PayPal’s Neural Network Patent Could Reveal the Firm’s AI Plans

: PayPal wants to create AI that tracks all kinds of user behavior.

Sign up to uncover the latest in emerging technology.

PayPal wants to train its AI models with a personal touch.

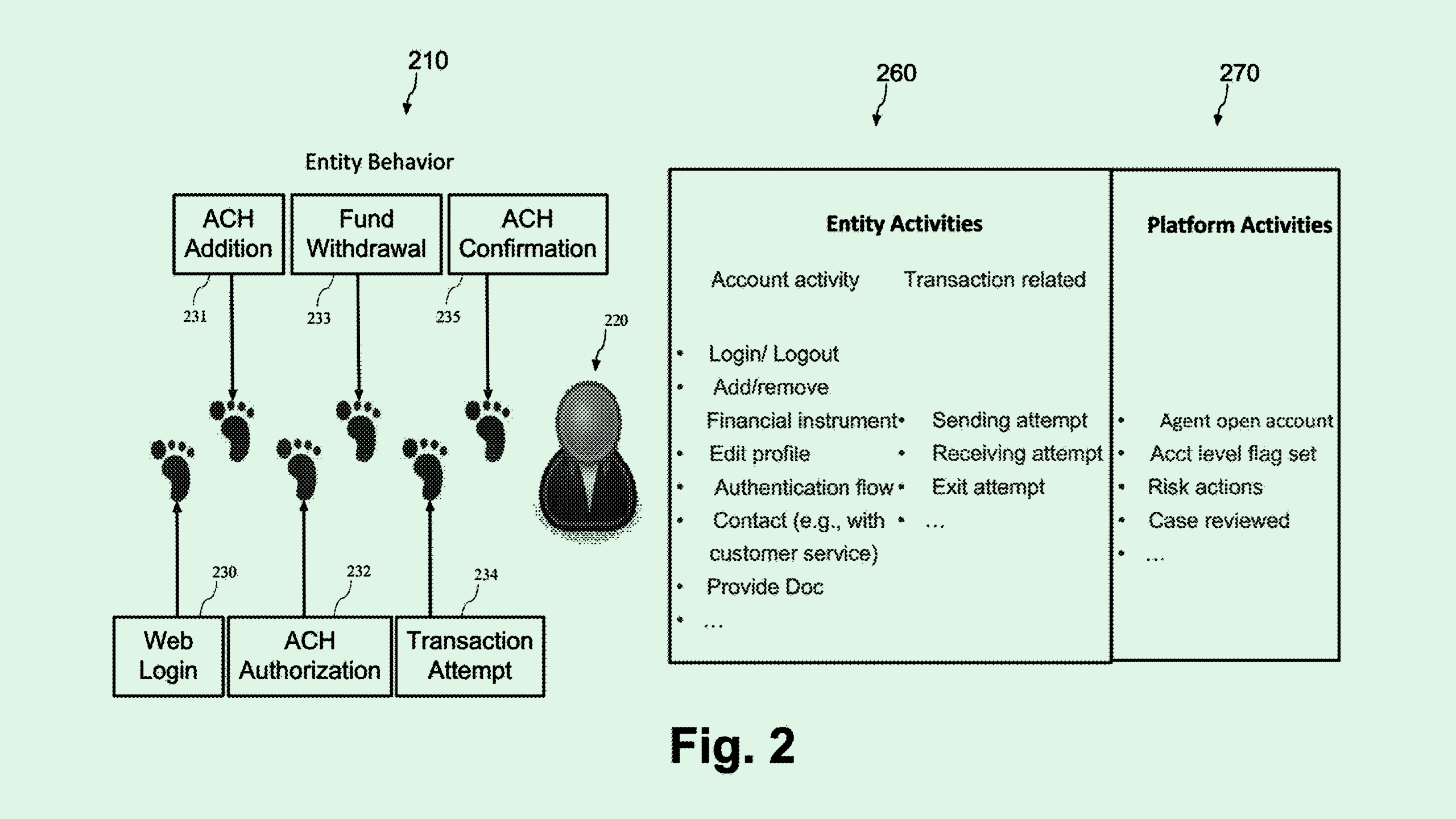

The fintech giant filed a patent application for a way to train a “recurrent neural network” with “behavioral data.” PayPal’s system essentially aims to identify patterns and trends in user behaviors over time via their account data, particularly their transaction history.

Though transaction data is particularly helpful in understanding user trends, “conventional technology is unable to leverage transaction data associated with an entity to predict behavior of the entities,” PayPal said in the filing.

PayPal’s patent lays out a way to do this kind of user analysis and prediction using an “ensemble” of three different AI models, each of which pinpoint a “predetermined behavior” of a certain customer. The filing noted that this ensemble of models can analyze trends in tons of different data, both structured and unstructured, including “human behavior data, textual data, side channel data from processors, information from networks such as social networks and the like.”

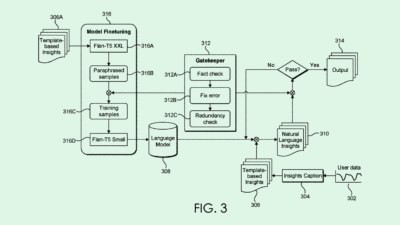

First, a user’s “account parameters,” or the hoard of data associated with their profile, is fed into a graphical neural network, or one that’s particularly good at parsing out structured data. The data is then passed to an “autoencoder,” which is good at turning unstructured raw data into something easier to understand. Finally, the last layer is a recurrent neural network, or a model that’s particularly good at analyzing how data changes over time.

The filing listed several different behaviors that this wide-ranging AI may be able to track down, including harmful actions like fraud, the “behavior of high value customers” such as spending on high-end purchases, or actions indicating the likelihood of needing a loan. Long story short: PayPal’s army of AI models can paint an accurate picture of who you are as a consumer.

AI has long been embedded in the fintech space. However, most of these integrations are put to use on the back end, such as in fraud detection. PayPal’s patent history has tons of examples of this, including methods to find anomalies with machine learning and to calculate trust scores of certain user activities.

This patent, however, lays out plans for AI-based tech that can do more than detect something going wrong. This filing pitches a model with the capability to find patterns in just about anything relating to users – whether it be used for loan approval, purchasing trends, or shopping deals.

And PayPal’s fondness for AI extends beyond just patent applications. The company announced a host of new AI-driven products in January that would be released throughout the year, including tools to help merchants better target their customers.

“The data that we have and our ability to actually see what people have bought and know what merchants are trying to target, that’s where I think AI is the huge opportunity for us,” PayPal CEO Alex Chriss told Reuters in an interview.

However, this patent’s core concept of predicting user behavior has also been around “as long as we’ve had data,” said Arun Kumar, executive vice president of data and insights at Hero Digital. What PayPal’s models may offer is a way to use this tracking to potentially create much more value for the individual consumer, Kumar said, bringing AI into the user-end of the fintech space.

But given that personal financial data is some of the most sensitive data that a company can collect, creating fintech products that people actually use requires three things: security, trust and value creation, said Kumar. If a platform is mining data without providing users anything of equivalent value in return or it has security holes, then users simply won’t trust or use it.

“Consumers think a lot about their money – how they spend it, save it, invest it, and manage it,” said Kumar. “The benchmark for consumers handing over all of their personal financial data is creating that value for them.”