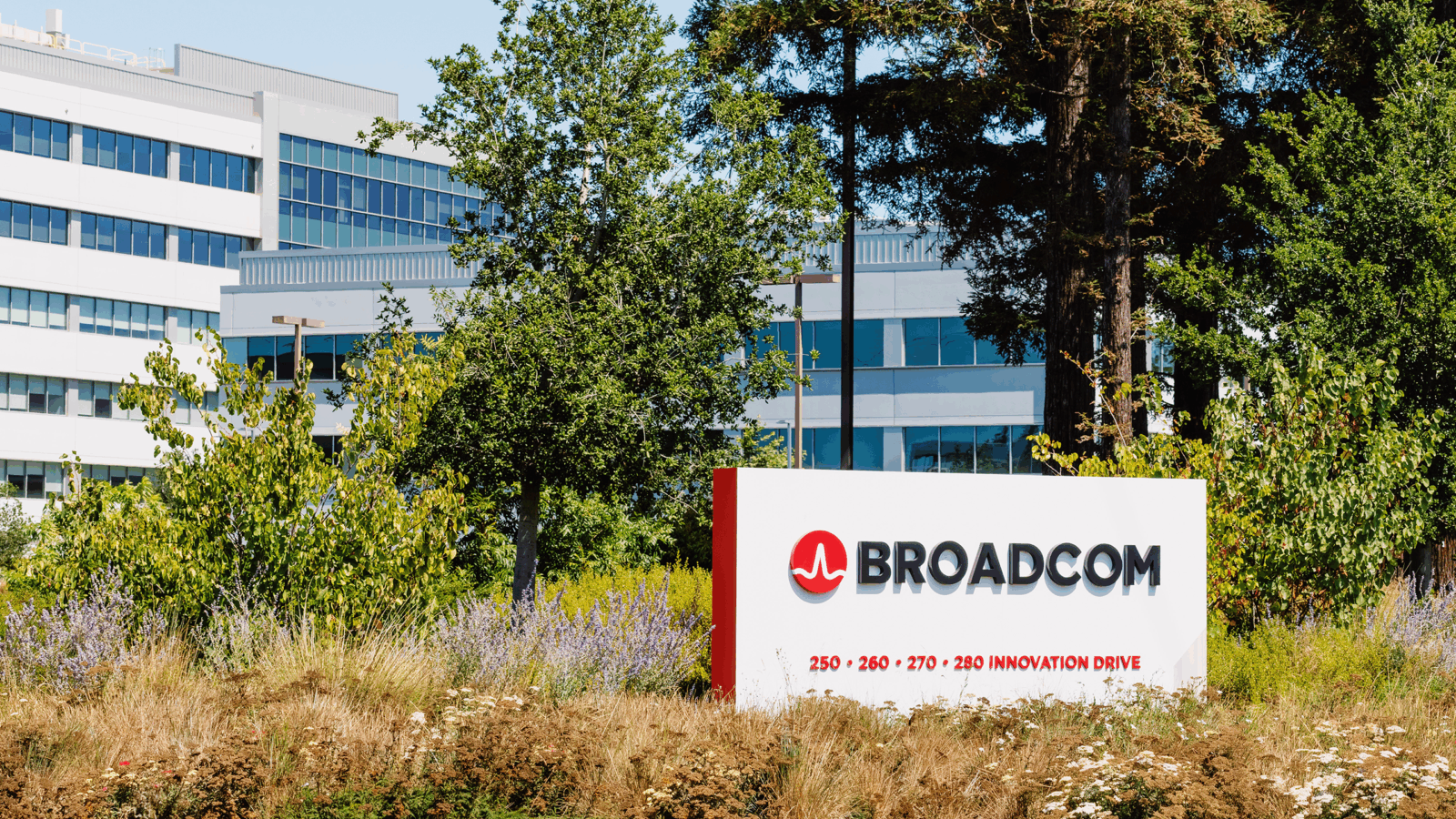

AI Sparked a Chip Rally, But Only For a Select Few

Not every company that produces chips for cars, medical equipment, or smartphones is taking part in the semiconductor boom.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

Artificial intelligence systems may not need humans one day, but they’ll always need semiconductors. So you’d think the enormous success achieved by chipmakers Nvidia and Advanced Micro Devices amid an AI boom would extend to the companies that produce chips for cars, medical equipment, or smartphones.

That’s not happening, according to the Financial Times.

The Chips are Down

By May 2023, Nvidia hit $1 trillion in market cap, and in this early year alone, its stock has already jumped about 23%. Shares of AMD have had a similar trajectory to Nvidia’s, while chip suppliers like Taiwan Semiconductor Manufacturing Co and Supermicro also benefited from the AI-driven chip rally late last year.

But they’re the exception to the rule, with the broader Philadelphia Semiconductor Index up only about 7% this year:

- Texas Instruments delivered a troublesome forecast, citing slumping demand for industrial and automotive electronic components. Analysts at market researcher Simply Wall St estimated TI’s 2024 revenue will be $16 billion, an 11% decline in its sales over the past 12 months.

- Because of uncertain demand for its chips in traditional servers and personal computers as well as plenty of canceled orders over the past few quarters, Intel forecasted revenue for the first quarter could miss Wall Street’s estimates by more than $2 billion. The bad news caused selloffs across the chip market last week, with even Nvidia’s stock dropping slightly.

A Slight Setback: During its quarterly conference call, Intel CEO Pat Gelsinger said he expects challenges in the current quarter to be an anomaly and that business momentum “will grow stronger as the year progresses.” Earnings reports this week from Qualcomm and AMD are expected to give a better look at the state of the industry, so we’ll see where the chips are falling.