The Future of AI ETFs May Be Data Centers

Investments in AI infrastructure are set to take off in the next decade, and more ETFs are focusing on that.

Sign up for exclusive news and analysis of the rapidly evolving ETF landscape.

Sure, not all AI companies are created equal, but they are all powered by the same infrastructure.

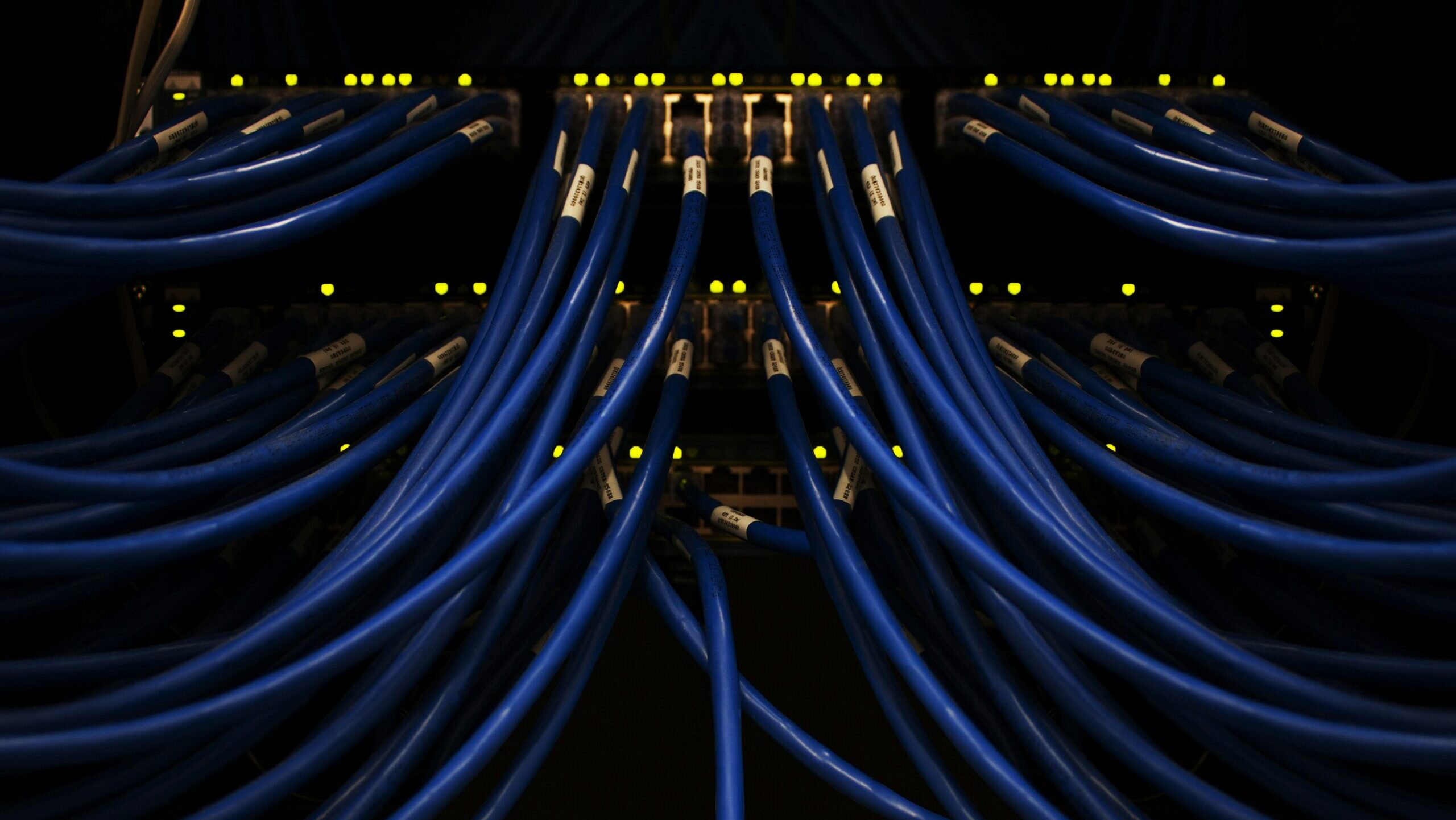

Several ETFs focused on the backbone of AI companies — cables, data storage systems, cooling devices and more — have popped up in recent months looking to cash in on the AI boom and the industry’s projected growth. The AI infrastructure sector is expected to surpass $350 billion by 2032, according to the market research firm Fortune Business Insights, an expansion experts say is noteworthy. “[It’s like] if you could go back in time and tell people, ‘Hey, would you like a slice of the internet?’ but you knew what the internet would be,” said Zeno Mercer, a senior research analyst at VettaFi. “Now you have companies that are actually highly profitable… and they have an angle on those various possibilities of where the world is heading.”

Laying the Groundwork

There are countless ways to invest in AI infrastructure, including energy and electricity companies and hyperscalers like Google and Meta, which build the large data centers that hold the information AI pulls from. There are also natural gas or nuclear power plants being built specifically to power those data centers. “You can invest in Meta, but just think about the millions of servers that need to be in that data center — companies like Dell, Cisco and other server makers are going to be selling off the servers to them,” said Rob Thummel, managing director at Tortoise Capital, which launched its own AI infrastructure ETF last week. “[Data centers] need millions and millions of data storage devices, so companies like Stargate and Western Digital will be providing a lot of that.”

Other ETFs with exposure to AI infrastructure include:

- The iShares AI Infrastructure UCITS ETF (AINF), which launched late last year and tracks semiconductor companies, cloud computing software and big data technologies.

- The Defiance AI & Power Infrastructure ETF (AIPO), which launched last month and invests in the electrical grid, data centers and the AI hardware sector.

Investors who want exposure should generally allocate roughly 5% to 10%, Mercer said, but they should avoid overweighting the biggest players. “We had 20-plus years of American tech imperialism,” he said. “But there is a chance now for companies worldwide that were dependent on us to be like, ‘Hey, we actually can make this ourselves a lot easier.’”

Where’s My Data? Data centers are about to become a nationwide phenomenon, too, having been clustered until now in northern Virginia and Silicon Valley. Thummel said other regions, ranging from Kansas City to Columbus, Ohio, are being considered because local and state governments — seeing the business opportunity — are offering builders tax exemptions. “This AI thing is growing pretty rapidly, and you’re going to need lots of different locations to build your facilities,” Thummel said. “AI can’t run on code alone.”