Semiconductors

Get More Than News. Get Insights.

Our daily email brings you smart and engaging news and analysis on the biggest stories in business and finance. For free.

-

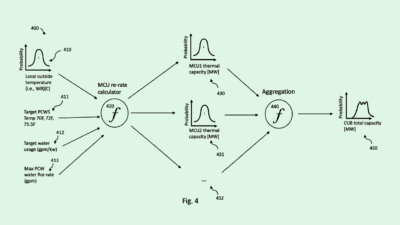

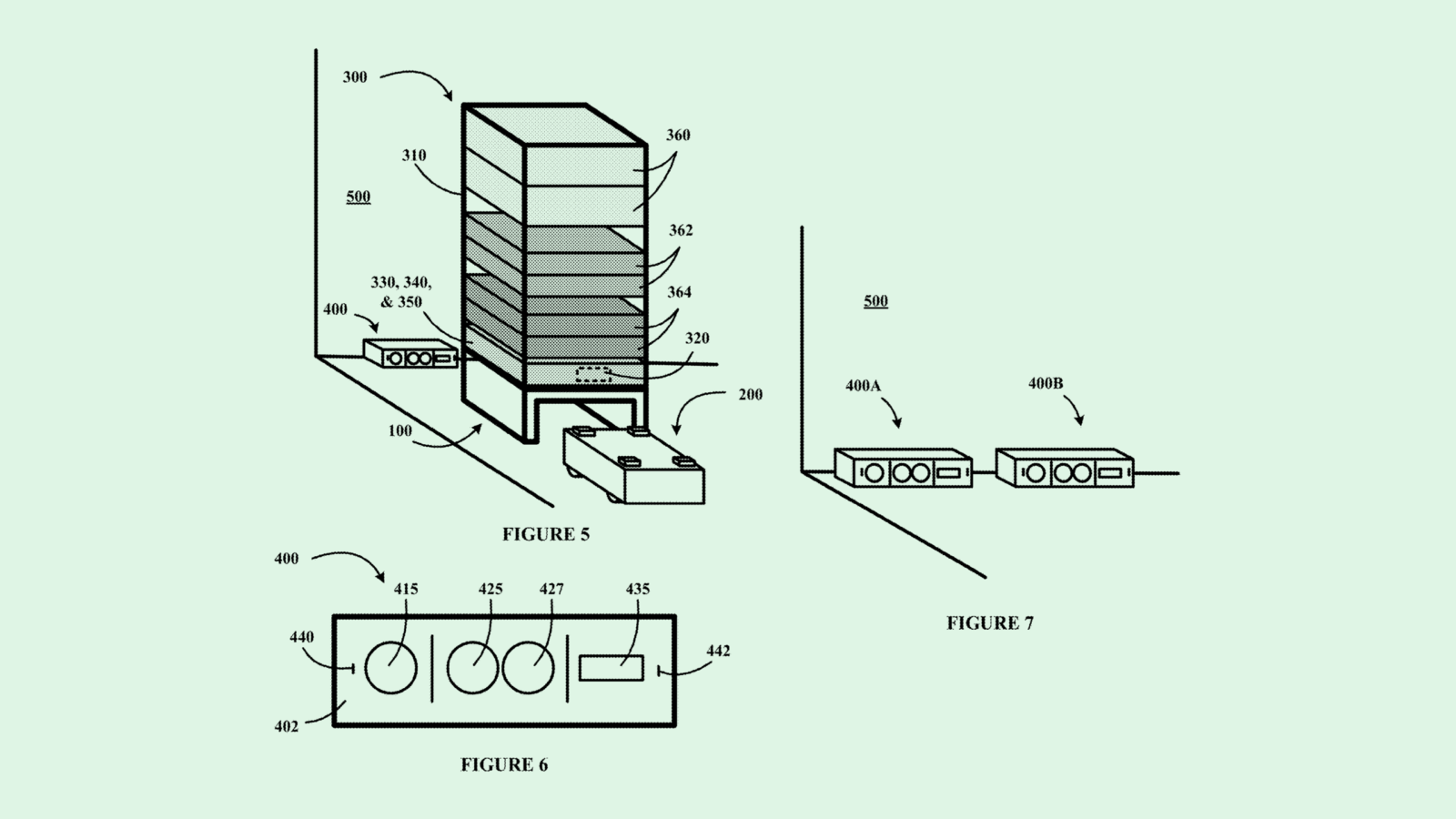

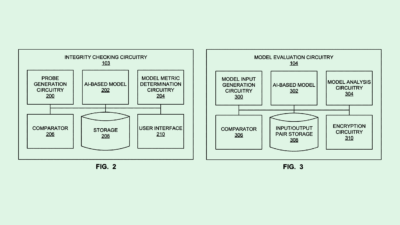

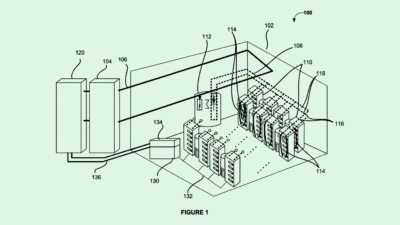

Nvidia May Take Humans out of the Data Center Equation

Photo via U.S. Patent and Trademark Office

-

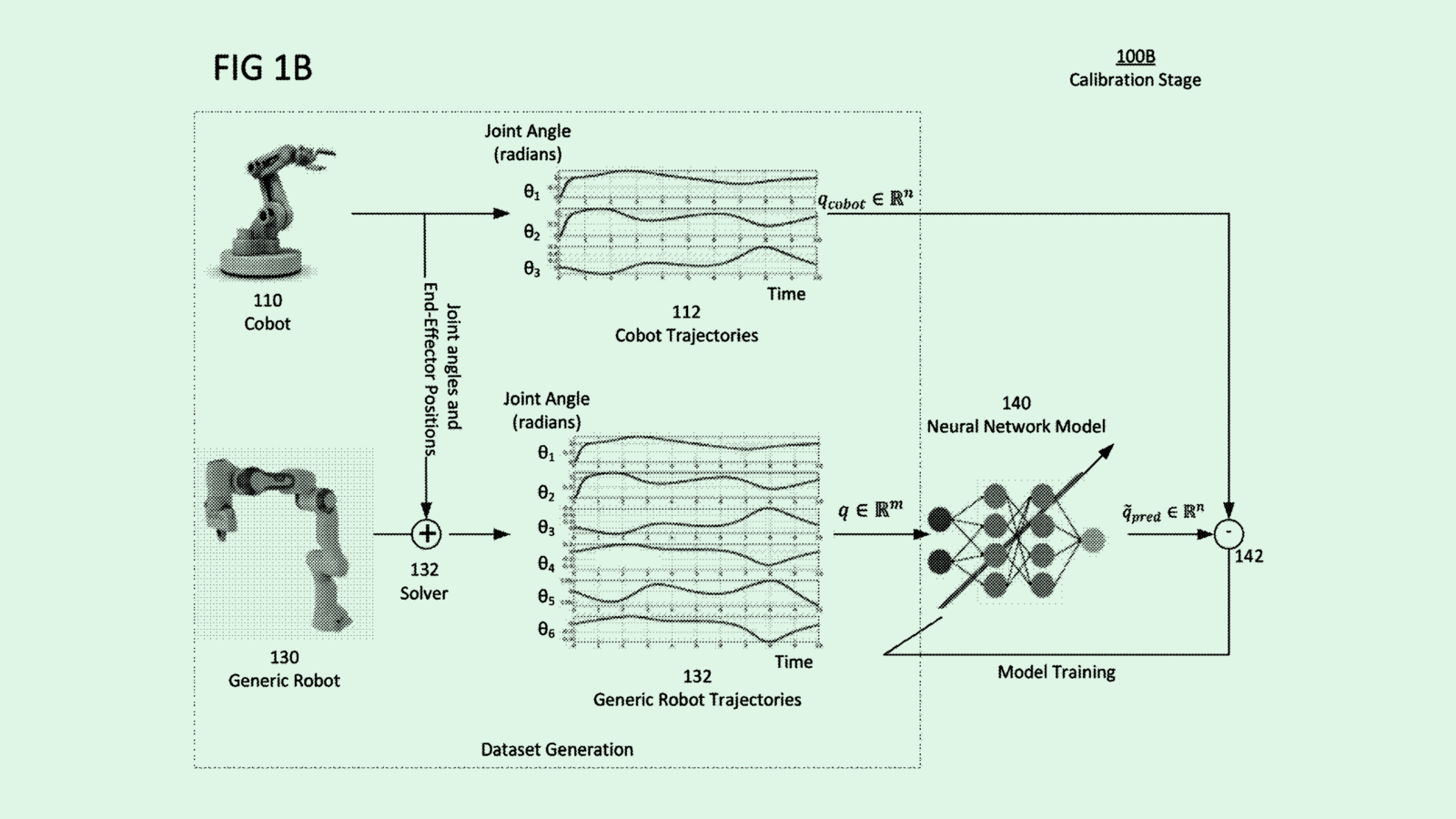

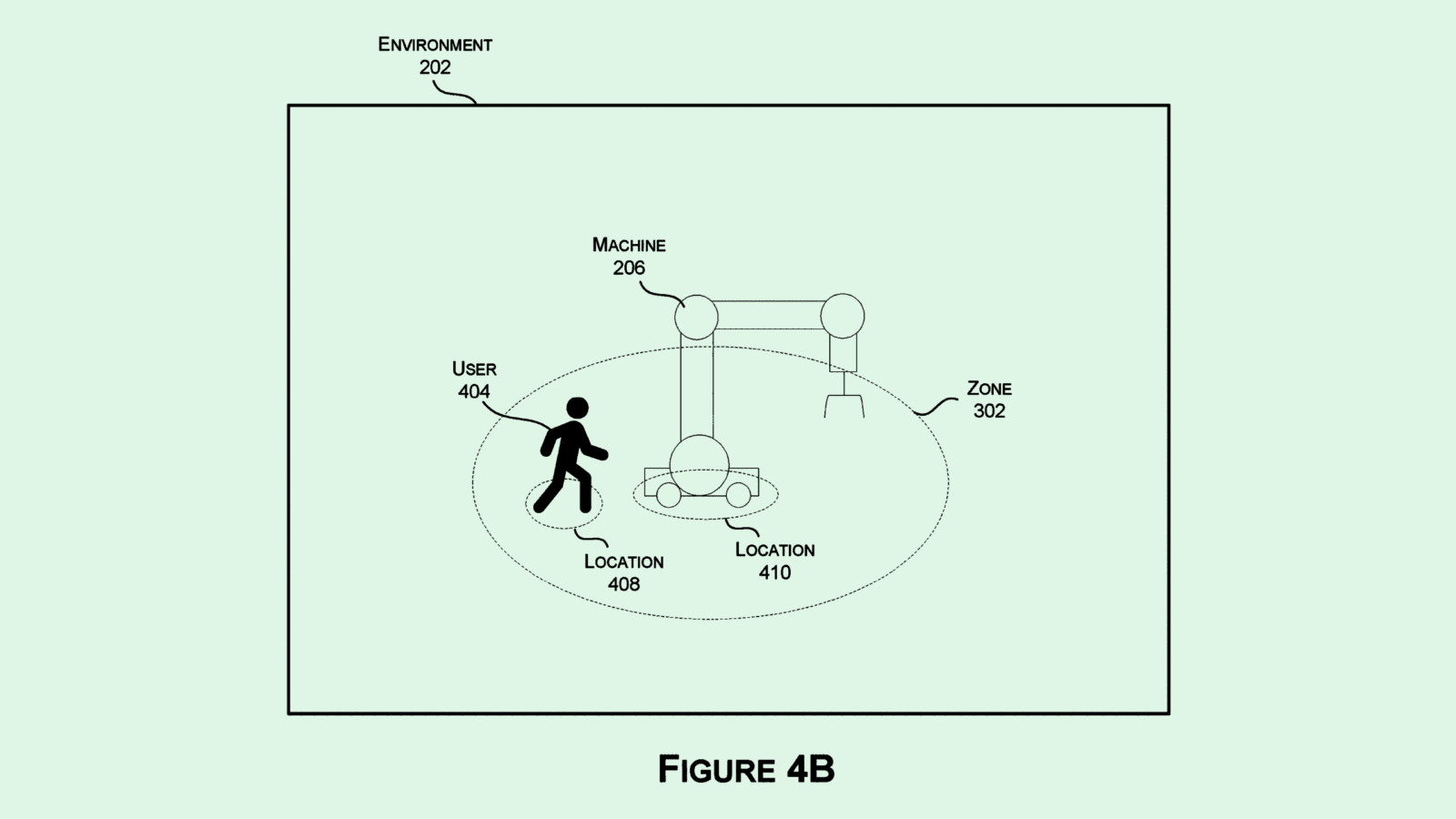

Intel ‘Cobots’ Patent Highlights Growing AI Robotics Market

Photo via U.S. Patent and Trademark Office

-

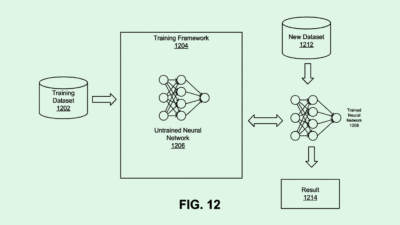

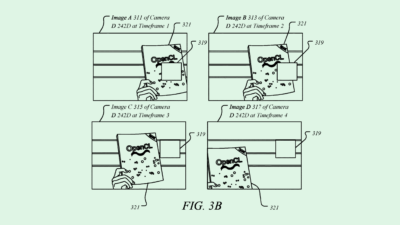

Nvidia Robotics, Self-Driving Patents Could Make Its Chips Even More Popular

Photo via U.S. Patent and Trademark Office