Trump’s New China Tariff Threat Halts Markets’ Optimistic ‘Melt-Up’

Tech stocks, among the most vulnerable to souring US-China trade relations with China, led Friday’s sell-off.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

It feels like April in October, and not just because temperatures are back in the 60s in New York City. The trade war jitters that roiled Wall Street last spring are back.

US stocks closed down sharply on Friday after President Donald Trump renewed threats to impose a “massive increase” in tariffs on imports from China. After markets closed, he said the US would impose a levy on goods from the world’s second-largest economy, amounting to 100% “over and above any tariff that they are currently paying” starting November 1. It was a gut check at a time when analysts are increasingly worried about an unsustainable “melt-up” driven by AI enthusiasm.

Trading Places

Slowdowns in the US job market and manufacturing sector haven’t dented optimism about generative artificial intelligence, which has fueled the equities euphoria since the White House tariff shock in April. Describing America as “one big bet on AI,” Financial Times columnist Ruchir Sharma noted last week that 80% of gains in US stocks this year have come from AI companies. As of Friday, the S&P 500 was trading at roughly 9% above its 200-day moving average. That’s what has some commentators fearing a “melt-up,” where equity valuations are bolstered by investor optimism, herd mentality, and/or fear of missing out (FOMO) instead of economic fundamentals.

International Monetary Fund Managing Director Kristalina Georgieva invoked the dot-com bubble in a speech last week, stating that “valuations are heading towards levels we saw during the bullishness about the internet 25 years ago.” She added that global growth would be dragged down “if a sharp correction were to occur.” JPMorgan CEO Jamie Dimon told the BBC he’s “far more worried than others” about such a correction, believing it could materialize in six months to two years. “I would give it a higher probability than I think is probably priced in the market … if the market’s pricing in 10%, I would say it is more like 30%,” he said. Meanwhile, Trump’s threat to revive sky-high tariffs on China on Friday, which he blamed on Beijing expanding export controls on rare earth minerals critical to high-tech manufacturing, highlighted how quickly things can change:

- The S&P 500 closed down 2.7% for the day, the Nasdaq Composite dropped 3.5%, and the Dow Jones fell 1.9%. “We’d become quite accustomed to relatively quiescent markets with an upward bias, so it was quite shocking to see stocks in a quick freefall,” Interactive Brokers chief strategist Steve Sosnick wrote in a note to clients.

- In the spring, Trump imposed escalating tariffs on Chinese goods, peaking at 145%, while Beijing retaliated with a 125% duty on US goods. Battered markets recovered only after the two sides reached a detente, but now the relationship between the world’s two largest economies could be headed for the rocks once more.

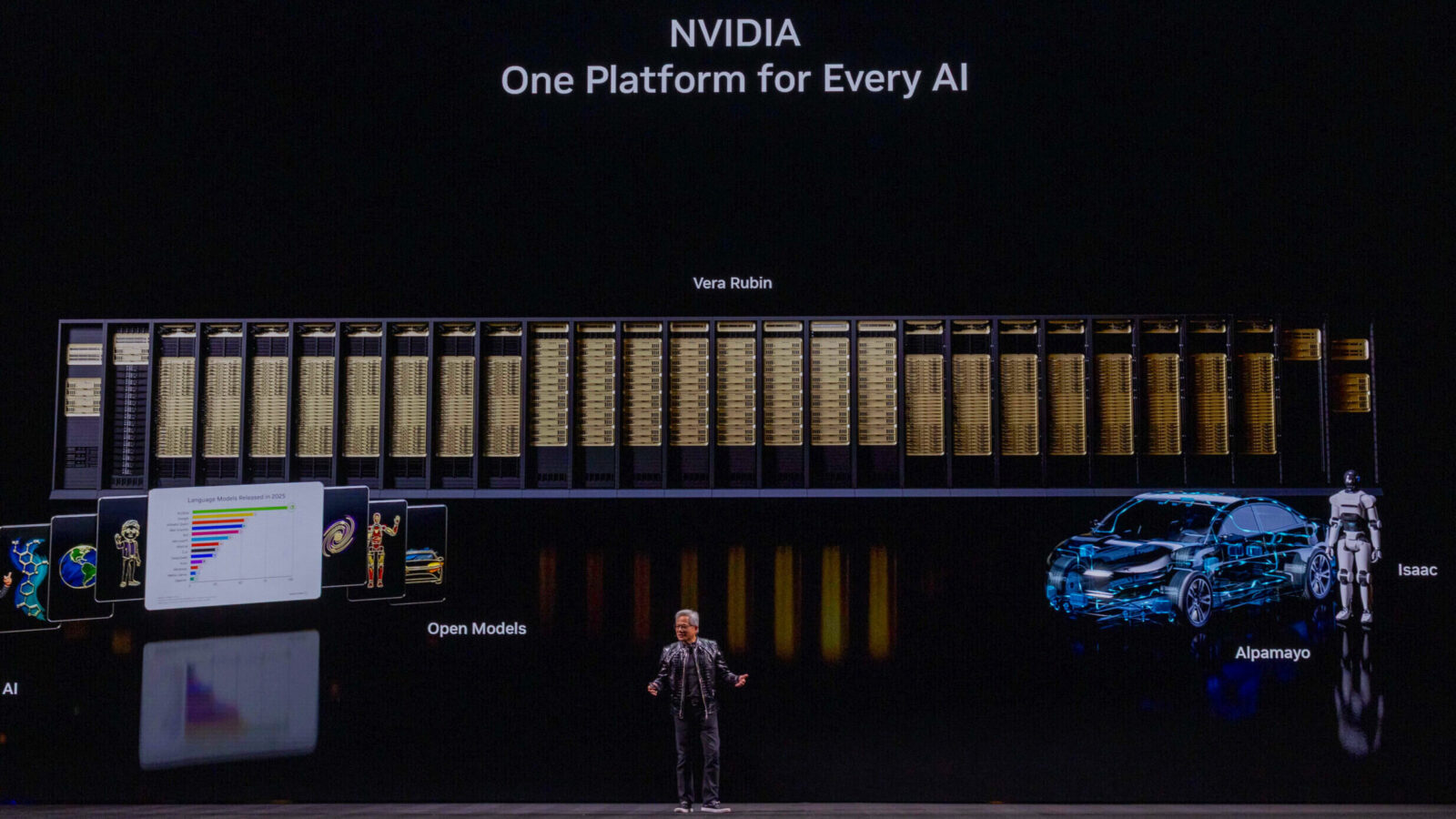

High Growth Stop: Tech stocks, among the most vulnerable to souring US-China trade relations, led Friday’s sell-off. Nvidia fell 4.8%, Meta 3.8%, Amazon 5%, AMD 7.7%, and Tesla 5%.