Goldman Sachs’ Data Breakdown

The financial institution wants to help traders see the future.

Sign up to uncover the latest in emerging technology.

Some financial decisions can be hard. Goldman Sachs wants to lessen some of the guesswork for traders.

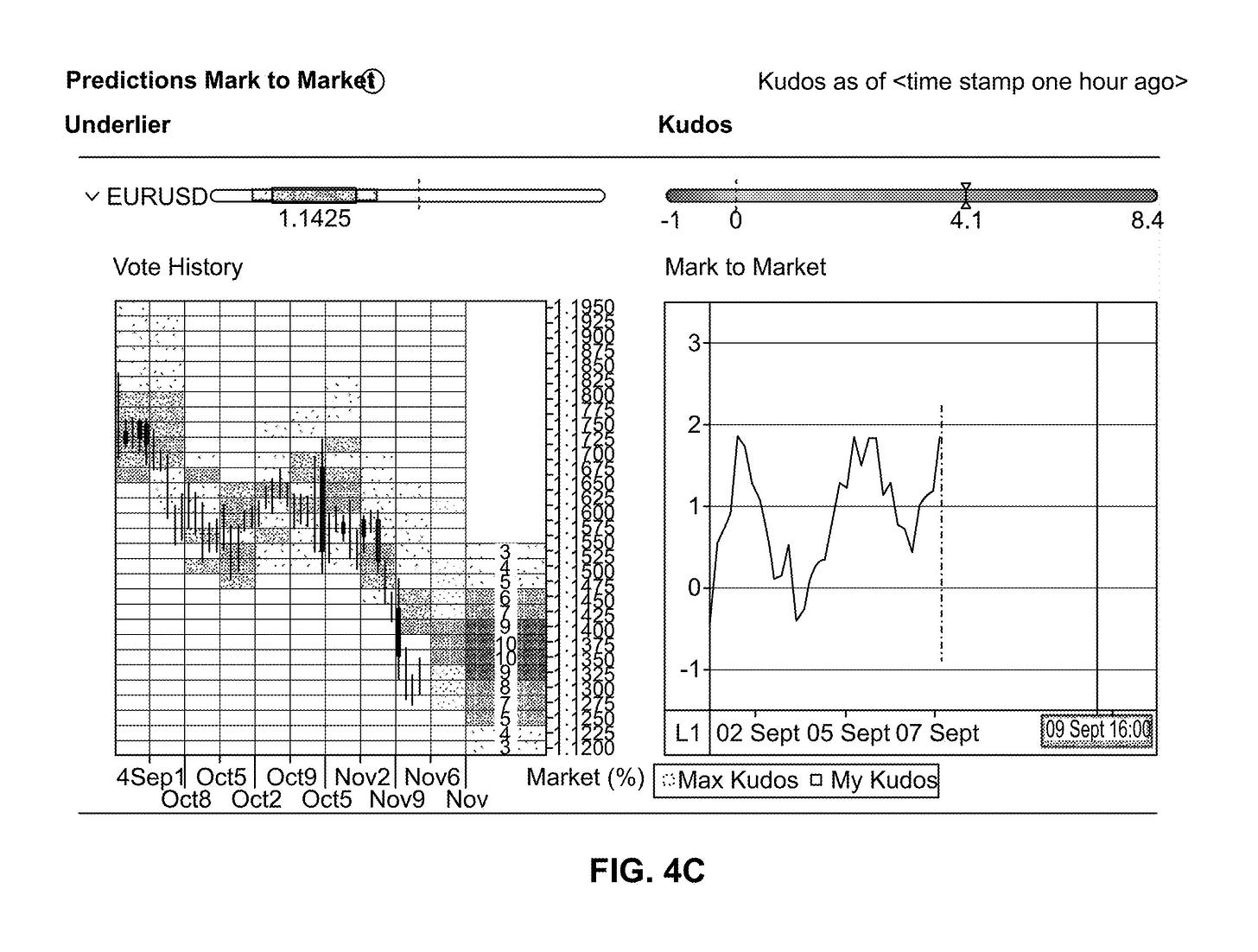

The financial institution is seeking to patent an “information-dense user interface” to visualize asset prices and transaction parameters. To put it simply, Goldman’s tech essentially aggregates everything a trader needs to know in one place to help predict stock prices, as “existing systems make it very difficult for a trader to understand the universe of scenarios or place those scenarios in historical context.”

Goldman’s user interface comes with a host of different displays, including:

- A polling tool to predict asset prices;

- Historical data based on past predictions;

- An asset ordering system that provides “intra-trade updates;”

- And an interface that allows users to define the “parameters,” such as spot price, timeframe or expiration date, for a transaction based on their predicted prices.

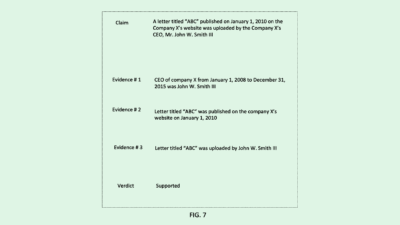

This interface also shows how often an individual user’s price prediction is correct, and uses machine learning to figure out how likely they are to be correct in the future, assigning “kudos” to the user that predicts the most correctly. “Higher kudos corresponds to more accurate historical predictions and vice versa,” Goldman noted.

The company said that in conventional systems, relevant information is spread across several spreadsheets, apps and databases that a trader must flip through, “if it is available at all.” Using those systems requires a high level of skill and experience, Goldman said, and “has a high propensity for human errors resulting from the trader not correctly drawing correlations between disparate pieces of data in the spreadsheets.”

Patent tech like this is par for the course for Goldman: Most of the firm’s patent filings relate to financial data and how to manage it. Plus, given that this tech could likely help Goldman continue to make money faster, there’s certainly incentive to implement it among their own workflow.

With the skyrocketing demand for financial data, creating systems that help traders meaningfully organize it is itself a lucrative business. Along with using a system like this internally, Goldman could license a system like this to other firms. But if the system could give the firm an advantage over competitors, keeping it for itself may be a better option, said Dean Kim, head of equity research at William O’Neil.

Internally, tech like this could provide a major benefit, making trading more efficient, helping make better decisions and limiting the chance for human error, said Kim. “There’s clients behind every trade,” he said. “So if a trader at Goldman makes a mistake, then at the end of the day, they’re going to be on the hook in terms of making the client whole.”

Tech like this can also save on labor costs, said Kim. Since conventional trading systems require more expertise and time to operate, a simpler, AI-backed system could create opportunities for less-skilled traders to join the big leagues.

Trading human labor for AI is a controversial issue that’s sprung up among the tech’s critics. But Goldman faced bleak earnings yesterday morning, and has several rounds of layoffs from the past year under its belt. The company may see AI-based tech as, at least, a helping hand.

“The number one cost for Goldman Sachs is people,” said Kim. “If you can reduce the number of people that are trading, all of that is going to fall to the bottom line.”

Have any comments, tips or suggestions? Drop us a line! Email at admin@patentdrop.xyz or shoot us a DM on Twitter @patentdrop. If you want to get Patent Drop in your inbox, click here to subscribe.