Toyota Carbon-Tracking Patent Could Incentivize EV, Hybrid Buyers

“Any potential cost savings based off a vehicle’s lower-than-average carbon footprint could influence more price-conscious consumers.”

Sign up to uncover the latest in emerging technology.

Toyota may want to pass the cost (or the savings) of carbon emissions onto its customers.

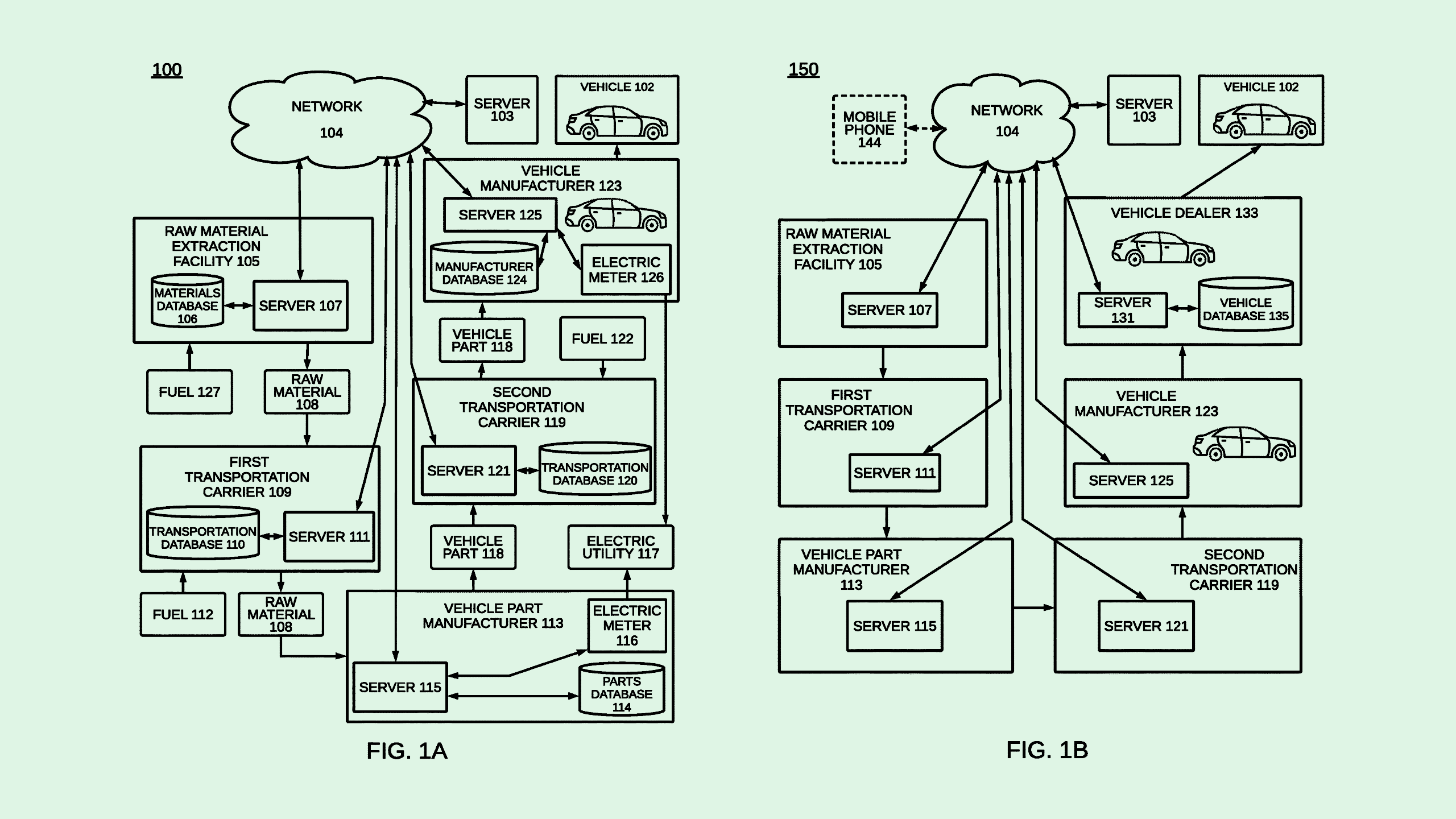

The auto manufacturer filed a patent application for “carbon footprint determination for manufacturing a vehicle.” This tech essentially tracks how much carbon is emitted when creating vehicle parts, and sets the vehicle’s price “based on the carbon footprint.”

To calculate the carbon footprint of manufacturing each vehicle, Toyota’s tech would take into account every process that goes into producing each component, including obtaining raw building materials, transportation, the manufacturing itself, and installation.

The total sum of carbon is then used to adjust the price of the vehicle. To do this, Toyota looks at the average carbon footprint to manufacture a similar vehicle, and subtracts that from the carbon cost of the individual vehicle’s pricing. The system may also perform this calculation for the individual components to discover the “highest carbon contributing part” of a vehicle.

“The price of the vehicle can be set so as to encourage consumers to purchase vehicles that are manufactured using lower total carbon footprints,” Toyota said in the filing. For example, the price “may be set to include a discount that is inversely related to the total carbon footprint for manufacturing the vehicle.”

As it stands, cost remains the biggest pain point in getting consumers to purchase electric vehicles, said Madeline Ruid, AVP and research analyst covering clean energy at Global X ETFs. Any kind of purchasing incentive is going to be welcome, whether it comes from government-sponsored rebates or from the automaker itself, as this patent suggests.

“Any potential cost savings based off a vehicle’s lower-than-average carbon footprint could influence more price-conscious consumers,” said Ruid.

Toyota, however, has historically focused less on fully electric vehicles than its competitors. That’s because of the company’s success with hybrids, namely the ever-popular Prius. CEO Ted Ogawa told Automotive News in March that he doesn’t expect EVs to make up more than 30% of the vehicle market by 2030. “We are respecting the regulation, but more important is customer demand,” Ogawa said.

Demand for hybrids has jumped as factors such as cost and lack of charging infrastructure scare buyers away from EVs. Hybrid sales grew 57.2% in the first half of 2024, according to Bloomberg, though Toyota’s sales fell around 9.8% in the aftermath of Prius and other models’ recalls.

“Hybrid vehicles have been gaining popularity in recent quarters as they can be cheaper than fully electric EVs but still offer gas cost-savings potential,” said Ruid. “We have seen other automakers shift their strategy to focus more on hybrid models and match current consumer preferences.”

But despite current market shakiness, Ruid expects EVs to take over the market in the long run, and for Toyota to follow suit. “Toyota is among the automakers working towards next-gen EV batteries and models, so we expect they will be able to potentially shift their focus more towards fully-electric vehicles as the market evolves,” she said.

Plus, like every other automaker, Toyota has its own lofty climate goals to meet, and tracking carbon emissions as this patent suggests could help it meet them. The company has pledged to become carbon neutral across its operations by 2050 — though that goal may be contradicted by the company’s heavy lobbying to stop climate policy goals.