ETFs Unfazed by Market Volatility

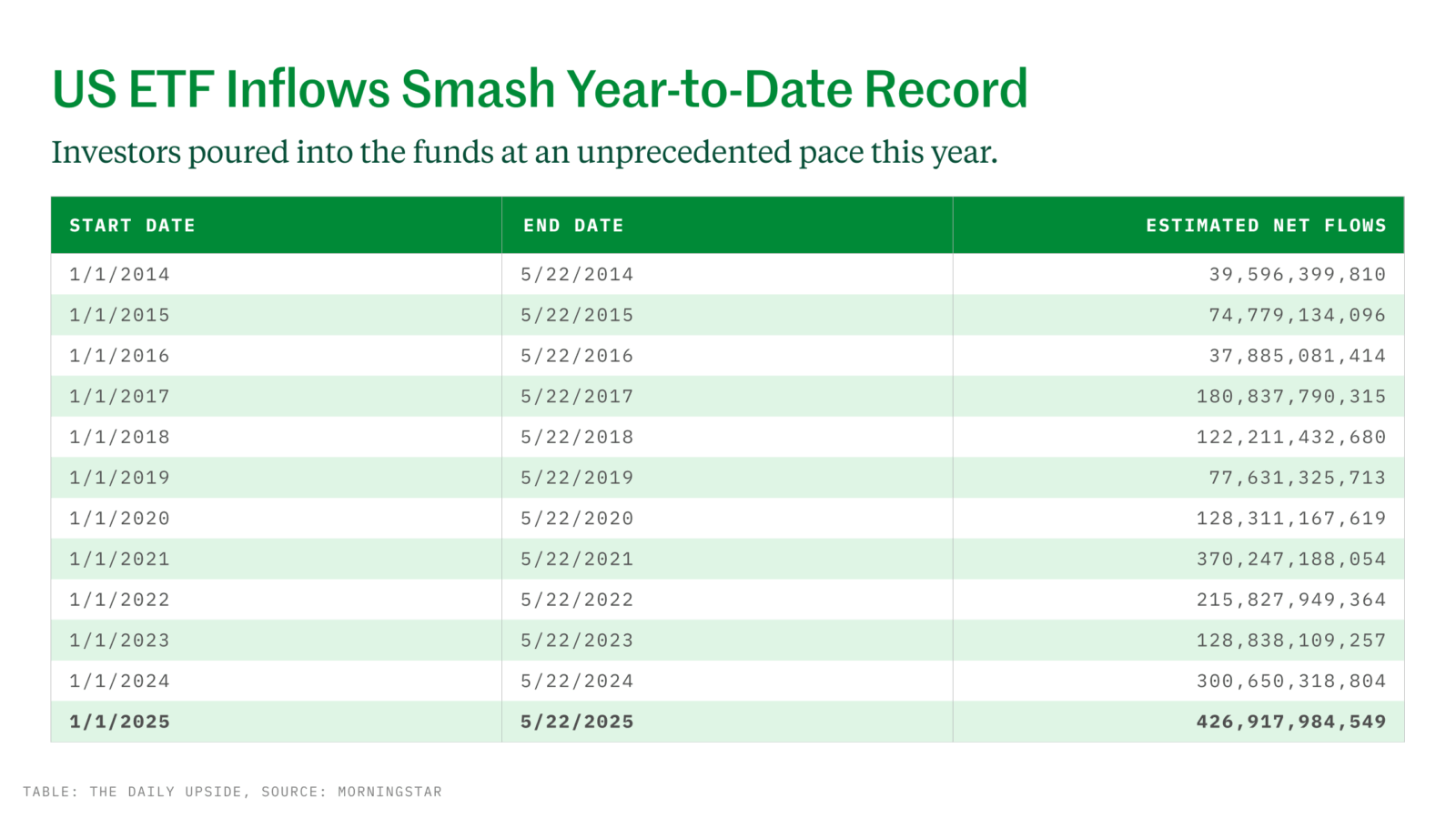

The vehicles have seen $427 billion in inflows, outpacing the roughly $301 billion from last year, per Morningstar.

Sign up for market insights, wealth management practice essentials and industry updates.

Volatility may be the defining word from the first half of 2025, but ETF investors just aren’t flinching.

Despite ongoing economic uncertainty and trade war tensions, ETFs attracted record inflows in the US. So far this year, investors poured $427 billion in new assets into ETFs, far surpassing the $301 billion over the same period last year, according to Morningstar. Much of this has flowed into equity ETFs as investors look to buy the dip, but diversification still remains key for advisors and their clients.

“The appetite for funds has not wavered,” said Bryan Armour, director of ETF & passive strategies research at Morningstar. He said it’s also a good time to increase bond exposure with TIPS ETFs, or consider alternatives like gold funds. “No one knows what’s going to happen next, and there’s a lot that’s up in the air economically right now.”

You Double Dipped!

With markets recovering from earlier losses and the major indexes flat year-to-date, investors have piled into equity ETFs. Stock-based funds in the most popular ETF segments have taken in nearly $200 billion so far in 2025, according to data platform Trackinsight. While passive funds remain dominant in terms of flows and total assets, active ETFs are moving the needle, accounting for nearly 40% of inflows so far this year.

The biggest equity fund winner is the Vanguard S&P 500 ETF (VOO), which has seen roughly $65 billion in inflows so far this year. In February, it overtook State Street’s SPDR S&P 500 ETF Trust (SPY) as the largest fund. “Two years ago, that would’ve been a single-year record,” Armour told Advisor Upside. “Even if we stopped in May, it would be the second-largest year of inflows ever for VOO. That’s nuts.”

In fixed income, investors are playing it safe, favoring ultra-short bonds and T-bill ETFs that offer lower credit and interest rate risk amid ongoing market choppiness, Armour said.

Risky Bet? The previous high for ETF inflows by this point in the year was in 2021, at just over $370 billion — followed by a downturn in 2022. Could history repeat? Armour said ETF inflows alone don’t pose a systemic risk. “With the amount of money in bonds, stocks, mutual funds, hedge funds, and private equity, ETF inflows aren’t going to tip the scales to the point where assets are overpriced,” he told Advisor Upside.