Can Tesla and Samsung Find Salvation in Each Other?

For Samsung, it’s a chance to finally carve out some foundry industry market share from rival chipmaker TSMC.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Sometimes, mutual dependency is a good thing.

On Monday, Tesla and Samsung announced a $16.5 billion multiyear deal for the latter to provide all-important artificial intelligence chips for the former. For Samsung, it’s a chance to finally carve out some market share from rival chipmaker TSMC. For Tesla, the deal could serve as the backbone for the lofty autonomous vehicle ambitions it has now staked its entire future on.

Play it Again, Samsung

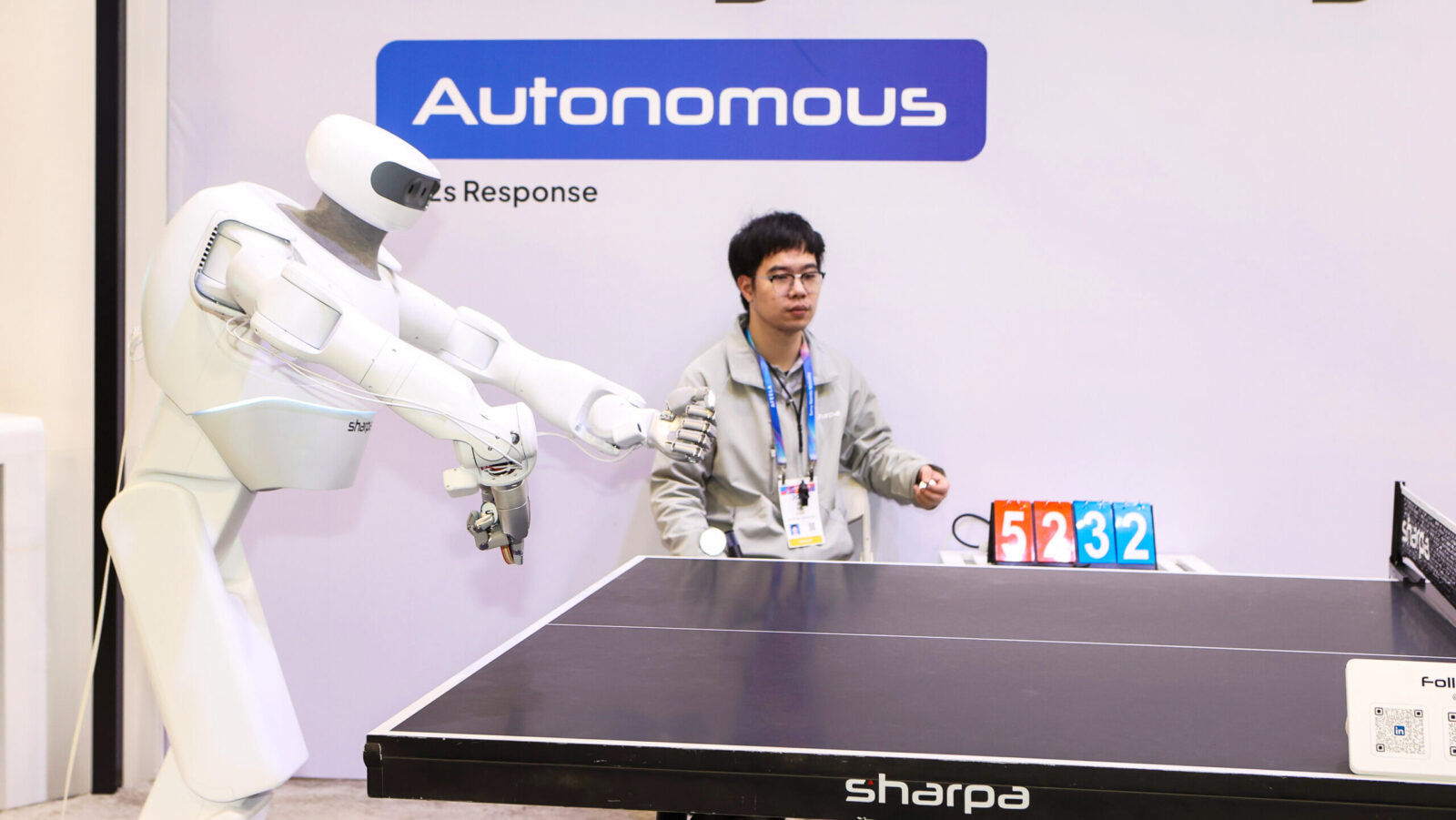

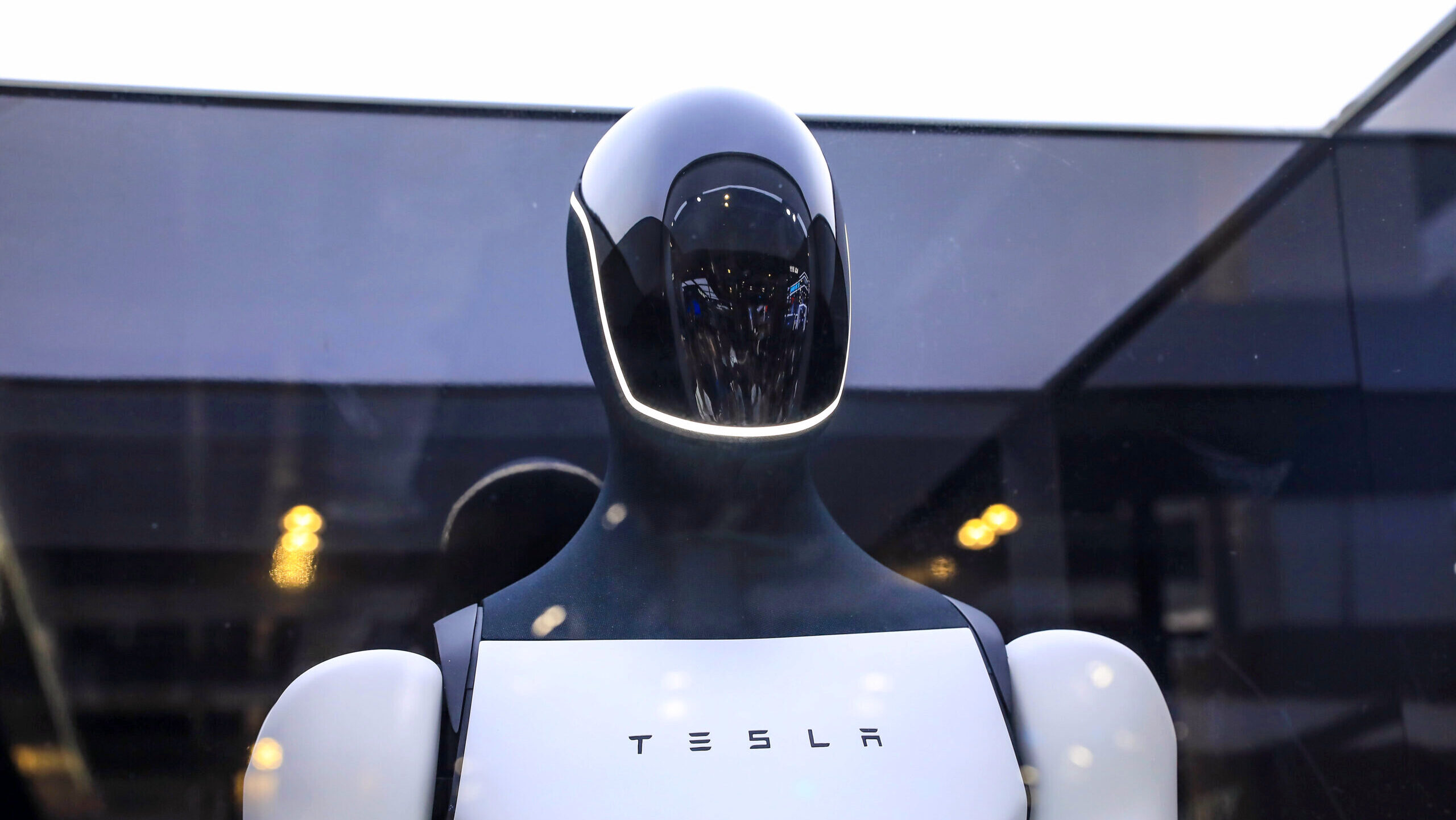

Tesla is in trouble. Its second-quarter earnings report marked something of a disaster, with a 16% plunge in net income and a 12% drop in revenue failing to reverse a narrative that the company is rapidly losing market share both at home and abroad (not to mention rapidly losing lucrative carbon credits, thanks to a new regulatory environment). CEO Elon Musk, rarely one for humility, even copped to the gloomy outlook ahead. “We probably could have a few rough quarters,” Musk said. Still, he continued to sell a vision in which EVs are turning from a company cornerstone into a mere stepping stone to its most valuable form: one in which it becomes one of the world’s foremost purveyors of autonomous vehicles (AVs), as well as humanoid robots.

To achieve that future, Tesla says it needs to develop a next-gen “AI6” all-in-one chip that can power both its AVs and its humanoid robots. Enter Samsung. While Tesla is designing the AI6 chip itself, it’s returning to Samsung as a manufacturer; Samsung previously made Tesla’s AI4 chip, while TSMC has been pumping out the current-gen AI5. Consider it a massive win for Samsung, which may be in even bigger trouble than Tesla:

- In the first quarter of 2025, Samsung’s share of global chip foundry revenue fell to 7.7% from 8.1% in the previous quarter, according to data from research firm Industry Tracker, as seen by The Wall Street Journal. TSMC, meanwhile, saw its leading market share increase to more than 67% in the first quarter.

- The $16.5 billion would be the equivalent of nearly 8% of the company’s total revenue for 2024, though Musk said on social media that figure marked “the bare minimum” and “actual output is likely to be several times higher.” In a release Monday, Samsung said the deal will run through 2033.

Fresh Intel: The partnership marks what could be the second major win for Samsung in as many weeks. Key word: could. That’s because the company would theoretically benefit if fellow foundry also-ran Intel ultimately bows out of the chipmaking industry, a move apparently on the table, according to a Reuters report last week. According to Reuters’ sources, Intel’s continued presence in the space relies on the company securing a major US client. Now, it can scratch Tesla from its list of potential buyers.