Intel Looks at AI Tuning to Bolster Software Offerings

Intel is far behind in the AI race. Taking on chip giant Nvidia would require Intel to build a development ecosystem at a better price.

Sign up to uncover the latest in emerging technology.

Intel wants to give your AI models a tuneup.

The company filed a patent for a system for “accelerated tuning of hyperparameters of a model” using a machine learning based tuning service. Basically, Intel’s filing pitches a service to speed up the testing and optimization of AI.

To put it simply, Intel’s patent allows developers to test out different optimization strategies for a machine learning model’s “hyperparameters,” or the configurations that control how well an AI can make predictions, without having to readjust the entire model.

When this service first receives a work request to tune up an AI model, Intel’s system breaks it up into a “full tuning task” and a “partial tuning task.” While the full tuning task is underway, the partial tuning task is completed and can be used as a proxy for it, providing a reliable estimation of how the full task will operate once it’s finished. In other words, it allows you to try before you buy.

If the tuneup doesn’t meet a certain “performance threshold,” the system may make changes, such as resetting or blocking certain tuning parameters. This can speed up and save computational resources on AI fine-tuning because you don’t have to run a full tuning operation over again until you get the most optimal outcome.

The company noted that models are often implemented with “default hyperparameters” that aren’t tailored to specific tasks, but adjusting these parameters is a labor-intensive and resource-intensive task, “making it difficult to efficiently and effectively enable optimizations and subsequent improvements of the machine learning models.”

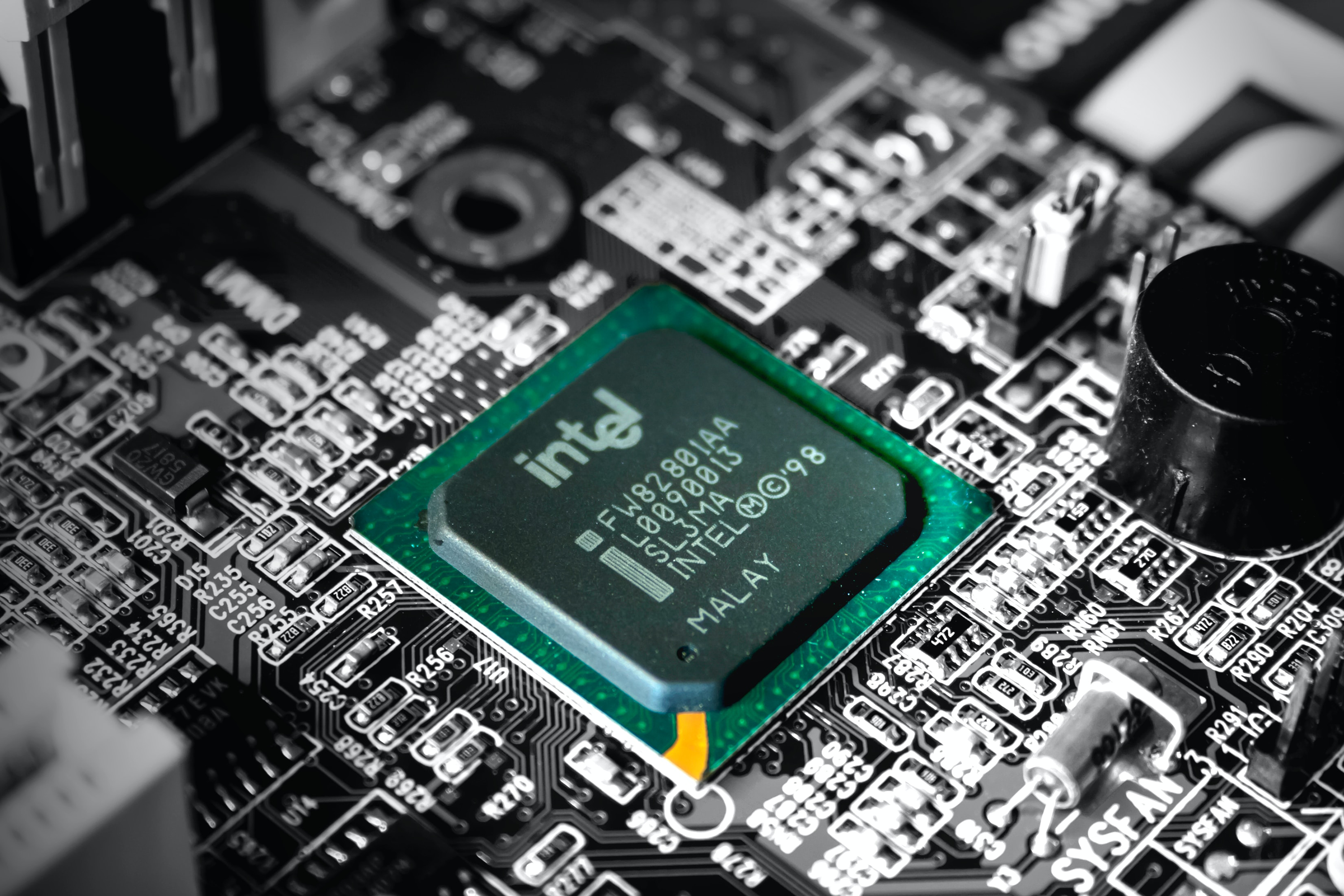

It’s no secret that Intel is lagging behind in the AI market. Chips are currently the biggest offering it’s putting forward, but its market share is dwarfed by that of Nvidia’s stranglehold, said Romeo Alvarez, director and research analyst at William O’Neil. If the company wants to catch up, Intel has no choice then to strengthen its software offerings, he said.

“It’s not going to be enough to have a competing hardware to be able to dethrone the king,” he said.

What attracted developers to Nvidia in the first place wasn’t just its chips, Alvarez said, but the fact that it offers an entire ecosystem. Nvidia’s CUDA AI development kit is not only easy for developers to use, but is “sticky” Alvarez said, as the company makes it easier for developers that start there to stay there. Taking on Nvidia would require Intel to build a similar ecosystem, giving developers everything they need in one place.

However, with the power that Nvidia has comes the ability to abuse it. With the dominance it has in the industry, if it were to raise its pricing, “companies wouldn’t have a choice but to pay up.”

Just building a competing ecosystem won’t initially draw customers away from Nvidia, said Alvarez. But if other options are available, developers might start to turn to them, even if it’s “not as advanced or easy to use, but could be good enough for them,” said Alvarez.