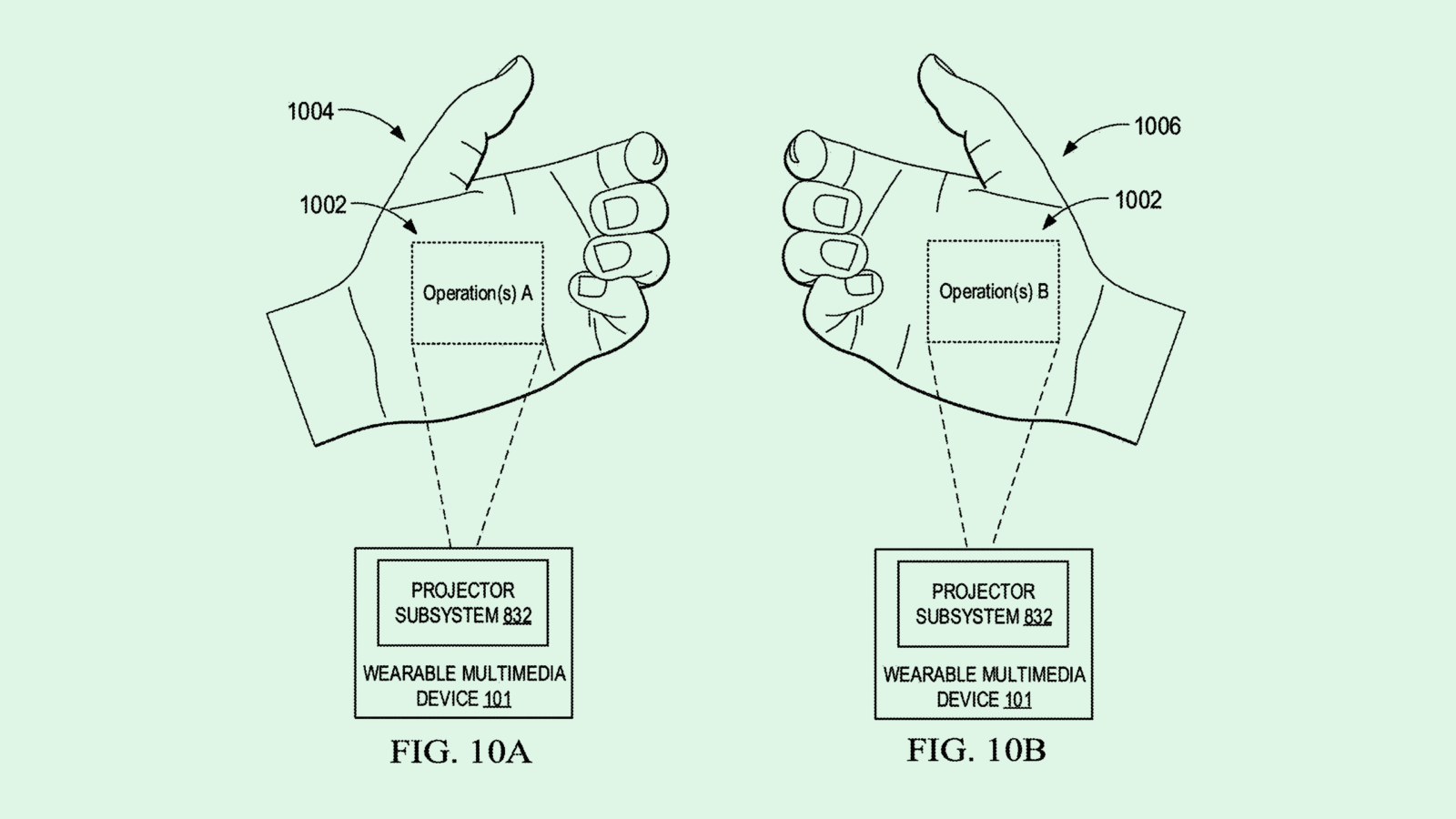

This system uses two smart wallets, a primary wallet and a designated secondary wallet, where digital assets are automatically transferred if the first wallet experiences a period of inactivity.

After a wallet is inactive for a certain amount of time, this system receives a “propagation request,” which includes “unspent transaction output addresses” (where a user was sending money to or getting money from), a digital signature, and the digital address of the secondary wallet. With this information, the system creates a new smart contract, which is configured to “self-execute” after a certain amount of time, moving the contents of the first wallet to the secondary wallet.

“This results in a “dead man’s switch” that will enable the user, or another authorized party, such as a bank, trust, friend, relative, lawyer, etc., to retain ownership of the cryptocurrency should something happen to the primary wallet or the user,” the company noted.

Finally, the system monitors the blockchain for new smart contracts involving the primary wallet to automatically create and submit new smart contracts to the blockchain, moving the assets to the secondary wallet.

It adds up that Mastercard is looking to make blockchain transactions a safer endeavor: Cryptocurrency doesn’t have the best reputation for safety, and public perception of the tech has fallen far from grace.

“The nature of blockchain wallets is that they’re pretty fickle,” said Jordan Gutt, Web 3.0 Lead at The Glimpse Group. “This is kind of abstracting the need for the end-user to secure their own wallet by creating a failsafe in this scenario that they lose their key.”

Despite crypto’s drop in public trust, Mastercard has pushed ahead with plans to build out its blockchain ambitions. The company has filed for a number of blockchain related patents, and is in talks with digital banks and fintechs on a digital asset credit card. Other financial firms have followed suit, including PayPal and Visa.

Gutt said this is because these firms are in the stages of building out their blockchain infrastructure, taking advantage while the market is down. “We’re seeing MasterCard double down on usability and wallet infrastructure, so more people could have an easier time adopting the technology,” he noted.

While institutional interest brings a sense of legitimacy, it also challenges the nature of blockchain as a decentralized technology. But in the race to create and scale strong blockchain infrastructure, “Not everything will be decentralized,” Gutt said. There’s a “spectrum to decentralization,” he said, with more hard-core enthusiasts opting for disparate systems and individual wallets while casual users gravitate towards institutional offerings.

“There will be some centralization, because otherwise it’s really hard to coordinate decentralized systems,” he said.