Saudi Arabia Now Top Among Sovereign Wealth Fund Spenders

A report released Monday by data platform Global SWF showed sovereign wealth spending in 2023 dropped 20% from the previous year.

Sign up for smart news, insights, and analysis on the biggest financial stories of the day.

The minute you walked in the joint…

A report released Monday by data platform Global SWF showed sovereign wealth investment outlays in 2023 dropped 20% from the previous year. It also revealed there’s a $31.6 billion gorilla in the room: Saudi Arabia’s Public Investment Fund (PIF) represented a roughly 25% chunk of all sovereign wealth spending last year.

All in the Game

Saudi Arabia snatched the top spot from Singapore, which was previously the biggest spender among sovereign wealth funds for the last six years. But while Singapore spent almost 50% less than in 2022, Saudi Arabia’s investment for 2023 ticked up 33%.

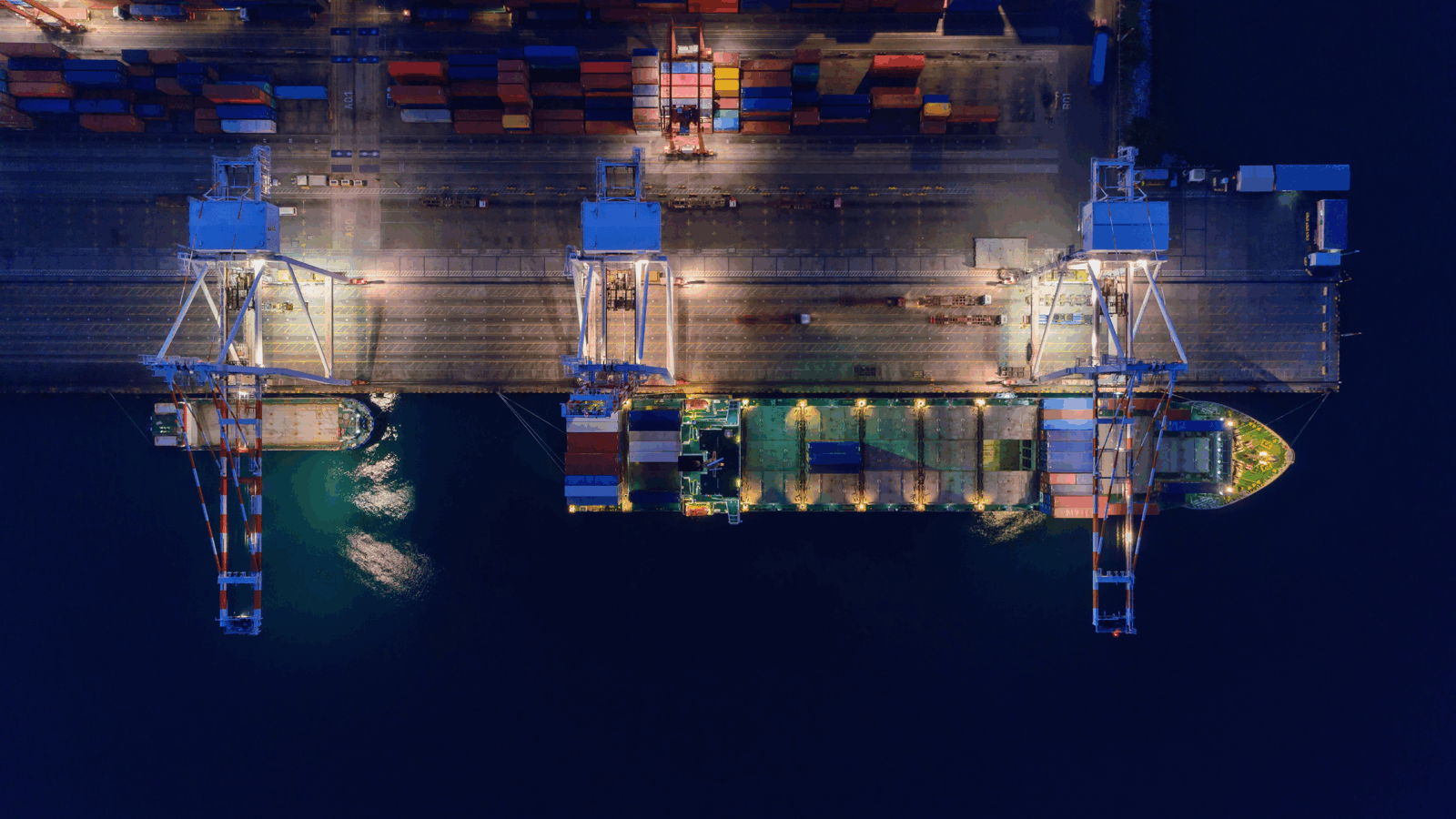

According to Global SWF’s report, sovereign wealth funds overall invested the most in real estate, and the year saw a record level of investment in the green energy transition. Saudi Arabia specifically invested heavily in sports in 2023, prompting criticism of “sports-washing,” i.e. trying to distract from their unsavory human rights records:

- In June, the Saudi-backed LIV Golf League merged with the more established PGA Tour. In August, the PIF announced it bought a minority stake in the Professional Fighters League, an upstart challenger to the Ultimate Fighting Championship.

- Saudi Arabia is embracing all manner of games, not just those that involve some kind of physical exertion. In April, the PIF announced it was consecrating $38 billion to break into the video game industry.

Saudi Arabia could find itself with outsized influence (even by its own outlandishly wealthy standards) in gaming, as overall investment in the sector has taken a massive nosedive since the height of the pandemic, and many games studios living off 2020-era investment will start running out of runway soon.

Swooping In: Saudi Arabia and other Gulf nations stepped up their investment in Southeast Asian startups last year, filling a funding vacuum left behind by China, the Financial Times reported in December.