Tech Firms Inch Closer to Users with AI Wearables

Your data may be more valuable than the money made from selling devices themselves, experts told Patent Drop.

Sign up to uncover the latest in emerging technology.

Tech firms want to get to know you really, really well.

From watches to rings to pins, tech firms continue coming up with new and inventive ways to track users, reeling them in with promises of a better understanding of their health, habits, and selves. The growing popularity of AI stands to empower these devices even more, allowing for real-time, in-depth personalization.

Though Apple leads the market with its ubiquitous smartwatch and headphones, fellow Big Tech companies like Google, Samsung, Meta, Microsoft, and more — as well as a slew of ambitious startups — have sought to stake their claim in the market.

However, tech firms may see greater value in this market than just device sales, experts told Patent Drop.

“It’s all about: How can we take some of the everyday items that we’re all already wearing, and get data from them?” said Thomas Randall, advisory director at Info-Tech Research Group. “It’s a great way to understand how humans behave and what we respond to. If you’ve got that information, that is a gold mine for a whole range of other use cases.”

Up Close and Personal

Wearable technology is an expansive category. It could include fitness-tracking watches, rings, headsets, or pins, as well as headphones. According to research firm IDC, Apple has a stronghold on the market: It represented 18.2% of the market share in the first quarter, followed by Xiaomi, Huawei, and Samsung.

But patent activity signals that other tech giants may be seeking to gain dominion over their own unique kinds of wearables:

- Snap has sought to patent “AR/VR enabled” contact lenses, which can switch between displaying content and an unobstructed view depending on environmental factors and is charged via “electromagnetic energy” within the case;

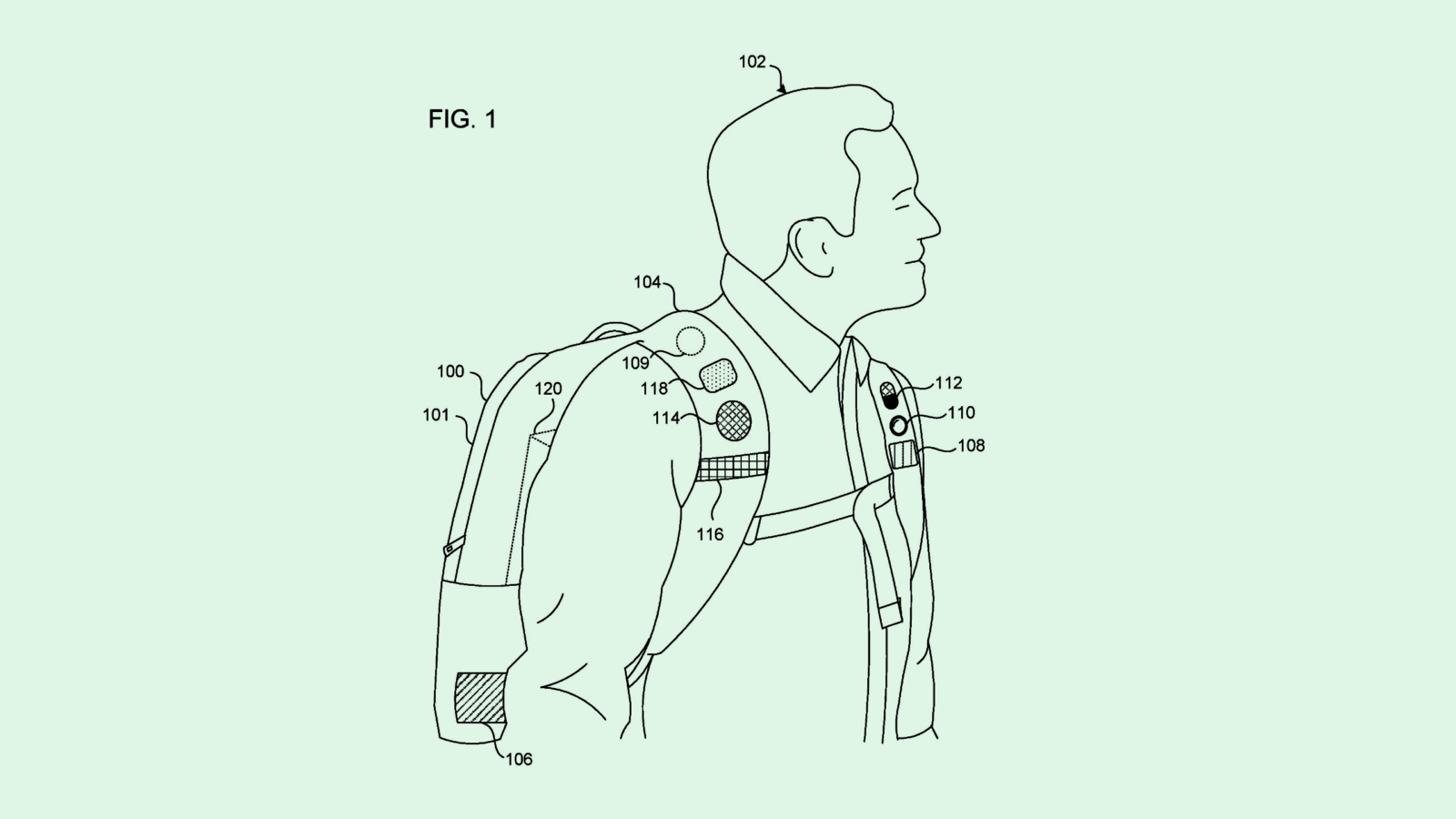

- Microsoft filed a patent application for a “context-aware” backpack, equipped with sensors and a microphone, which can tell you things about your surroundings;

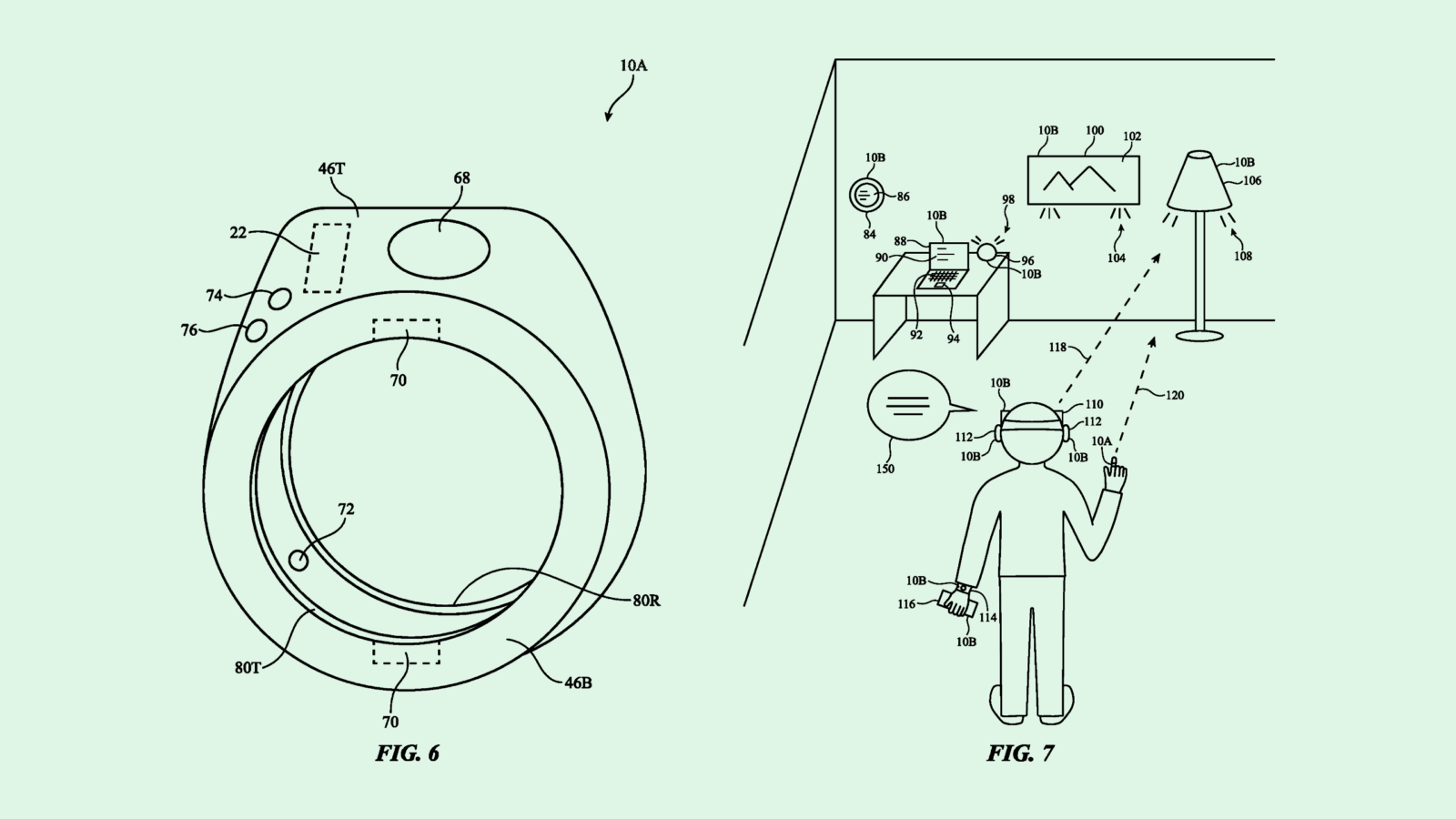

- Meta, whose Reality Labs has long been plugging away (and losing money) at mixed reality wearables, has filed patents to read users’ brain signals and estimate cognitive load using headsets and wrist-worn devices. The company’s patent filings have also detailed lighter, longer-lasting smart glasses with battery spans of eight to 12 hours.

And tech giants aren’t the only ones going after ambitious and outlandish wearables. Humane spent years developing its chestworn AI Pin, promising to upend the smartphone industry entirely (though since its launch late last year, returns of the device have started outpacing sales, per The Verge). Another startup is working on a device simply called Friend, a pendant that listens to your surroundings and texts you about them.

So what makes a consumer want a wearable? A big draw is a better understanding of yourself and your health in a simplified way, said Tim Rosa, CEO of sleep wearable company Somnee, and former CMO of Google-owned Fitbit.

“Everybody is different, every health condition, it all depends on the individual,” said Rosa. “But at a macro level, it offers a basic understanding of what’s happening with their general health and their fitness.”

Lots of startups have sought to go after that niche, and many have found success. Whoop, a fitness technology company founded in 2012, reached a valuation of $3.6 billion after a $200 million funding round in 2021, and has since expanded its flagship health tracker to 56 markets. Oura has skyrocketed in popularity with its health-tracking rings, garnering a valuation of $2.5 billion.

Though wearable tech has been around for more than a decade, the devices really began to take off during the early days of the COVID-19 pandemic as many looked to take control of their health, said Ido Caspi, research analyst at Global X ETFs. “The pandemic is really what kind of helped this trend hit its stride,” he said. “People are increasingly paying attention to their sleep, their step counts, their workouts, and so on and so forth.”

But health metrics aren’t the only thing that’ll draw someone to a piece of high-tech bling. These devices also need to be highly convenient, said Randall. That means good form factor, long-lasting battery life, and seamless integration. Though a lot of the market is still largely “immature,” he said, “if it’s not convenient to wear, to look after, if it gets in the way of your day-to-day processes, I think that’s one of the blockers of more people getting into wearables.”

The Apple Advantage

The draw of seamless integration is what gives Apple’s products in particular a leg up, said Romeo Alvarez, director and research analyst at William O’Neil. The company already maintains market dominance in the smartwatch sector.

“Apple already has over 2.2 billion devices that are active,” said Alvarez. “People are familiar with how Apple products work, how simple they are, and how they link with each other.”

Though the company sits behind Samsung in the global smartphone market, according to IDC, its product ecosystem is particularly “sticky,” said Randall. Anything it adds, whether it be a user-tracking ring, health-monitoring AirPods, or a tabletop robotic iPad, is going to fit neatly into that puzzle.

This factor, plus the sheer saturation of the market, makes it difficult for smaller wearables startups to break through and upend larger companies, said Alvarez. Even if their product is new and innovative, he said, it generally has to easily integrate into an ecosystem to find success. “It would be very hard for a startup to be able to have a competing product,” he said. “Apple is never first, but in the end it always wins.”

Another point in Apple’s favor is trust, said Randall. The company has made privacy and security one of the main selling points of its entire device ecosystem. And when these devices are capable of collecting a large amount of incredibly personal data, consumers are likely to err on the side of caution.

“A lot of it is, how comfortable are people with the biometric data being shared? Do you trust where that data is being collected and being stored and protected?” said Randall.

Data Dilemma

The data collected by these devices may be the reason that Big Tech firms are interested in these devices in the first place, said Caspi. Though Apple’s bread and butter is consumer tech, it’s far from the primary revenue source for companies like Microsoft, Meta, and Snap. “Data is the big picture here,” said Caspi.

“These companies thrive off data,” said Caspi. “The more data they have on their users, the more they can advertise towards them, the more they can cater towards them. And there’s no better way to pick up user data than a device that they’re wearing on their wrist or on their finger.”

That data is also incredibly valuable to the tech industry’s current It Girl: AI. Building AI models comes at the cost of a lot of high-quality and in-depth data, said Caspi. Plus, while this data can help build stronger AI, it can also make these devices better at their jobs, said Rosa, taking real-time personalization and monitoring to new heights.

“It becomes fully integrated into your life and your lifestyle, and it’s plugged into your root level datasets,” said Rosa. “To me, that is powerful, and that’s where the magic is going to happen. We’re not there yet, but we’re almost there. That’s the future.”