Sign up to uncover the latest in emerging technology.

Why PayPal’s all in on data while Visa and Apple are all over fintech.

Happy Thursday and welcome to Patent Drop!

Today’s edition of Patent Drop is brought to you by Caliber. With tax season rapidly approaching, opportunity zones can offer a way to defer hard-earned capital gains to allow investors to tap into tax-deferred compounding. Download Caliber’s no-cost guide to learn more.

This morning, we’ll be diving into the Big Tech’s fintech ambitions: PayPal wants its hands on all your data, Apple wants to cheer on your financial wellness and Visa wants to go cardless. Let’s get to it.

#1. PayPal’s big box of data

PayPal wants to get to know you… or at least get to know your data better.

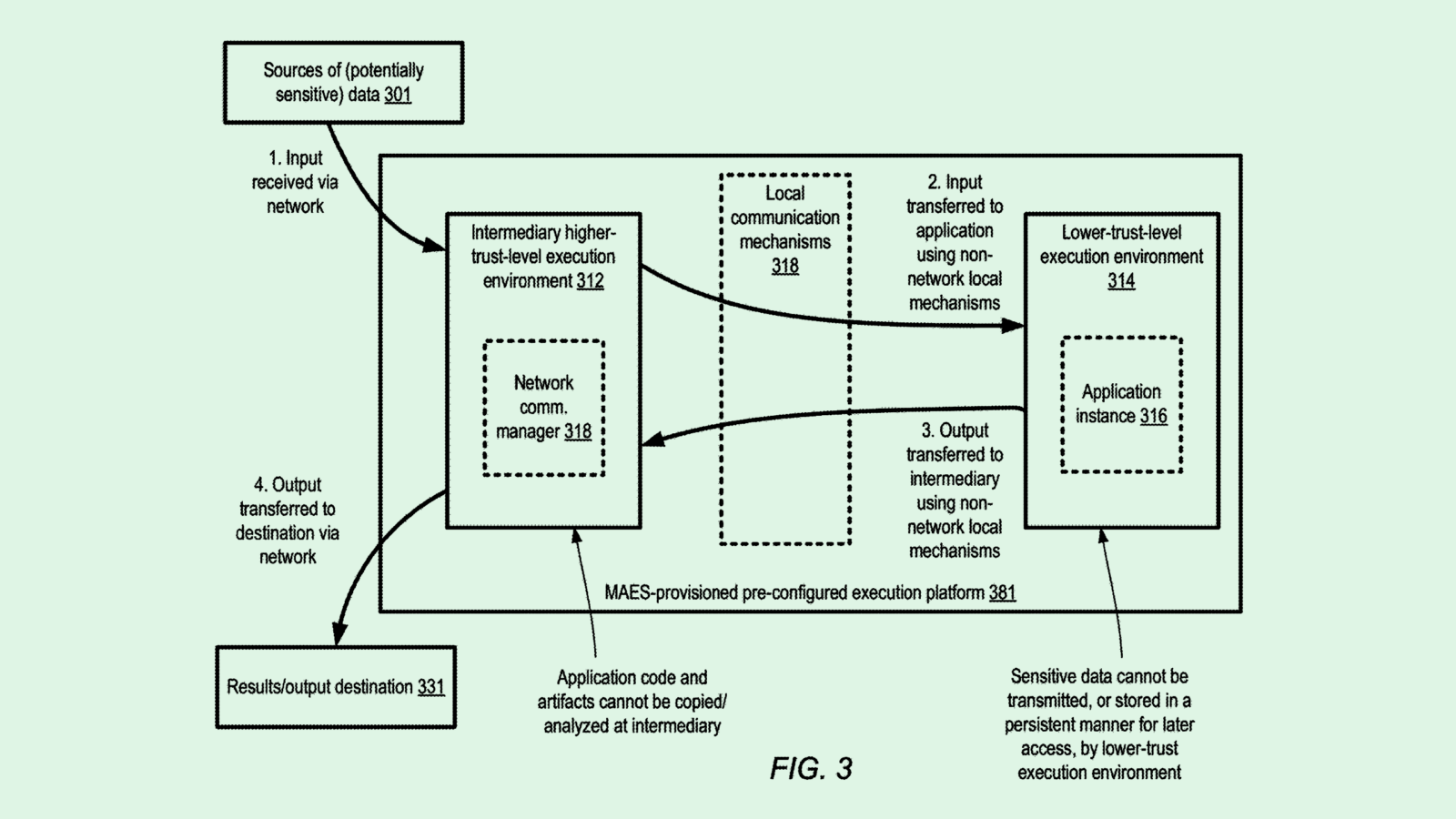

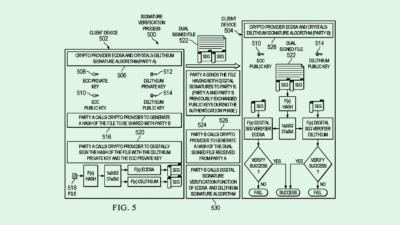

The company is seeking to patent what it calls a “personal data wallet” to make transactions easier for e-commerce merchants and to help users “retain control over their user data.”

Think of this as a blend between a digital wallet and a password manager. Rather than every e-commerce merchant you shop at holding onto your payment information, PayPal would have it stored in one place and only accessed on an as-need basis without the use of a digital wallet like Apple Pay or Google Pay. Essentially, this acts as a multi-purpose autofill tool: While you seemingly can’t make payments through it the way you could with a digital wallet, you can access your payment information for any site, whenever you need it.

Notably, the application said this wallet might also be able to store a wealth of other personal data, like your gender, birthday, age, driver’s license number, social security number, demographic information and health information like blood type and pre-existing conditions. This possibility makes PayPal’s concept less like a data wallet and more like a data suitcase.

While it’s unclear how PayPal would make money from this service, Apple Pay rakes in cash through interchange fees and password managers like LastPass make their revenue from subscriptions, so it’s possible that PayPal could take on one of those models, or both.

PayPal’s concept has both the convenience factor and security comfort for customers who might otherwise leave their personal information scattered across dozens of e-commerce sites. That said, PayPal itself is no stranger to security breaches, from flaws to security workarounds to phishing attacks. Just last week, news broke that roughly 35,000 accounts were breached, leaving personal data like addresses, social security numbers, tax IDs and birth dates exposed. PayPal told users that while the information was vulnerable, it had“ no information” suggesting that it was misused by a third party.

“Upon learning about this unauthorized activity, we promptly began an investigation and took action to address this incident, including by taking steps to prevent unauthorized actors from obtaining further personal information,” PayPal said in a memo to users.

If PayPal plans to collect a mountain of personal data from thousands of customers, shoring up its cybersecurity measures might be necessary to actually get people to agree to hand their information over. While a leaked password or username can generally be fixed, large-scale leaks of addresses or health records is a personal data nightmare.

#2. Apple, the … financial planner?

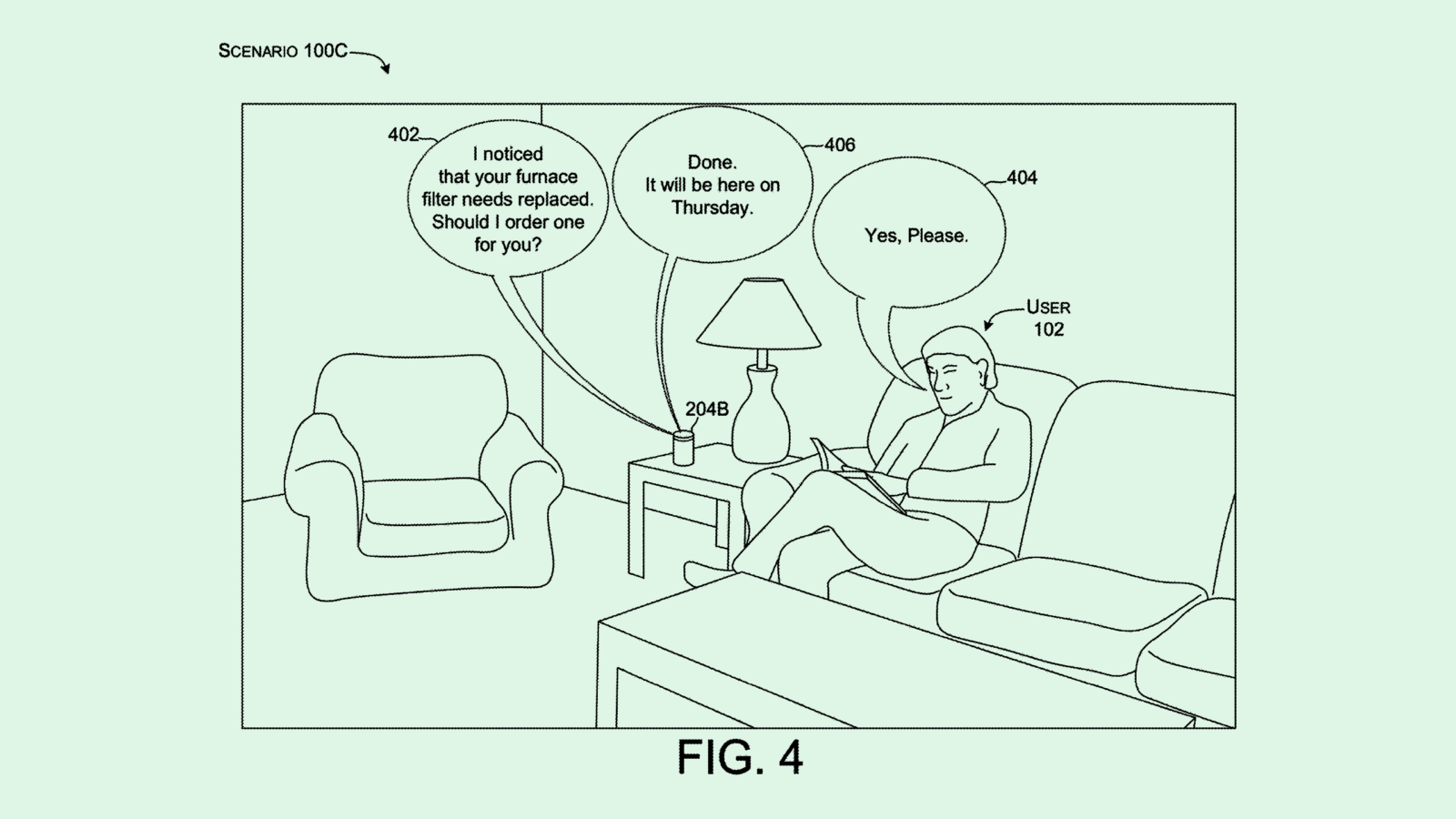

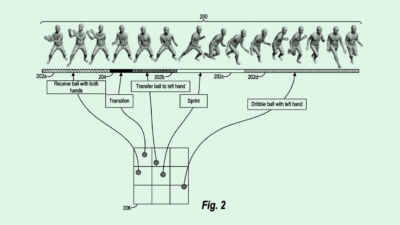

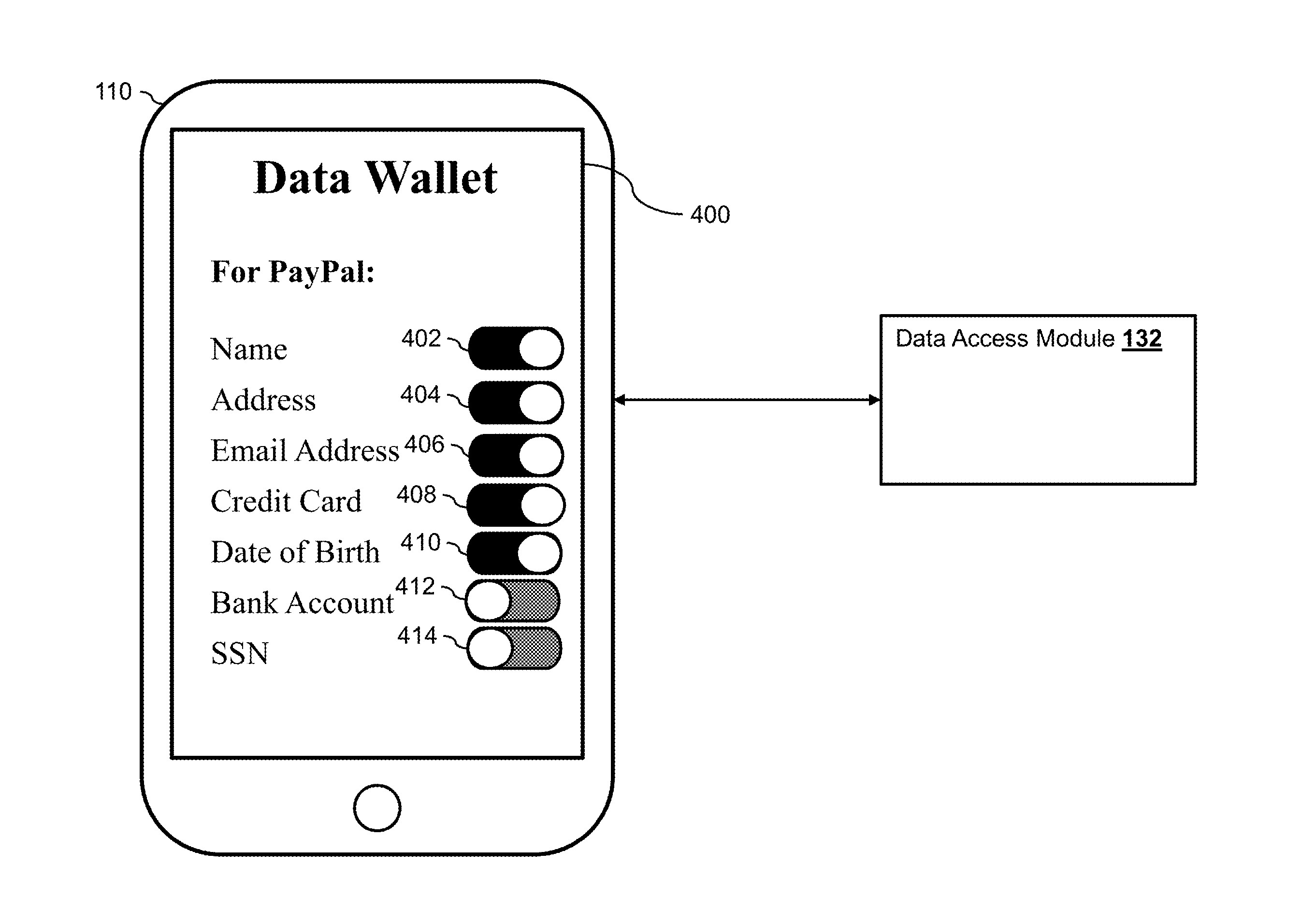

Apple wants to push you to pay down your debt, like on the iPhone, MacBook, Apple Watch and iPad you picked up over the holidays. The company is seeking to patent a “payment milestones” system to encourage users to improve their financial health.

Essentially, this tech will look at a customer’s current financial statements, balances and past payment history to create a number of customized payment plans to help them pay down credit card debt by breaking up payments into several parts (with interest, of course).

“Typical financial statements are not designed with the best interests of a customer in mind,” Apple said in the application.

This system, which would likely pair with the company’s ever-growing Apple Card, determines how many payment options to give a user based on their current financial health, categorizing them as financially healthy or unhealthy based on statement history and chosen payment options in the past. For example, if you have a history of only paying the bare minimum, this system would deem you less financially healthy and give less payment options, aiming to nudge the customer to “pay a little more than they are accustomed, and the payment options can slowly increase each month.”

This product could add yet another tool in Apple’s growing fintech arsenal. Plus, the fact that it seems similar to the wildly-popular buy now, pay later model might also prove to be a boon for the company.

Prodding customers to make bigger payments might also give the Apple Card a needed boost. Its credit card, which is run through Goldman Sachs, reportedly lost the bank $1.2 billion in nine months last year, and is now being investigated by the Federal Reserve for its consumer protection practices.

Apple also stands to benefit from the sheer amount of data that it can collect on its customers, said Sandy Fliderman, CTO at financial services firm Industry FinTech. Though it’s unclear from the filing whether or not Apple’s milestone system will use AI, Fliderman told me the more data that Apple collects, the better it can train AI to improve things like fraud protections, risk assessments and helping onboard new customers – and the stronger its fintech arm can get. (Though it does, however, add to Apple’s ever-growing pile of consumer data.)

Plus, the more customers that Apple can attract to its digital wallet or its Apple Card, Fliderman said, the more it can compete with its biggest competitors: Samsung Pay and Google Pay.

“Apple Pay is huge,” said Fliderman. “I have a wallet with credit cards, but I really don’t have to pull it out. I’m using my digital wallet. Little by little, year after year, credit cards are just going to go away.”

SPONSORED BY CALIBER

Sitting on Capital Gains of $100K or More?

First, give yourself a pat on the back, that’s no small chunk of change. Second, take a deep breath and get ready for the most important part: keeping what you’ve earned.

Pro Tip: There are now extremely attractive ways of reinvesting your capital gains and putting them to work. It’s an incredibly rare instance where IRS regulations were actually built to save you money.

So, how familiar are you with Qualified Opportunity Zones? If your answer is “very,” then you know just how powerful they can be when it comes to after-tax returns. If not, well, you’re in luck — because the experts at Caliber, The Wealth Development Company, can help.

This no-cost investor guide will show you how to cash in on substantial perks, namely: tax deferral until 2027 on certain capital gains, and avoiding taxation completely on growth above your original investment. Also known as a “home run” in common vernacular.

Grab the investor guide today at no cost and capitalize before key deadlines expire.

#3. Visa’s card-free future

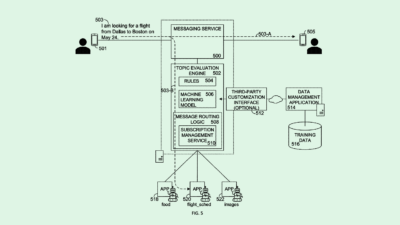

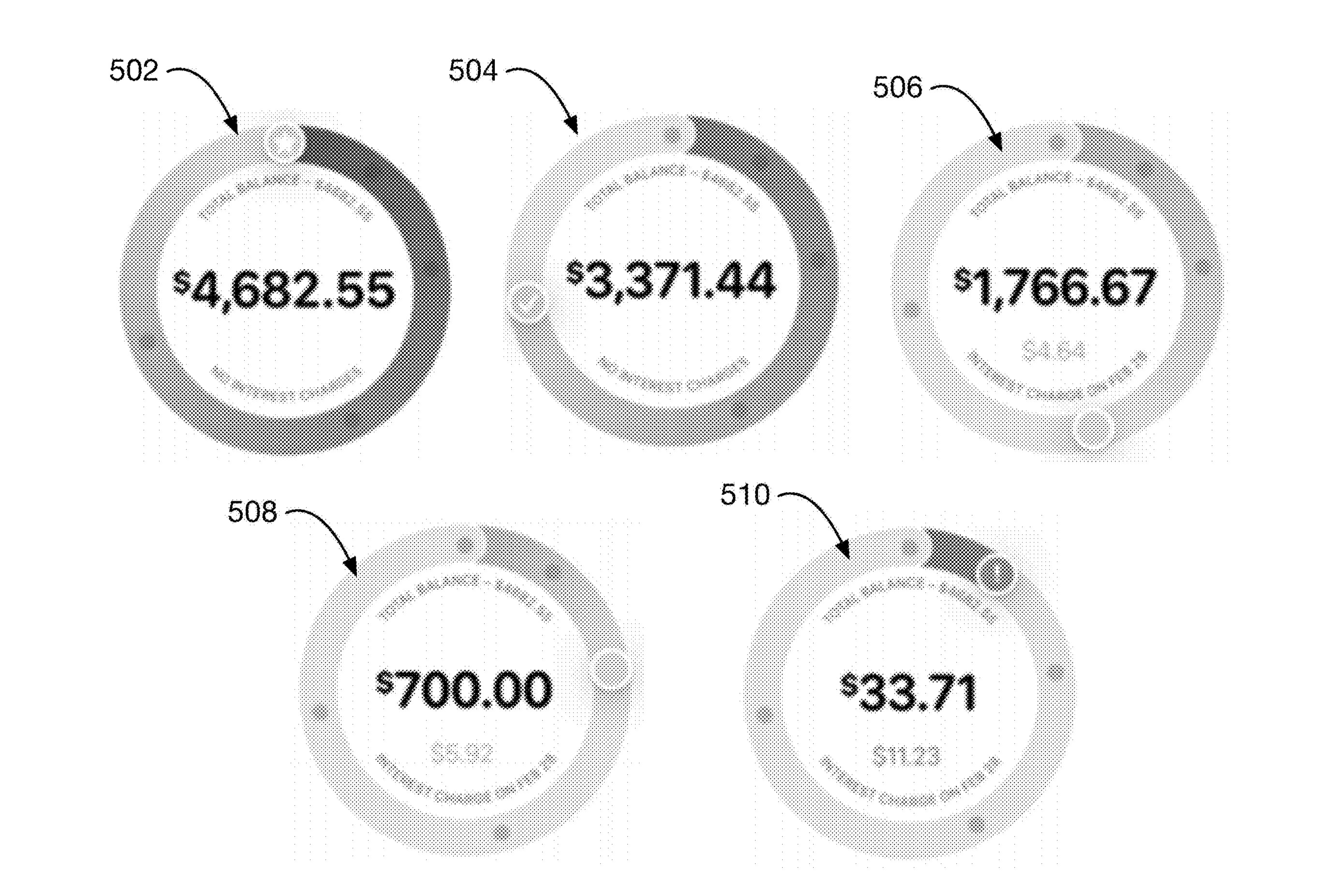

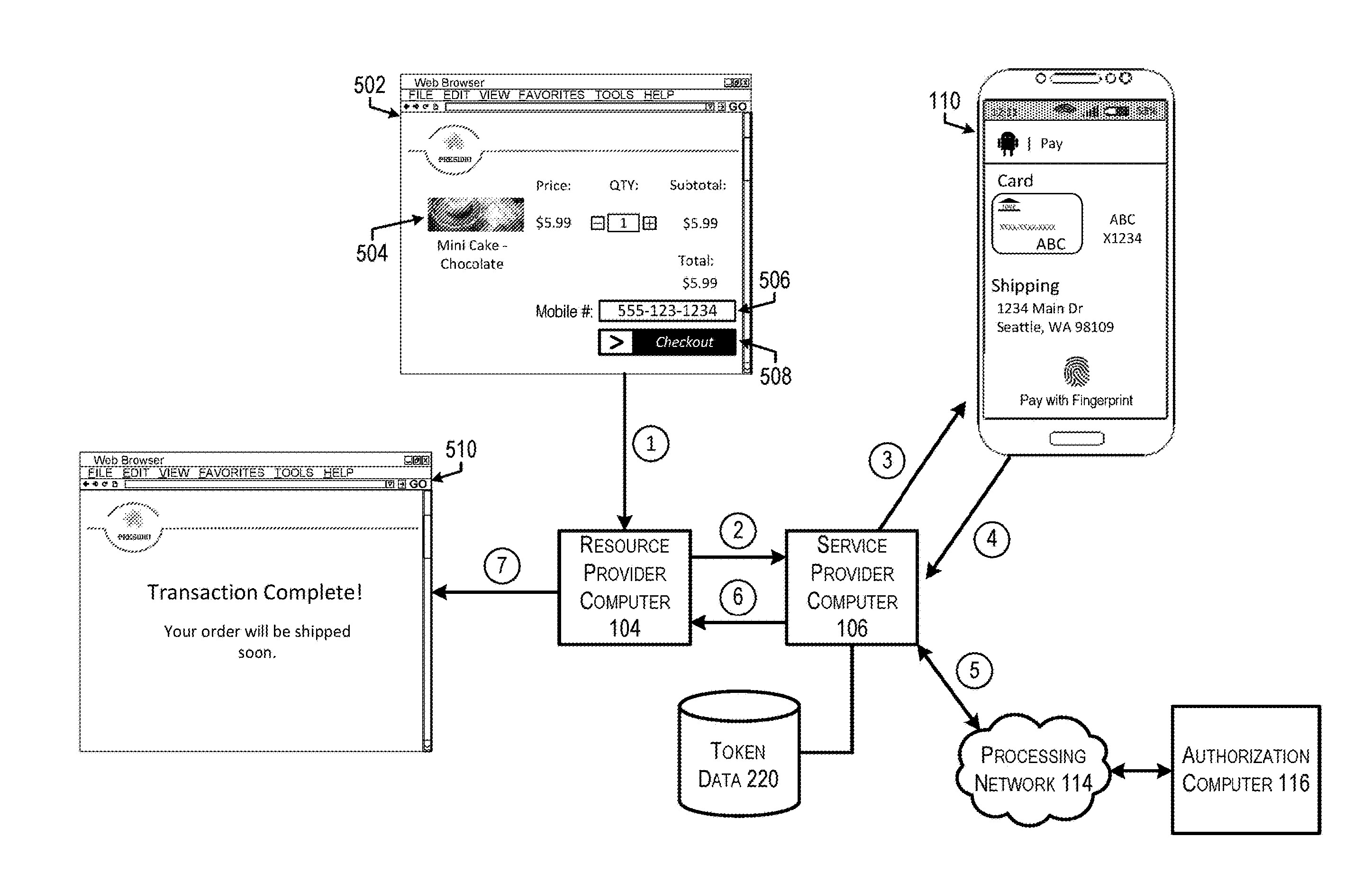

Visa is also hopping on the cardless bandwagon. The company filed a patent application for a secure remote transaction system which works with digital wallets on mobile devices.

Here’s how it works: A user gives a merchant their phone number, then gets a text asking them to complete the transaction through any digital wallet application of their choice. This way, even if the merchant doesn’t accept those digital wallets, the user can still finish the transaction with those payment options. For example, if a seller doesn’t have a tap-to-pay option for in-person sales, Visa’s system would allow a customer to pay with Apple Pay anyways.

“This allows for significantly more flexibility on the part of the user than conventional systems,” Visa said in its application.

This concept could spell some trouble for digital wallets like Apple Pay and Google Pay: While this system works with digital wallets, it also has the potential to replace a merchant’s need to offer payment through said digital wallets.

Visa isn’t new to the fintech space. The company has plenty of partnerships with fintech startups and digital banks, and currently offers its own digital wallets for merchants and businesses. Visa also agreed to jump onboard a digital wallet offering backed by Wells Fargo, Bank of America, JPMorgan Chase and other major banks that will debut at the end of the year (Check out The Daily Upside’s Tuesday edition for more on that).

Visa might be ahead of the game in terms of fintech adoption among its traditional credit card company peers, but it’s right where it needs to be amid the digital payments boom, Fliderman said.

“Lots of credit card providers are just staying the same course,” Fliderman told me. “But the guys that are really pushing forward with new technology, I believe they’re going to be way ahead. But it’s going to move really fast.”

To keep up with a financial system quickly going cashless and cardless, Visa needs to keep riding the fintech wave and others need to get on board – or eventually sink.

Extra Drops

Here are some other fun patents we wanted to share.

Sony wants to keep an eye out for you. The company filed a patent for an alert system for VR headsets which monitor the voices it picks up near you to keep you aware of your surroundings while you’re playing a video game or exploring the metaverse.

EBay is going into fashion…but make it tech. The e-commerce platform filed a patent for a body measurement garment to help buyers get well-fitting clothes. Basically, the company would send buyers a shirt with sensors in it to get your size right down to the millimeter.

Adobe wants to get things straight. The software firm filed a patent for adaptable drawing guides by confining users’ strokes to “input paths.” This way, a user can create clean lines without being stuck to tracing a template.

What else is new?

Elon Musk is considering raising $3 billion in a share sale to pay down Twitter’s $13 billion in debt.

SAP is cutting 3,000 jobs, or 2.5% of its workforce, after profit growth slowed in 2022. The company is also considering selling its stake in German software company Qualtrics.

Global smartphone shipments plummeted more than 18% in the holiday quarter to roughly 300 million units sold amid falling consumer demand.

The IRS has a gift for you. Sounds impossible, we know. But thanks to Caliber, investors are making good on capital gains in 2022, and taking advantage of tax-deferral opportunities until 2027. If you want to follow their lead, check out Caliber’s investor guide to see how you could benefit. *

*Partner.

Have any comments, tips or suggestions? Drop us a line! Email at nat@thedailyupside.com or shoot us a DM on Twitter @patentdrop.