Intel’s CEO Resigns After Failed Turnaround Effort

If the artificial intelligence revolution has ushered in a boomtime for chipmakers, no one seems to have told Intel.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

If the artificial intelligence revolution has ushered in a boomtime for chipmakers, no one seems to have told Intel.

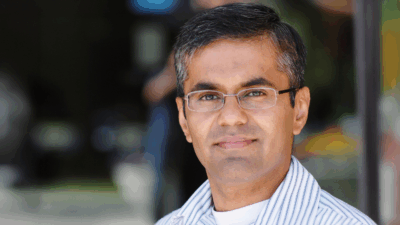

Late Sunday night, the stumbling semiconductor giant’s CEO, Pat Gelsinger, announced his resignation, effective immediately, after a mostly terrible nearly four-year run at the helm of the company. By Monday morning, Bloomberg reported that Intel’s board had forced Gelsinger out after losing confidence in his plans and ability to turn around the once-storied titan of Silicon Valley.

Big Plans

When Gelsinger took the CEO job back in 2021, he was something of a prodigal son. He started out working for Intel as a teenager in 1979 before leaving in 2009, only to return as a wise sage with a vision of turning Intel, then mostly focused on personal computing, into a contract chipmaking foundry. Things didn’t go exactly as planned. Instead, Gelsinger’s tenure has been marked by inflated expectations, major delays, technical problems, and massive sunk costs. Worse: according to a Reuters report this fall, Gelsinger torched Intel’s crucial and cozy relationship with TSMC, the foundry it actually relied on to make many of its chips and which long offered the American company massive discounts — until it didn’t.

Last year, Intel generated just $54 billion in revenue, down roughly 33% since 2021. This year, it’s on track for its first annual net loss since 1986 as it struggles to attract customers to its nascent foundry business; in August, Intel announced layoffs of some 15,000 employees. And all this pain has come with Intel being one of the biggest beneficiaries of the Biden administration’s massive push to upgrade the US’s domestic chip-making industry:

- Just last week, Intel locked in nearly $7.9 billion in federal grants to build chip-making facilities in four states — though its final haul is lower than previously expected. Still, Gelsinger had promised to invest roughly $60 billion overall into Intel’s factory expansion.

- Meanwhile, Intel has largely failed to demonstrate to high-profile clients that its Gaudi chip, an AI accelerator, could serve as an alternative to Nvidia’s GPUs, and The New York Times recently reported that clients have been informed that Intel’s foundry unit remains far behind the production capabilities of TSMC’s.

In other words: Gelsinger may have had vision, but he didn’t have follow-through. Intel’s stock is down around 50% year-to-date, and over 60% since he took the job.

Export Opinion: A comeback won’t be easy, even under new management, though Intel (and other US chip makers) got a big assist on Monday when the US government imposed a new wave of restrictions on exporting chipmaking equipment to China, which one expert analyst told the Financial Times has been the missing piece in the Biden administration’s export control policies.